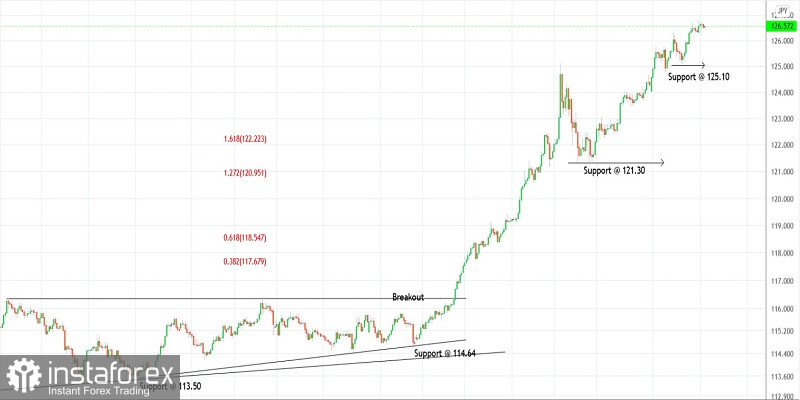

Technical outlook:

USDJPY continues to print fresh swing high defying resistance. The currency pair has marked yet another high around 126.80 early hours on Monday before pulling back. It is seen to be trading close to 126.60 at this time of writing showing no sign of a potential top in place. Bears need to break below 125.10 to confirm a top in place.

USDJPY is well supported around 125.10 and a break lower is now required to confirm bears are back in control. Until that happens, the currency can continue printing higher highs. The only favorable move is that of bearish divergence seen on the RSI (not shown here). It is an indication of potential trend reversal ahead.

But we need to see further confirmation with respect to price action before concluding that trend has reversed. Earlier USDJPY broke out a triangle consolidation structure above 116.35 mark. The rally has exceeded over 1000 pips and could be well into an overbought territory. Traders might be preparing for a turn lower anytime soon.

Trading plan:

Preparing for a potential bearish reversal.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română