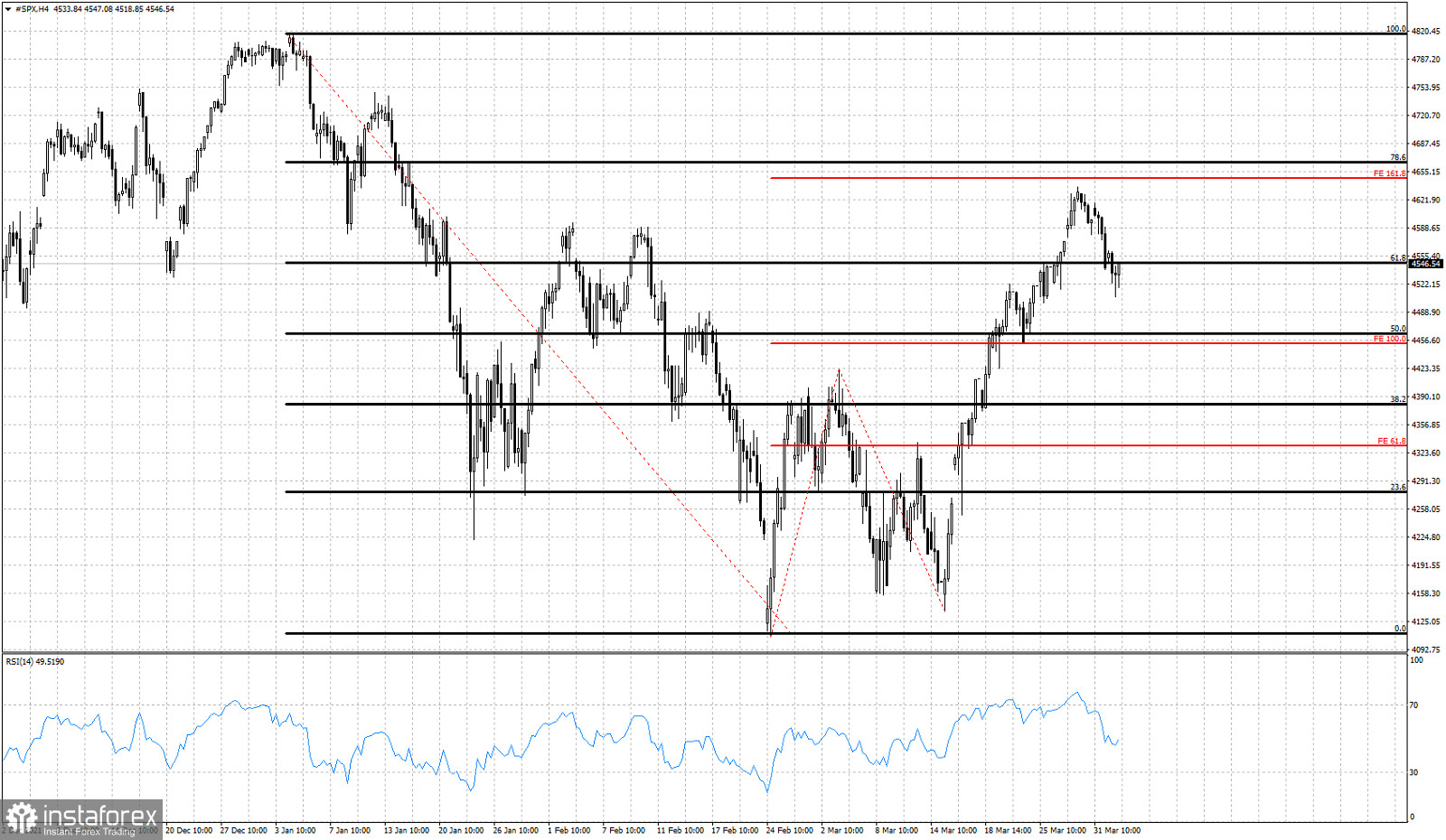

Red lines - Fibonacci extensions

Black lines- Fibonacci retracements

Our expected pull back target area was between 4,450 and 4,350 as a minimum. So far price has reached as low as 4,500. Our target of 4,450 remains very possible to be seen this week. Upside potential remains limited to 4,670 plus or minus 20 points. The risk in opening long positions is high relative to the potential gain according to our analysis and that is why we continue to prefer to be neutral if not bearish. Support is at 4,500 where we find the 23,6% Fibonacci retracement of the entire rise from 4,170. Failure to stay above this level will lead price lower towards 4,450 at least.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română