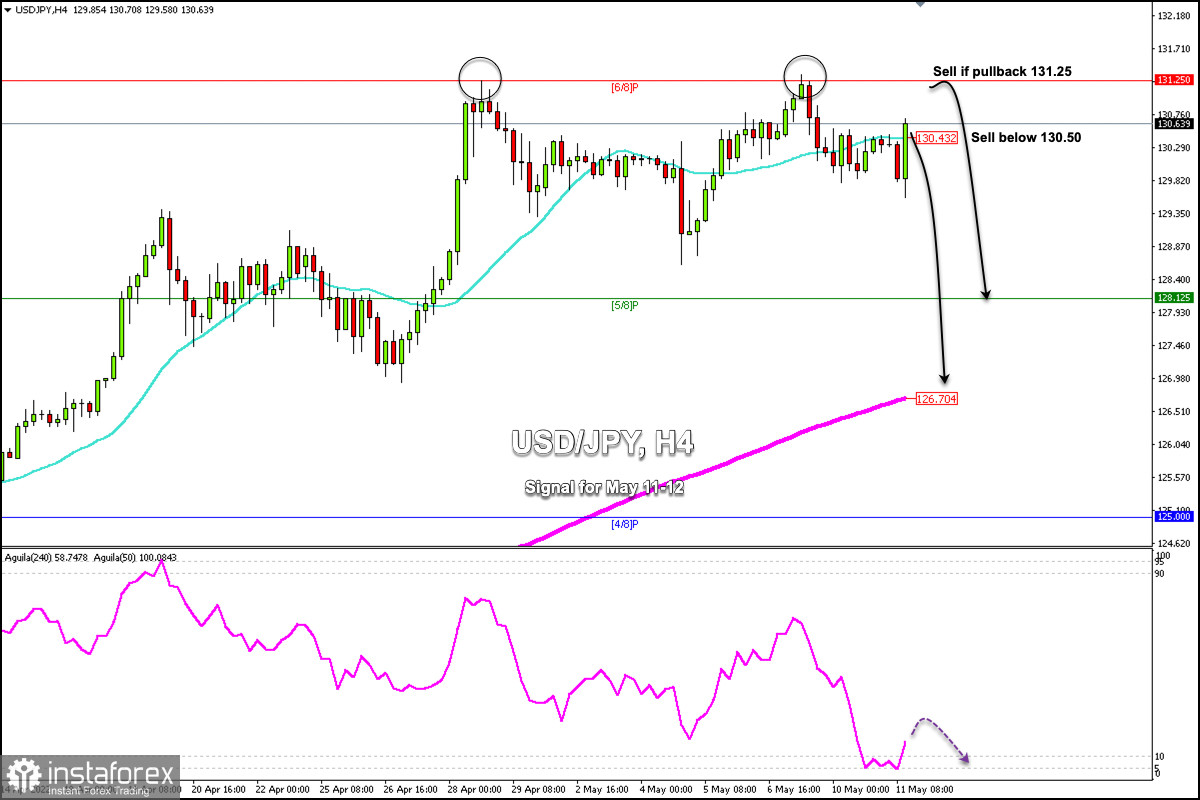

USD/JPY weakened to reach the level of 130.79, after the April inflation release from the United States, which showed higher-than-expected figures. The pair approached extremely overbought levels below 6/8 Murray.

The release of the US CPI signaled a turning point for risk markets. So, we are not likely to see any major moves until then, mainly in USD-related pairs.

In the case of the USDJPY pair, we can observe signs of the extremely overbought status, after the pair reached 6/8 Murray on April 28. It started a sequence of lower lows. The Japanese yen is expected to strengthen in the coming days as long as it remains below 131.25.

This bearish outlook is ruled out if the Japanese yen trades above 131.25 (6/8 Murray) or closes on daily charts, a very complex scenario at the moment.

On the other hand, in order to confirm the bearish momentum, we must wait for a daily close below the 21 SMA located at 130.43.

A close below the psychological level of 130.00 will open up the possibility of further declines. Our target could be placed at 5/8 Murray around 128.12 and could even drop to the 200 EMA at 126.70.

In the short term, we can continue to sell the Japanese yen as it consolidates below 21 SMA and 6/8 Murray. Below this level, we can sell with targets at 130.00 and 129.35.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română