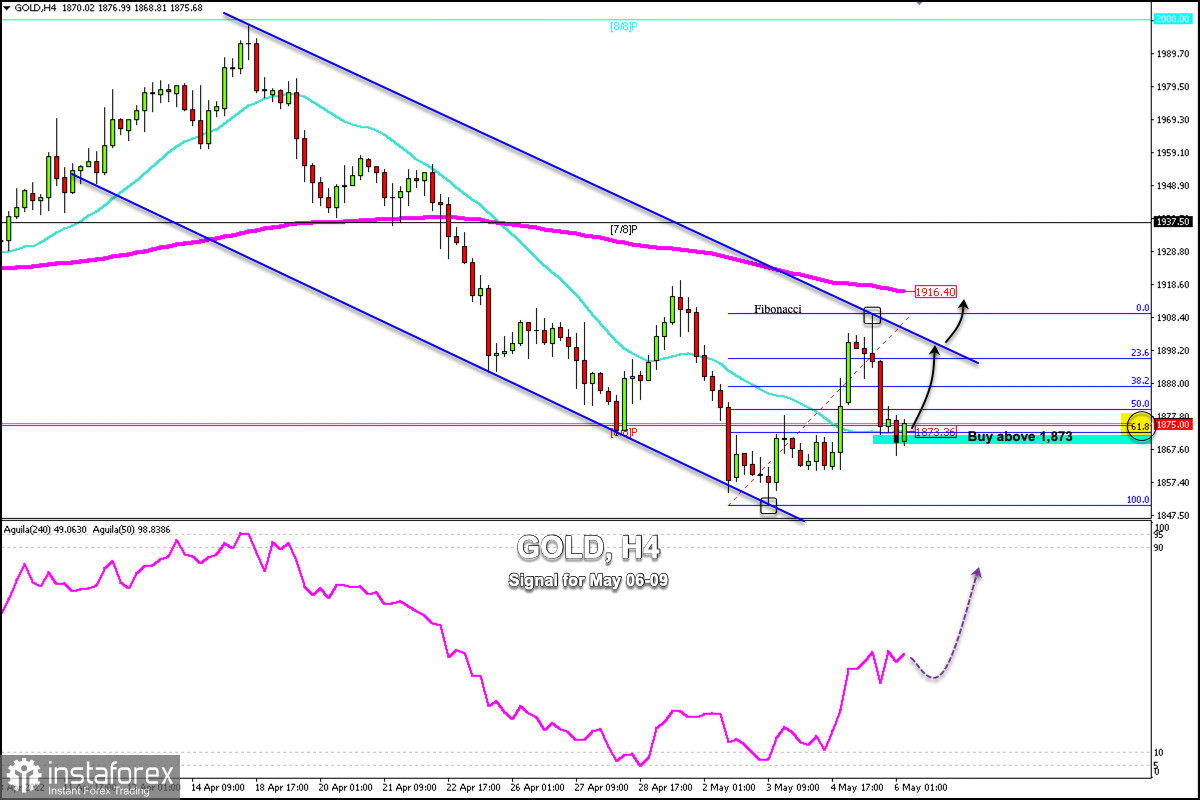

In the American session yesterday, gold rose to 1,909, around 2/8 Murray. However, it was unable to consolidate at that level, falling below the 21 SMA on 1-hour charts located at 1,894.

From the low of 1,850 to the high of 1,909, gold has corrected approximately 61.8% of this advance. This could be a sign that gold could resume its bullish move in the coming days as long as it keeps trading above 1,873.

Gold is currently trading above the 21 SMA located at 1,873 and around the 61.8% Fibonacci retracement.

This pullback of gold could be considered a technical correction and we could expect it to resume the upward movement that originated around 1,850.

If in the next few hours, gold consolidates above the 61.8% Fibonacci located at 1,873 and above the 21 SMA, it may reach 38.2% in 1886 and 23.6% around 1,895.

The 10-year Treasury yield jumped to 3.03% and the 30-year to 3.13%. This was the factor that pushed gold down and it is expected that there will be a technical correction and profit-taking in the American session on Friday, which could favor the recovery of gold.

The eagle indicator is giving a positive signal on the 4-hour chart. Gold is projected to recover in the coming days and could reach the top of the downtrend channel around 1,900.

Our trading plan is to buy gold above 1,873, with targets at 1,885, 1,895. Gold could even reach 200 EMA around 1,916.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română