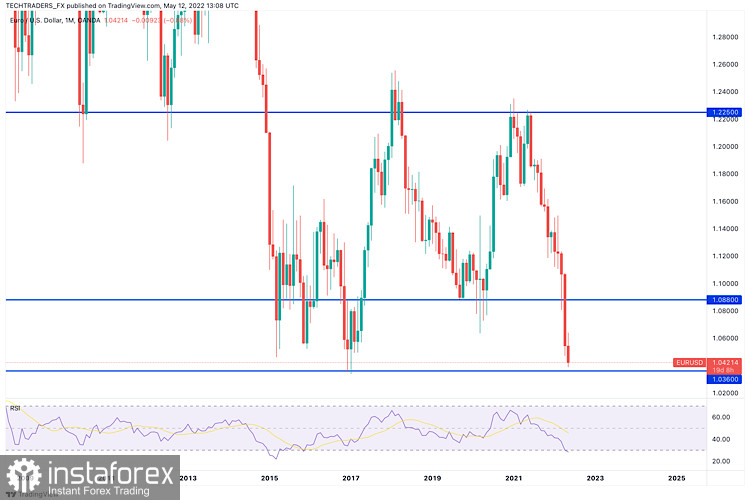

EUR/USD has recovered modestly from the fresh multi-year low it set below 1.0400 earlier in the day. The data from the US showed that the Producer Price Index (PPI) edged lower to 11% on a yearly basis in April from 11.5% in March, causing the US Dollar Index to erase a portion of its daily gains.

The EUR/USD pair currently trades a handful of pips above the 1.0400 threshold, but the daily chart suggests that the pair could still continue to fall. The pair has finally found some directional strength after a consolidative stage, and technical indicators reflect so, heading firmly lower near oversold readings. At the same time, the pair develops well below bearish moving averages, also reflecting prevalent selling interest.

For the near term, and according to the 4-hour chart, the risk remains skewed to the downside. Technical indicators maintain their bearish slopes, despite being near oversold readings, while the pair gave up after repeatedly failing to advance beyond a mildly bearish 20 SMA. Renewed selling pressure below the aforementioned daily low exposes January 2017 multi-year low at 1.0339.

Support levels: 1.0385 1.0340 1.0295

Resistance levels: 1.0470 1.0510 1.0550

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română