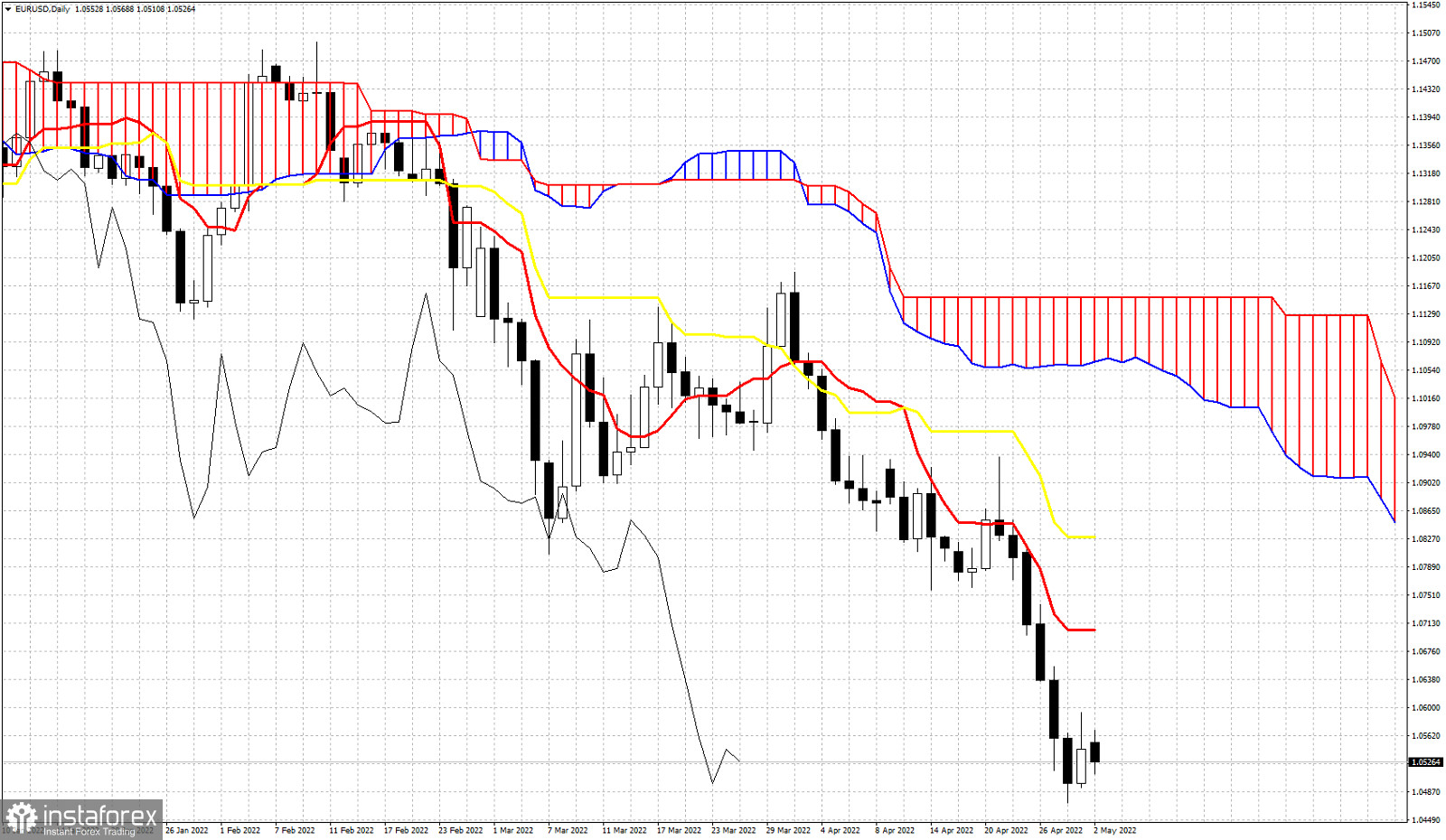

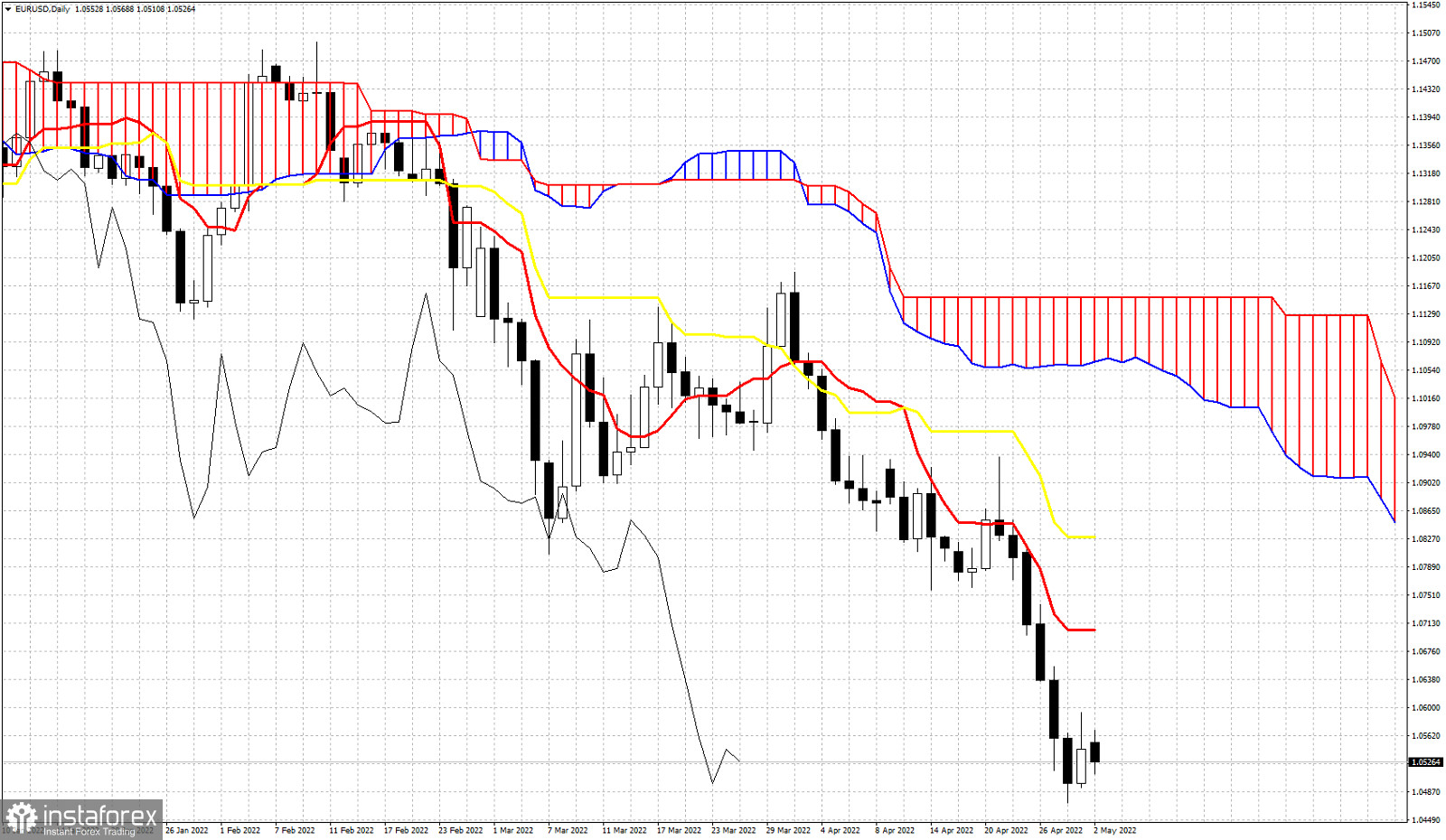

EURUSD is in negative territory after the relief bounce on Friday. Price reached very close to 1.06 on Friday but bulls were unable to close near the highs. EURUSD remains under pressure and vulnerable to more downside. In Ichimoku cloud terms trend remains bearish in the 4 hour and Daily chart.

Despite the bounce from Friday, price remains well below the first important resistance level at 1.07 where we find the tenkan-sen (red line indicator) in the Daily chart. A bounce towards that level is justified and the FOMC meeting of this week could be the trigger. I do not expect to see much price action until the Fed meeting. Traders need to be cautious as volatility will spike after the FOMC. Daily trend remains bearish as price is well below the Kumo (cloud).

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română