Crypto Industry News:

The city of Sorradino in the Argentinean province of Santa Fe could start mining cryptocurrencies to raise the money needed to modernize its railway infrastructure. Its mayor sees no risk in mining digital currencies that can be sold immediately.

According to the local media, the city of 6,000 inhabitants has already purchased six graphics cards, and will buy a mining platform in the near future. According to Sorradino's mayor Juan Pio Drovetta, the cryptocurrency mining initiative has been endorsed by the local community.

Like many rural cities in Argentina, Sorradino has been hit hard by the COVID-19 pandemic and ensuing inflation. The city is also struggling to pay for the modernization of its railway infrastructure, which came back into service for the first time in 33 years last year. The modernization will also target expenditure on railways linking Sorradino with key cities nearby.

Drovetta estimated the monthly income that the city's potential mining operations would bring to be around several hundred US dollars. The mayor has not specified which coins will be mined in Sorradino. In his comments on the possible risks of crypto asset price volatility, he stressed that while there is no plan to buy cryptocurrencies directly, mining remains a safe investment option.

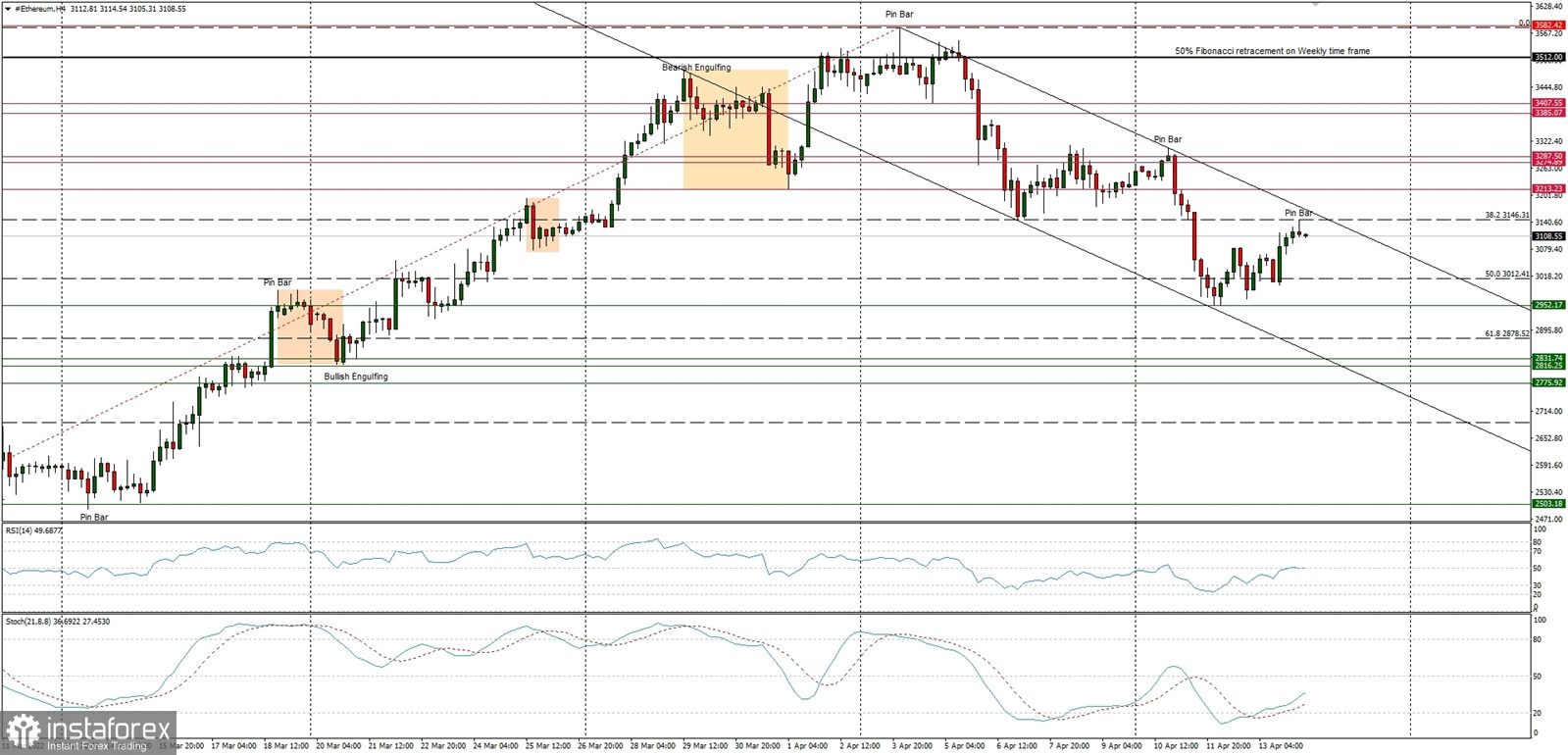

Technical Market Outlook:

The ETH/USD pair has bounced from the local low at $2,951 and hit the upper channel line seen around the level of $3,146. Th ebounce was terminated after the Pin Bar candlestick was made and the market is reversing now. The next target for bears is seen at the level of $2,878 (61% Fibonacci retracement level). This is the line in sand for bulls. The weak and negative momentum on the H4 time frame chart supports the short-term bearish outlook. The nearest technical resistance is seen at $3,146.

Weekly Pivot Points:

WR3 - $3,919

WR2 - $3,762

WR1 - $3,490

Weekly Pivot - $3,319

WS1 - $3,064

WS2 - $2,873

WS3 - $2,612

Trading Outlook:

The market bounce was stopped at the level of $3,512, which was the key Fibonacci retracement for bulls. The bears are now in control of the market and are heading lower, towards the level of $3,000 first, then lower towards $2,941.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română