Crypto Industry News:

Payment giant Mastercard filed 15 applications with the United States Patent and Trademark Office (USPTO) for NFT and Metaverse tokens.

Highlights from the documents include plans to create a virtual community for interacting with digital assets, processing payment cards in the Metaverse, an online marketplace for buyers and sellers of downloadable digital goods, virtual reality events and much more.

One trademark application for the company's slogan "Priceless" consists of multimedia files such as graphics, text, audio and video that are authenticated through the NFT. Another conclusion illustrates plans for its red and yellow "Circles" logo to process card transactions used to pay for goods and services in Metaverse and other virtual worlds.

Another patent is to add the name Mastercard to cultural events, concerts, sporting events, festivals and awards at the Metaverse, as well as seminars and financial education programs.

As previously reported, Mastercard hired 500 new employees in February to consult banks and retailers on implementing cryptocurrency and NFT-enabled technologies. However, it is not the only big fintech company to apply for the NFT or Metaverse trademarks. Visa and American Express have filed their own applications for the USPTO cryptocurrency.

Technical Market Outlook:

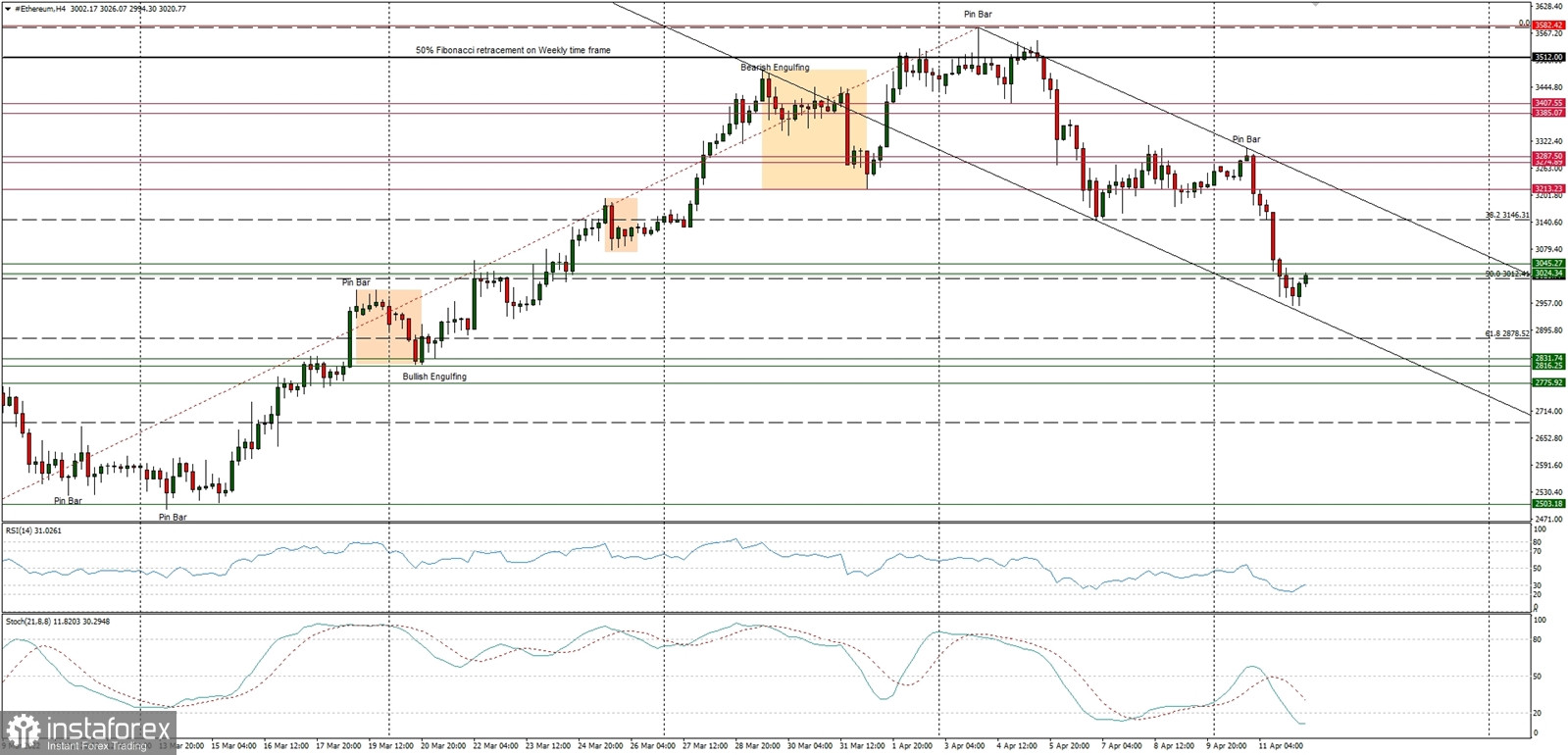

The ETH/USD pair has broken below the level of $3,012 (50% Fibonacci retracement level) and made a new local low at $2,951. The next target for bears is seen at the level of $2,878 (61% Fibonacci retracement level). This is the line in sand for bulls. The weak and negative momentum on the H4 time frame chart supports the short-term bearish outlook. The nearest technical resistance is seen at $3,045 and $3,146.

Weekly Pivot Points:

WR3 - $3,919

WR2 - $3,762

WR1 - $3,490

Weekly Pivot - $3,319

WS1 - $3,064

WS2 - $2,873

WS3 - $2,612

Trading Outlook:

The market bounce was stopped at the level of $3,512, which was the key Fibonacci retracement for bulls. The bears are now in control of the market and are heading lower, towards the level of $3,000 first, then lower towards $2,941.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română