Crypto Industry News:

According to Bloomberg Intelligence analysts, the current Ethereum (ETH) rate is heavily understated compared to the real value of the popular cryptocurrency. Taking into account the cash flow, they indicate a price in excess of $ 6,000.

Analysts also highlight the upcoming network update that will see Ethereum transitioning from PoW to PoS. This could make ETH something akin to an action.

Along with the merging of the current PoW chain with the PoS chain, the method of evaluating the ETH value may change. Instead of paying attention to the ETH extracted, you will need to focus on the amount of profits generated.

Report predicts that thanks to this, it will be possible to use traditional financial ratios (including P / E multipliers) in the Ethereum analysis. In this case, the fees paid to the grid will be treated as income and the incineration of ETH as the "shares" to be redeemed (buy back).

Depending on the adopted model, the target price of ETH ranges from 5 539, through 6 128, and ending at USD 9 328. The mid-market rate is $ 6,998. During the ATH on November 10, 2021, the ETH rate increased to $ 4,878. The current price of $ 3,319 is over 32% lower.

Technical Market Outlook:

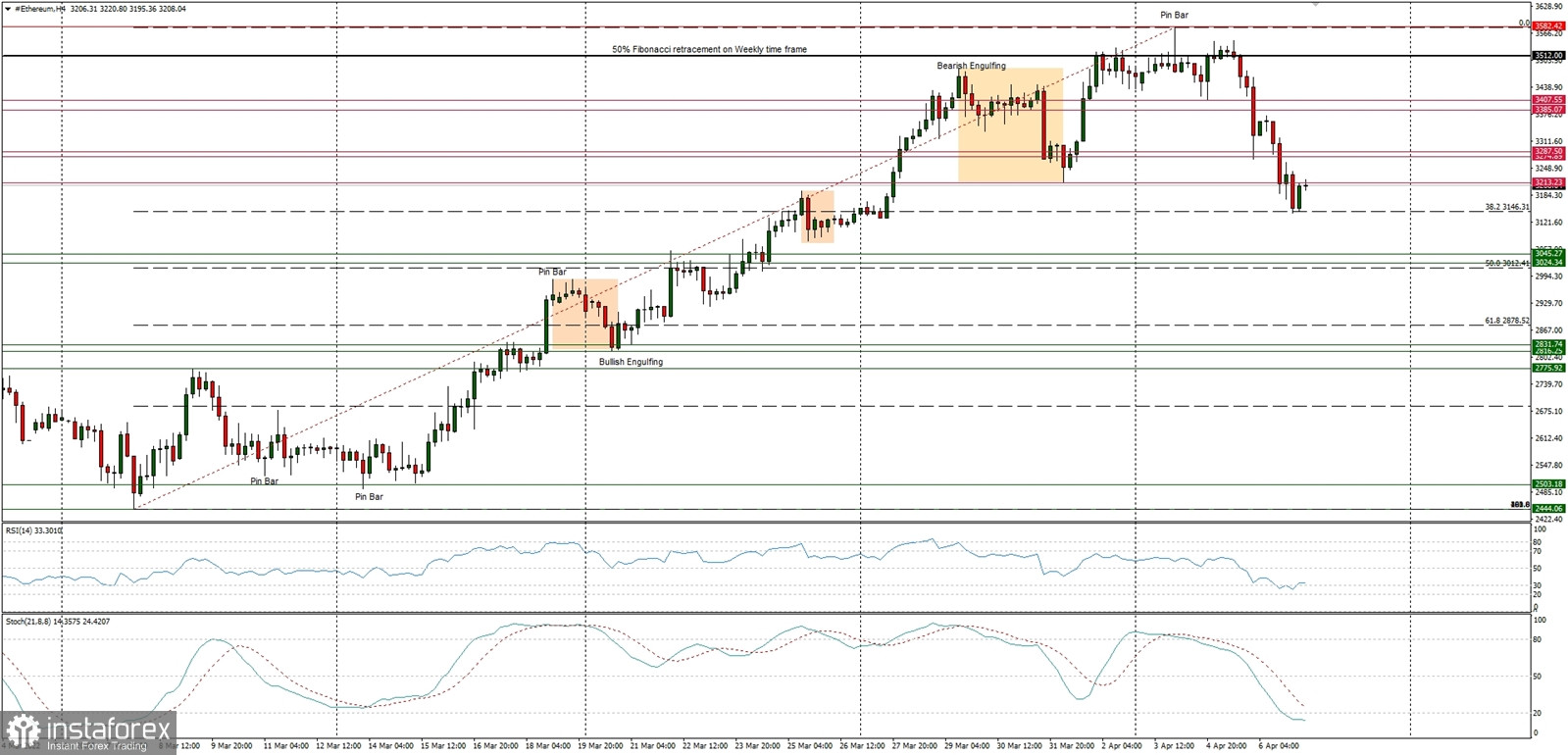

The ETH/USD pair has made a new high at the level of $3,582, but the rally was capped after the Shooting Star candlestick pattern was made. The market retraced 38% of the last wave up and hit the level of $3,146 recently. The bulls are trying to bounce higher, the nearest technical resistance is located at the level of $3,287 and $3,385. On the other hand, the key technical support is seen just above the 50% Fibonacci retracemnt at $3,045, so as long as the market trades above this level, the short-term outlook remains bullish.

Weekly Pivot Points:

WR3 - $3,968

WR2 - $3,746

WR1 - $3,642

Weekly Pivot - $3,423

WS1 - $3,335

WS2 - $3,113

WS3 - $3,000

Trading Outlook:

The market has broken above the level of $3,192 which was the key Fibonacci retracement for bulls. The bulls re now in control of the market and are heading towards the 50% Fibonacci retracement on the weekly time frame chart located at $3,512

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română