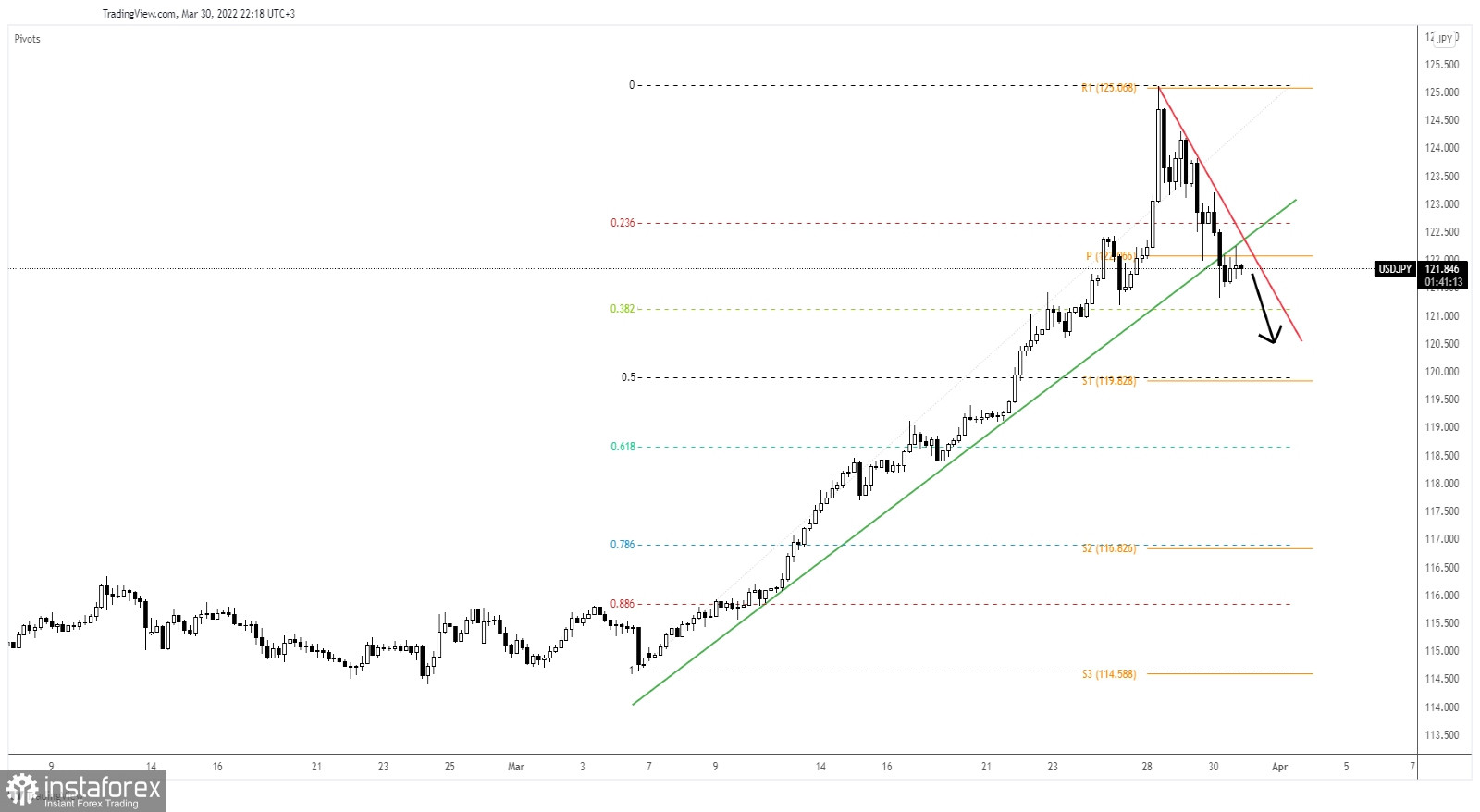

The USD/JPY pair extended its drop and now it was located below the uptrend line st the time of writing. You know from my previous analysis that a larger downside movement could be activated by a valid breakdown below the uptrend line. It's traded at 121.83 at the time of writing. The rate dropped as the Dollar Index plunged and because the Yen Futures rebounded.

In the short term, the Japanese Yen remains strong even if Japanese Retail Sales dropped by 0.8% more compared to 0.3% expected and after a 1.1% growth expected. On the other hand, the US ADP Non-Farm Employment Change came in line with expectations, while the Final GDP reported worse than expected data.

USD/JPY uptrend support violated

USD/JPY dropped below the uptrend line and below the weekly pivot point of 122.06 signaling a potential deeper drop. The bias was bullish as long as the rate was located above the uptrend line.

Technically, the rate has retested the broken uptrend line and the pivot point. As long as it stays under the downtrend line, USD/JPY could approach and reach new lows.

USD/JPY outlook

The USD/JPY pair could activate a larger drop if it drops and closes below 121.31 and below the 38.2% retracement level. This scenario could bring short opportunities. 120.00 and the S1 (119.82) are seen as potential downside targets.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română