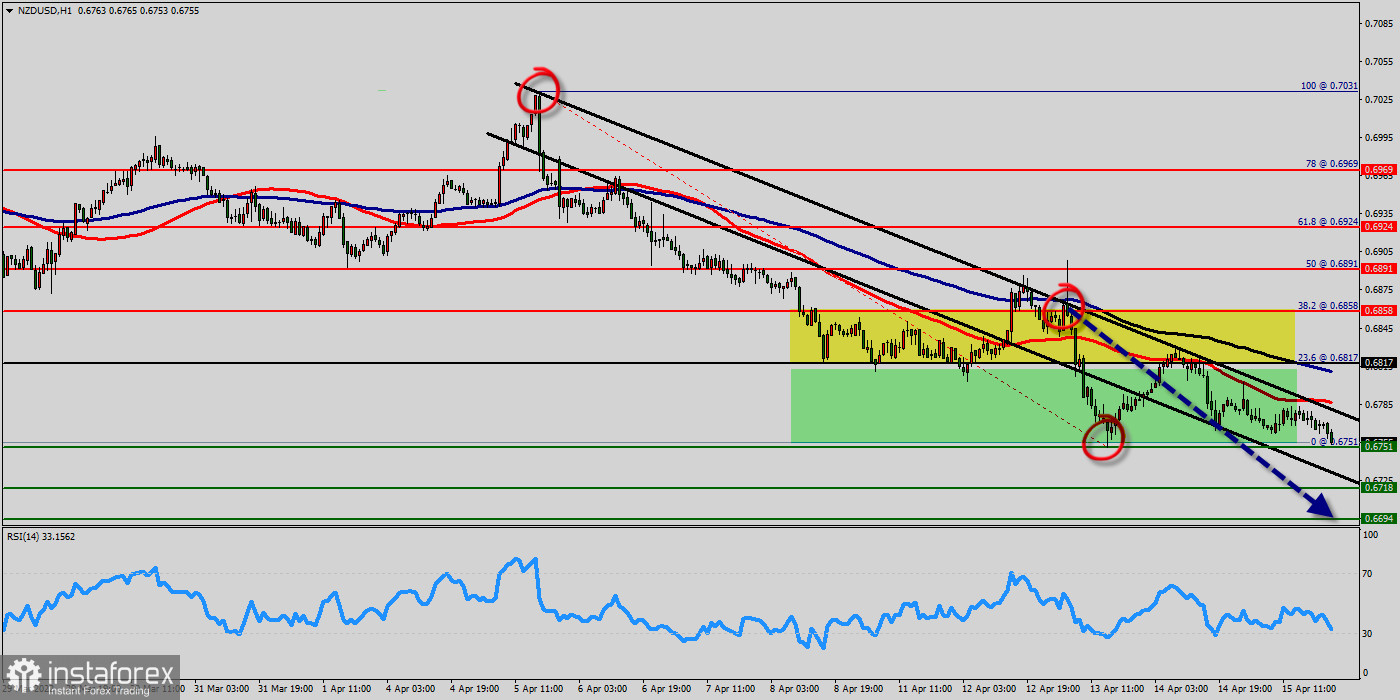

The NZD/USD pair dropped sharply from the level of 0.6817 towards 0.6751. Now, the price is set at 0.6751. On the H1 chart, the resistance is seen at the levels of 0.6817 and 0.6718. Volatility is very high for that the NZD/USD pair is still expected to be moving between 0.6817 and 0.6694 in coming hours.

Therefore, there is a possibility that the NZD/USD pair will move downside and the structure of a fall does not look corrective. The trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside.

This would suggest a bearish market because the moving average (100) is still in a negative area and does not show any signs of a trend reversal at the moment.

Thus, amid the previous events, the price is still moving between the levels of 0.6775 and 0.6718. If the NZD/USD pair fails to break through the resistance level of 0.6750, the market will decline further to 0.6718 as as the first target.

The NZD/USD pair broke support which turned to strong resistance at 0.6817. Right now, the pair is trading below this level. It is likely to trade in a lower range as long as it remains below the support (0.6817) which is expected to act as major resistance support since last week.

It will also call for a downtrend in order to continue towards 0.6694. The strong weekly support is seen at 0.6694. However, if a breakout happens at the resistance level of 0.6858, then this scenario may be invalidated.

Tips :

Question: What is expected if moving averages cross over one another?

Answer: The trend is probably changing soon.

A Moving Average (MA) is an indicator that shows the average value. Its function is to determine the general trend within a specific period of time.

- If Moving Average has expressed to a long period then its movement will be very slow.

- If Moving Average has expressed to a short period then its movement will be very quick.

- If prices are above the Moving Average then the market will be indicated for a bullish market.

- If prices are below the Moving Average then the market will be indicated for a bearish market.

- It should be remembered that there are four popular types of moving averages that lies in: Simple, Exponential, Smoothed, and Linear Weighted.

The most important of Moving Average are Simple Moving Average and Exponential Moving Average.

Question: What does «EMA» stand for?

Answer: Exponential Moving Average.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română