Technical outlook:

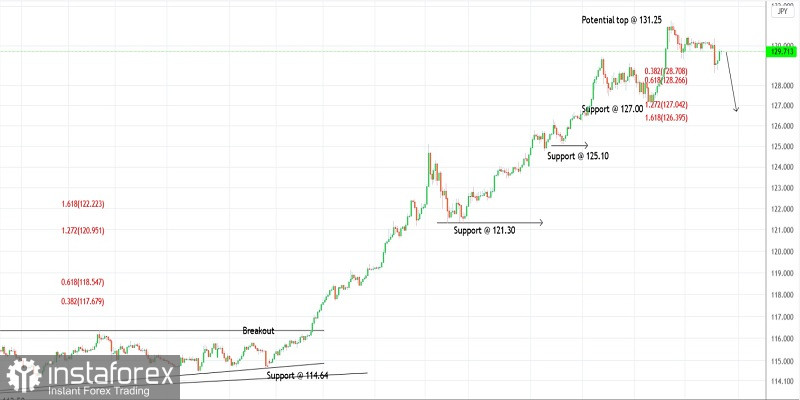

USDJPY rallied through 130.40 post FOMC on Wednesday only to reverse sharply thereafter. The currency pair dropped through 128.60 before finding support. Bears will be inclined to remain in control from here but the bottom line remains that prices should stay below 130.40 and broadly below 131.25 to keep the structure intact.

USDJPY had earlier rallied through the 131.25 highs before finding resistance. The high probability remains for a meaningful top in place and lower lows and lower highs would be carved going forward. The initial target is seen towards 126.40, which would take out the first support level as seen on the chart here.

USDJPY structure looks corrective until now between 131.25 and 128.60. If the 130.40 resistance remains intact and prices reverse from the 129.90-130.00 zone, bears will remain in control and drag prices below 127.00 in the near term. Traders might be preparing to initiate fresh short positions here with risk above the 31.25 mark.

Trading plan:

Potential drop to 126.50 against 131.50

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română