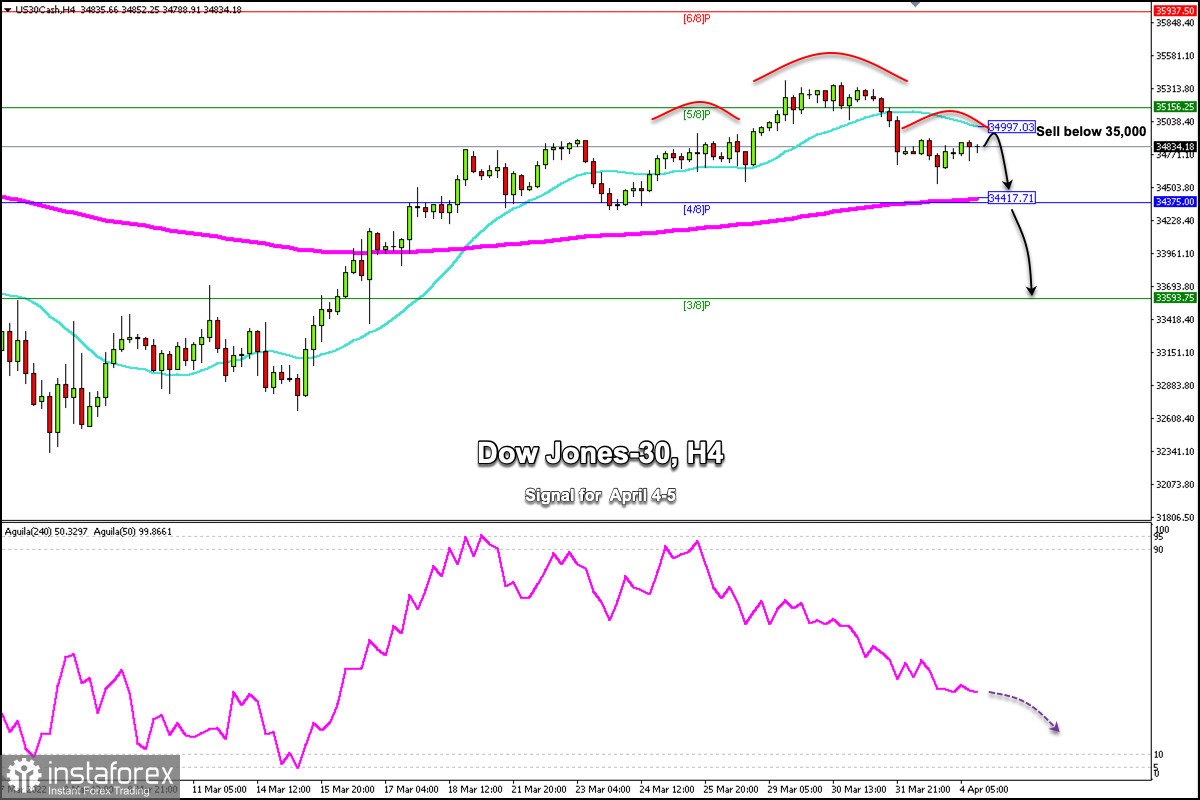

Early in the American session, the Dow Jones-30 Industrial Index is trading around 34,834. On the 4-hour chart, we can see that the Dow Jones is forming a technical reversal pattern, a head&shoulders (SHS).

Confirmation of this pattern could give the Dow Jones-30 a negative outlook. A break of the support 4/8 Murray located at 34,417 could accelerate the drop to 3/8 Murray at 33,750.

Speculators pay close attention to the news about Ukraine and Russia without expectations of any porgress in negotiations for the time being. More sanctions on Russia will be slapped by the US and its European allies. Investor fear and uncertainty could affect risk assets and the DJ30 could drop in case of risk aversion.

The focus for the week could be on the minutes of the latest meeting of the Fed and the European Central Bank and on the remarks of the central bankers.

The Fed will continue with its monetary policy. Analysts believe that it will announce a series of rate hikes of 50 basis points starting next month. This could put the Wall Street indices at risk.

Investors have already priced in economic factors such as rising energy prices, the war in Europe and a stronger rate hike cycle.

The markets hate unknowns. So, an increase in uncertainty and fears could quickly hurt the indices and the Dow Jones-30 could fall to the level 32,000-point.

Last week, the Dow Jones-30 broke the 21 SMA and is now making a technical correction. If there is a pullback towards the SMA 21 located at 35,000 points in the next few hous, it will be an opportunity to sell with targets towards 4/8 Murray at 34,375.

The head&shoulders pattern may remain intact as long as the index trades below the 5/8 Murray located at 35,156. In the short term, we expect a technical correction because the index is showing signs of exhaustion.

Our trading plan is to sell below 34,997 or below 35,156 with targets at 34,417 and 33,593. The eagle indicator is giving a negative signal and supports our bearish strategy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română