The US dollar continues its rise against the Japanese yen at the start of a new week. USD/JPY has advanced 175 pips since the Asian opening, reaching 125.76, its highest level on June 01, 2015, early in the American session.

USD/JPY accumulates gains for the seventh day in a row. Earlier in the US session, it reached 125.76, and then we see a pullback. A technical correction is likely in the next few hours.

The markets are keeping close tabs on the conflict in Ukraine, after President Volodymyr Zelenskyy said this morning that Russia is concentrating thousands of soldiers for the next assault. This data could favor the US dollar and the yen could suffer greater weakness and exceed the level of 126.00

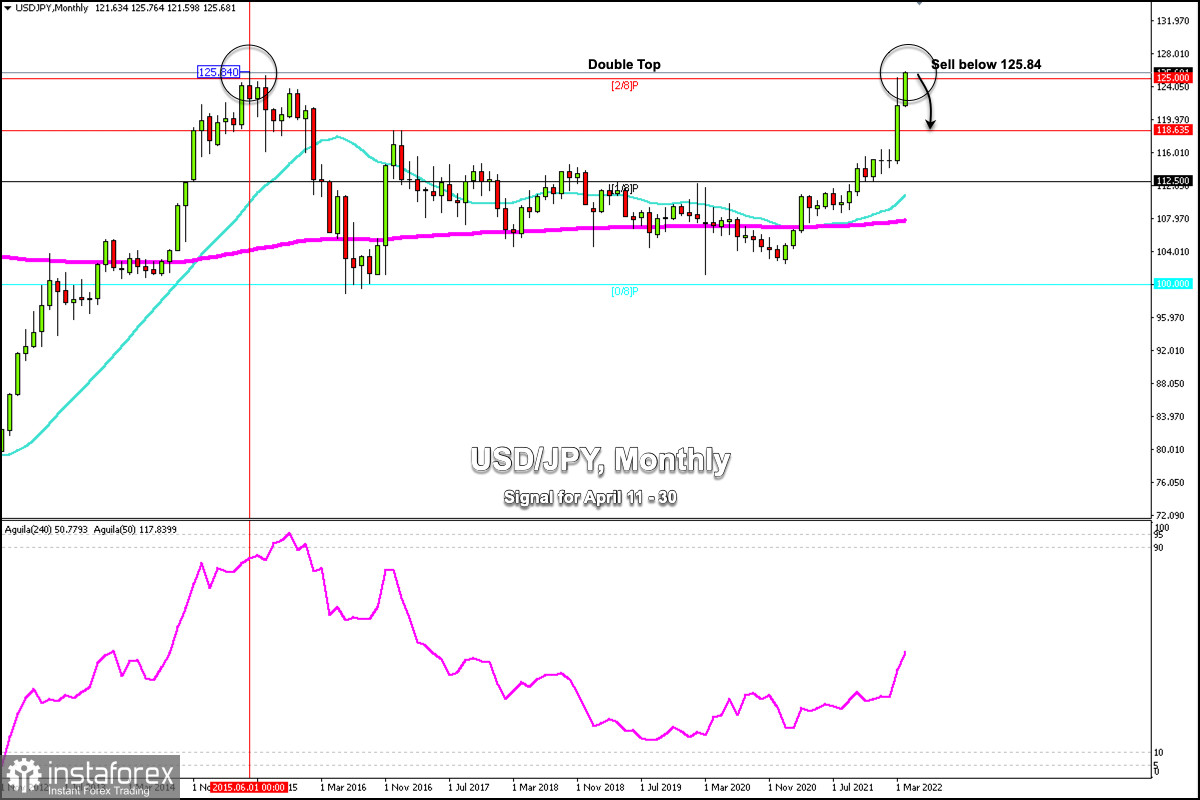

Any move higher for the pair should find initial resistance at 125.84, the top of June 1, 2015. Above, the barrier moves to 126.56 (+1/8 Murray), the highest level in almost twenty years. Further up, 128.12 (an extremely overbought level on the daily chart) will follow.

Japan's central bank is determined to maintain its ultra-loose monetary policy despite mounting inflationary pressures. In the medium term, the yen will continue to weaken and could reach the 134.00 level and even 137.50.

According to the monthly chart, USD/JPY has reached a key resistance level. If it manages to stay below 125.84, a technical correction is expected in the coming weeks towards the support level of 118.63.

On the contrary, if the yen manages to consolidate above 126.00 on the daily chart, USD/JPY is likely climb to the psychological level of 130 and even the zone of 3/8 Murray at 137.50.

Our trading plan is to sell below 125.84, with targets at 125.00 and 124.05. A close on the 4-hour chart below 125.00 could be a sign of a technical correction and the price could reach the level 120.00 in the next few days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română