The EUR/USD pair plunged in the short term after the ECB. The bias was bearish, so a new sell-off was expected at any time. In the short term, the Dollar Index retreated a little but the bias remained bullish. It is traded at 1.0785 at the time of writing far below 1.0923 today's high.

As you already know, the European Central Bank maintains its monetary policy. The Main Refinancing Rate was left at 0.00% as expected. On the other hand, the US data came in mixed. The Retail Sales indicator reported a 0.5% growth versus 0.6% estimates, while the Core Retail Sales reported a 1.1% growth versus 1.0% expected. In addition, the Prelim UoM Consumer Sentiment and the Import Prices came in better than expected, while the Business Inventories and the Unemployment Claims reported worse than expected data.

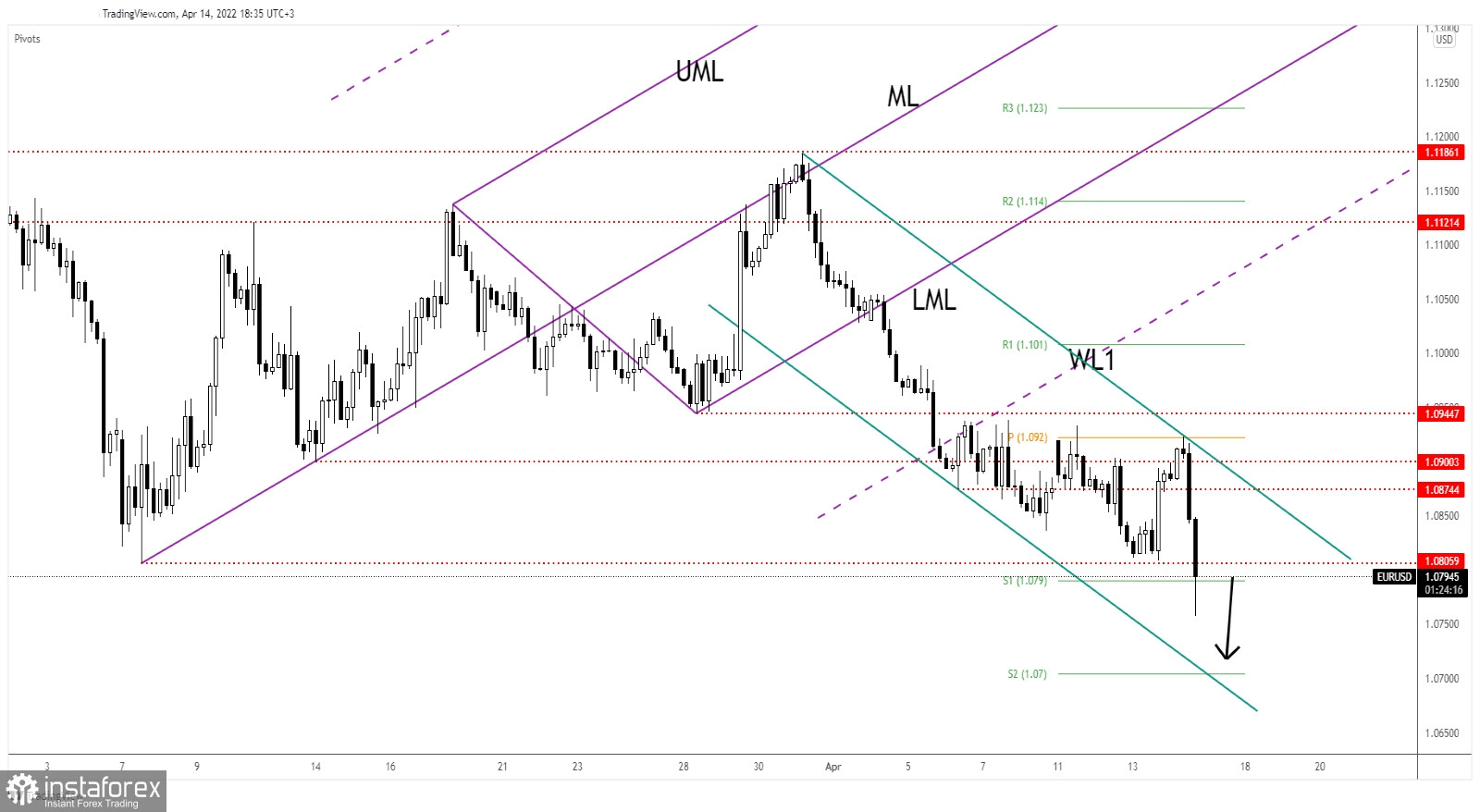

EUR/USD Down Channel!

Technically, the EUR/USD pair found resistance at the weekly pivot point of 1.0920 and now it has registered a strong sell-off. As you can see on the h4 chart, the price developed a down channel. The bias remains bearish as long as it stays within this pattern.

The current H4 candle will be closed in one hour. A valid breakdown below the 1.0805 key level could signal more declines. Still, after the current sell-off, we cannot exclude a minor rebound.

EUR/USD Outlook!

The pair challenges the 1.0805 static support and the S1 (1.0790). Closing and stabilizing below these levels may signal a downside continuation. The channel's downside line and the 1.0700 are seen as potential downside targets.

A new short opportunity could appear after a temporary rebound. Coming back to test and retest the downtrend line could bring new selling signals.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română