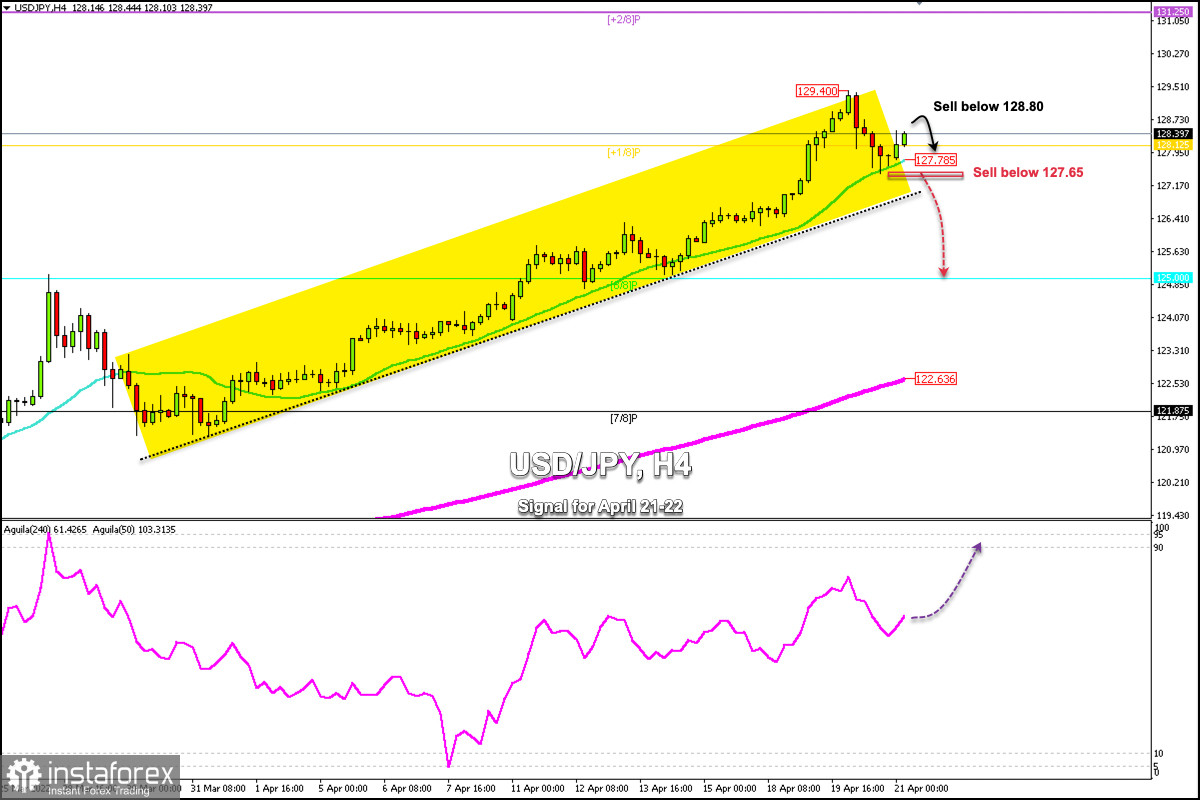

After several consecutive sessions on the rise, USD/JPY made a technical correction from the highs of 20-year when it reached 129.40. This move appears to be a technical correction of profit taking by investors.

This correction of the Japanese yen is also due to the fact that the Japanese government saw the weakness of the yen as a threat to the economy. As long as it remains trading below the high of 129.40, the technical correction is expected to continue.

On Tuesday, Japan's Finance Minister Shunichi Suzuki issued a blunt warning, explaining that the damage to the economy from a weakening yen outweighs the benefits from it.

The market reaction triggered a reversal of 195 pips, reaching the low of 127.45. It is currently bouncing above this level and is approaching the 61.8% Fibonacci retracement level at 128.75.

However, despite the negative factors, the decline appears to be a corrective move due to the divergence in monetary policy between the Fed and the BoJ. It is likely that after a correction phase, the yen could reach 131.25 in the short term.

The level 61.8% Fibonacci at 128.75 could be a key level for the technical correction to resume and the price could fall back towards the support 21 SMA at 127.78.

The area +1/8 Murray level has now become a key support, if the yen breaks this level and breaks the 21 SMA, it could accelerate the bearish move towards 0/8 Murray at 125.00.

Support around 127.60 should now act as a point to buy again in the short term. If the yen breaks this bottom, it is more likely that the correction will continue and the price could reach 125.00 in the coming days.

Conversely, a bullish move above the level 129.00 would suggest that the corrective pullback is over and it could lift USD/JPY to retest the high around 129.40 and even reach +2/8 Murray at 131.25.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română