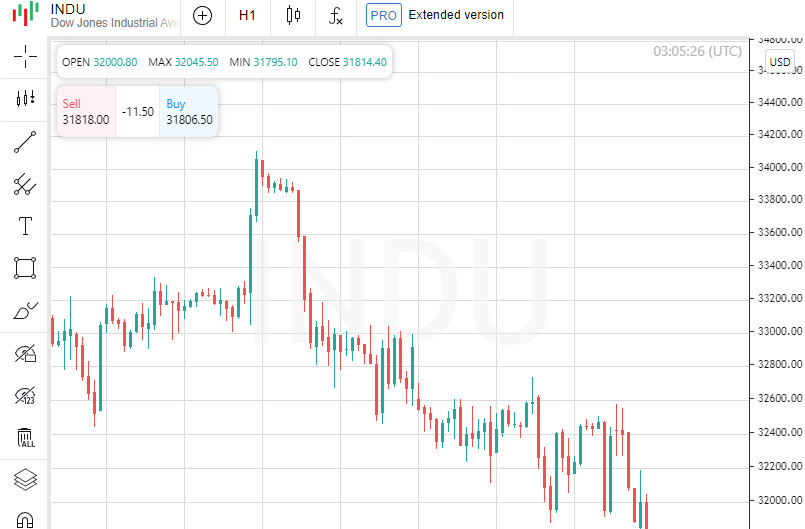

At the close in the New York Stock Exchange, the Dow Jones fell 1.02% to hit a 52-week low, the S&P 500 fell 1.65%, and the NASDAQ Composite fell 3.18%.

The leading performer among the components of the Dow Jones index today was Visa Inc Class A, which gained 3.14 points or 1.62% to close at 196.72. Merck & Company Inc rose 1.38 points or 1.57% to close at 89.19. Dow Inc rose 0.98 points or 1.49% to close at 66.79.

Shares of Apple Inc were the leaders of the decline, the price of which fell by 8.01 points (5.18%), ending the session at 146.50. Salesforce.com Inc was up 3.52% or 5.88 points to close at 161.27, while Microsoft Corporation was down 3.32% or 8.95 points to close at 260. .55.

Leading gainers among the S&P 500 index components in today's trading were Electronic Arts Inc, which rose 7.97% to hit 120.49, Duke Realty Corporation, which gained 7.83% to close at 53.46, and also shares of Philip Morris International Inc, which rose 4.79% to close the session at 103.62.

The biggest losers were DISH Network Corporation, which shed 19.72% to close at 17.46. Shares of Signature Bank lost 10.78% to end the session at 194.50. Enphase Energy Inc lost 9.30% to 137.55.

Leading gainers among the components of the NASDAQ Composite in today's trading were Regulus Therapeutics Inc, which rose 54.83% to 0.27, Golden Matrix Group Inc, which gained 23.91% to close at 4.25. as well as Charge Enterprises Inc, which rose 22.07% to end the session at 3.65.

Shares of View Inc became the leaders of the decline, which decreased in price by 62.04%, closing at 0.52. Shares of Redbox Entertainment Inc lost 42.86% to end the session at 3.20. Quotes of SQL Technologies Corp fell in price by 36.99% to 3.73.

On the New York Stock Exchange, the number of securities that fell in price (2288) exceeded the number of those that closed in positive territory (968), and quotes of 118 shares remained practically unchanged. On the NASDAQ stock exchange, 3,176 companies fell in price, 776 rose, and 173 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 1.30% to 32.56.

Gold futures for June delivery added 0.55%, or 10.10, to $1.00 a troy ounce. In other commodities, WTI crude for June delivery rose 5.48%, or 5.47, to $105.23 a barrel. Brent futures for July delivery rose 4.55%, or 4.66, to $107.12 a barrel.

Meanwhile, in the Forex market, the EUR/USD pair remained unchanged 0.14% to 1.05, while USD/JPY fell 0.31% to hit 130.02.

Futures on the USD index rose by 0.11% to 104.06.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română