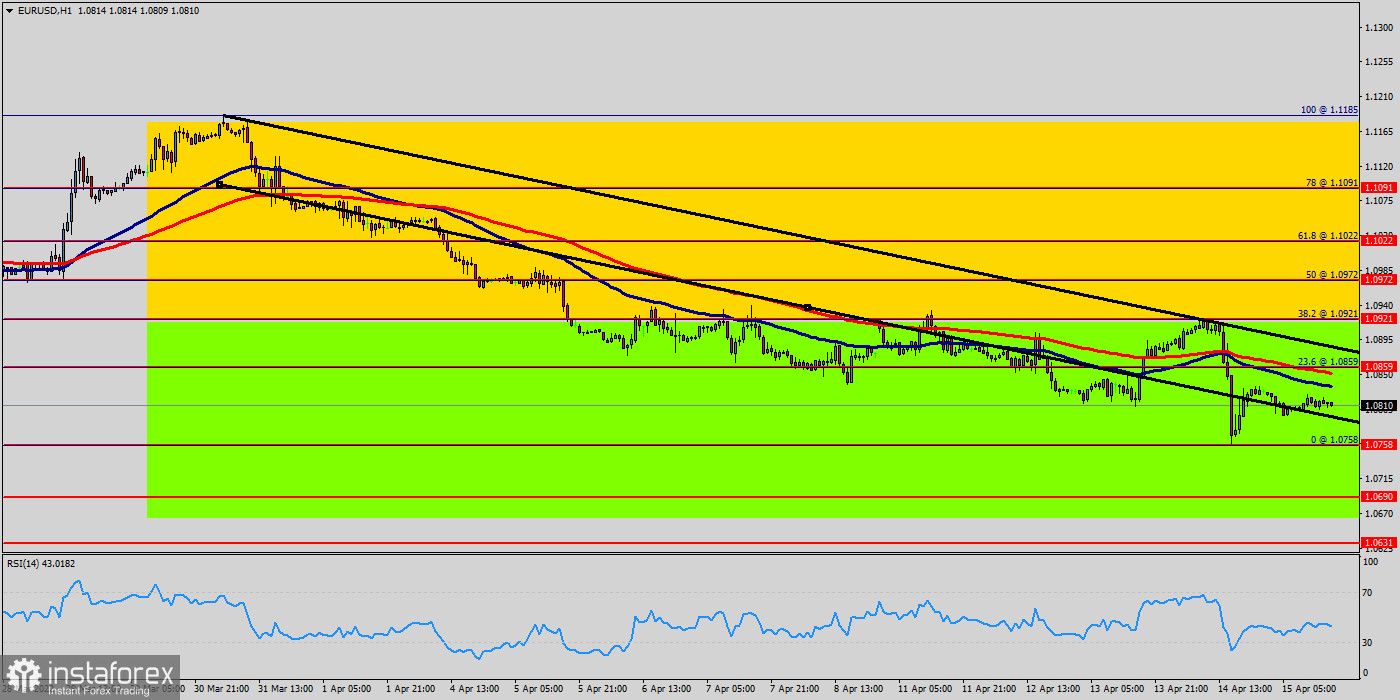

The main scenario for the EUR/USD pair's promotion, the pair may decline to next support levels of 1.0758 and 1.0690.

The EUR/USD pair continues to move downwards from the level of 1.0921.

The pair dropped from the level of 1.0921 (this level of 1.0921 coincides with the double top - pivot point - 38.2% Fibo) to the bottom around 1.0802.

Moreover, the double bottom (1.0802) is also coinciding with the major support this week.

Additionally, the RSI is still calling for a strong bullish market as well as the current price is also above the moving average 100.

The EUR/USD pair couldn't hit the weekly pivot point and resistance 1, because of the series of relatively equal highs and equal lows.

Hence, the pair has dropped down in order to bottom at the point of 1.0802.

Today, the first resistance level is seen at 1.0921 followed by 1.0972 (weekly resistance), while daily support 1 is found at 1.0758.

Also, the level of 1.0921 represents a weekly pivot point for that it is acting as major resistance/support this week.

Amid the previous events, the pair is still in a downtrend, because the EUR/USD pair is trading in a bearish trend from the new resistance line of 1.0921 towards the first support level at 1.0758 in order to test it.

If the pair succeeds to pass through the level of 1.0758, the market will indicate a bearish opportunity below the level of 1.0758.

However, if a breakout happens at the resistance level of 1.1022, then this scenario may be invalidated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română