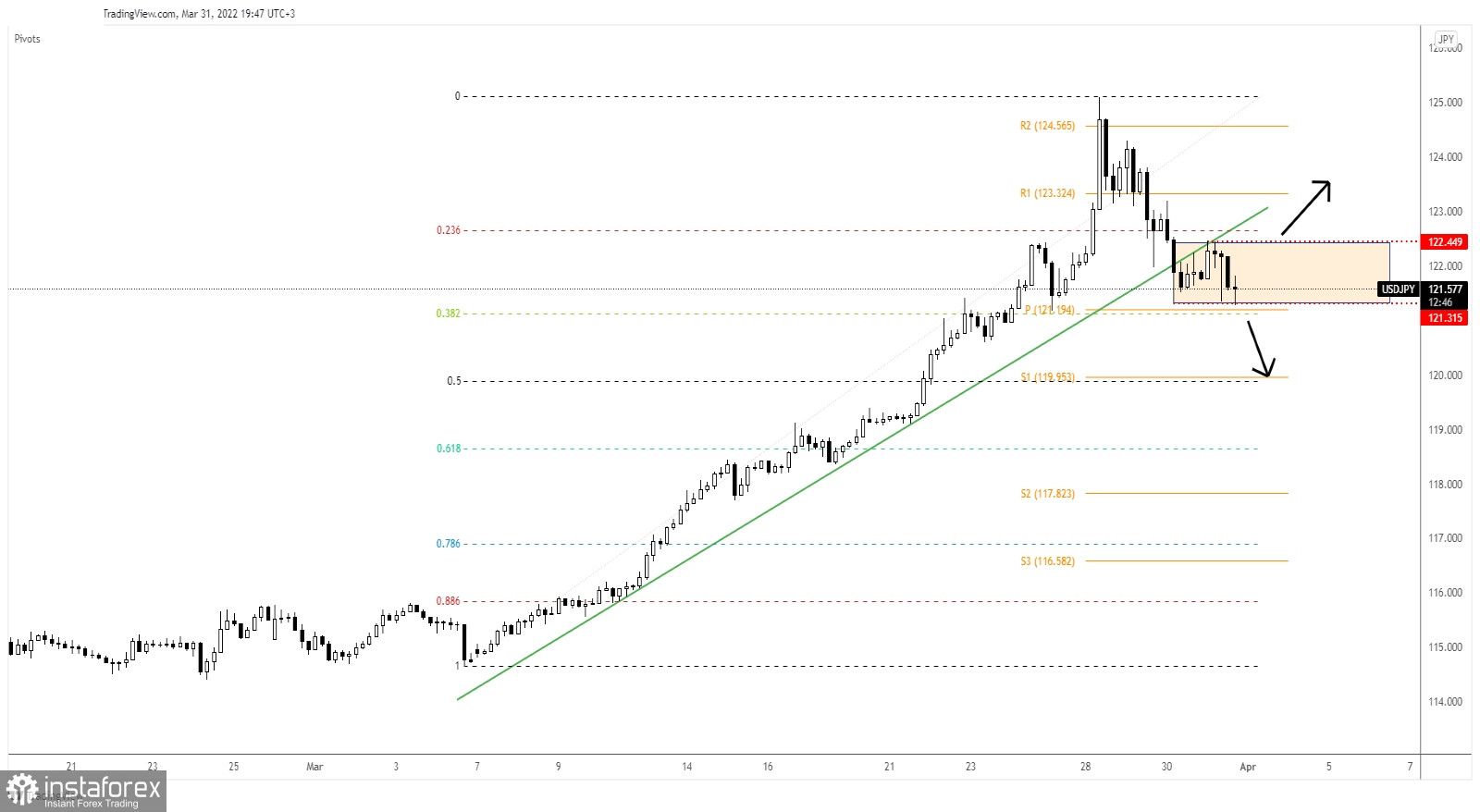

USD/JPY is moving sideways in the short term. Only a valid breakout could bring us new trading opportunities. In the short term, the pair could extend its sideways movement. USD/JPY is trading in the red at 121.55 as the DXY retreated after its amazing rally, while the Japanese Yen Futures are trading higher.

The price action developed a minor range. Fundamentally, the Japanese data came in mixed today. The Prelim Industrial Production rose by 0.1% less versus 0.5% expected, while the Housing Starts surged by 6.3% exceeding the 1.3% growth forecasted.

On the other hand, the US data came in mixed as well. Chicago PMI was reported at 62.9 points above 56.9 expected, Core PCE Price Index rose by 0.4% matching expectations, while the Unemployment Claims jumped from 188K to 202K in the last week, far above 195K expected.

USD/JPY Larger Drop Needs Confirmation!

As you already know from my analysis, USD/JPY could extend its corrective phase after dropping below the uptrend line. The rate retested the broken uptrend line and now it challenges the 121.31 static support. A new lower low could activate a larger drop.

On the contrary, staying above the 121.31 static support and making a new higher high could invalidate a downside continuation and could bring new long opportunities.

USD/JPY Outlook!

A valid breakdown below 121.31 and below the weekly pivot point of 121.19 could activate a larger correction and could bring selling opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română