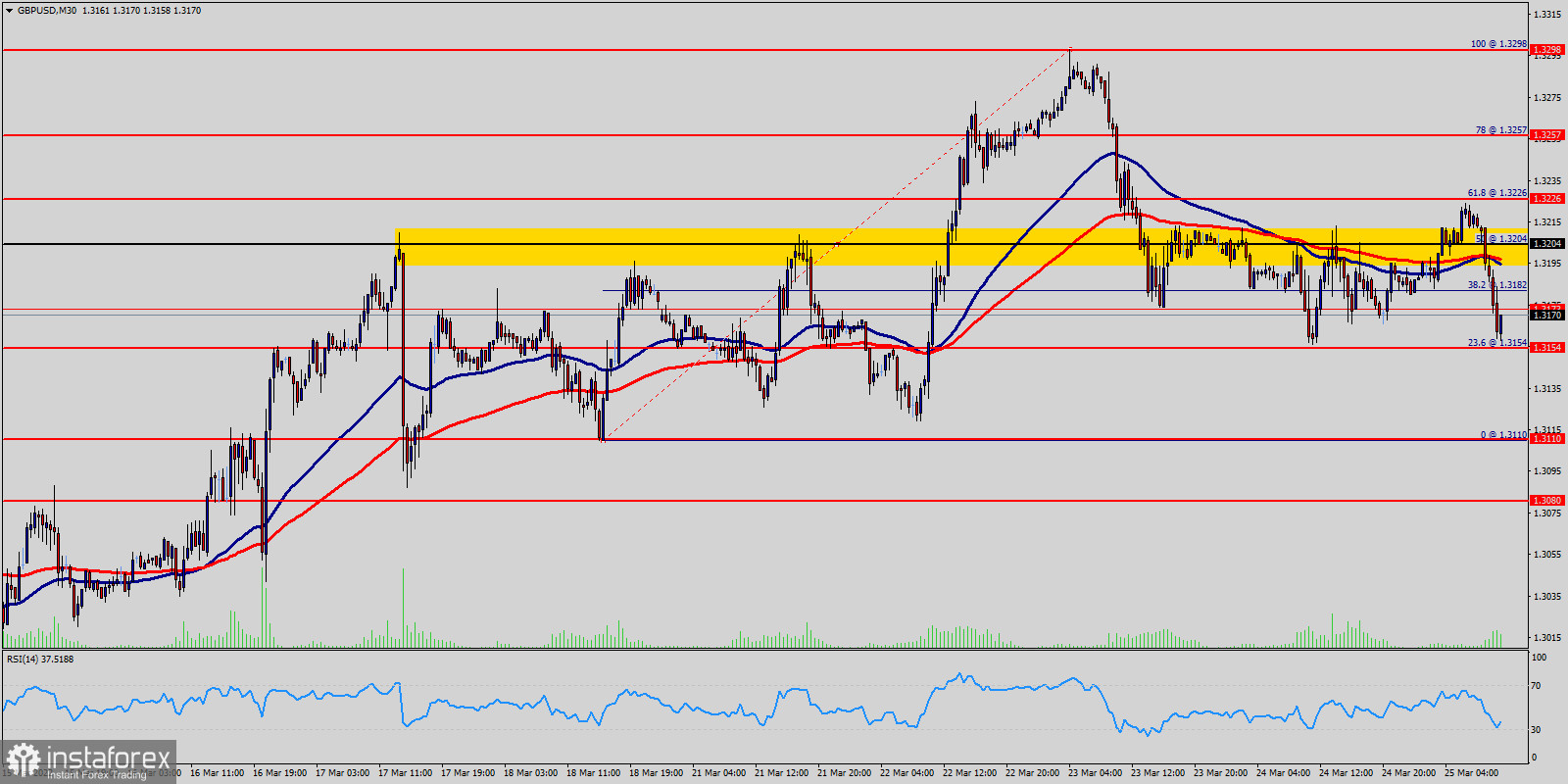

The GBP/USD pair continues moving downwards from the level of 1.3204 this morning. Today, the first resistance level is currently seen at 1.3204, the price is moving in a bearish channel now. According to the previous events, we expect the GBP/USD pair to trade between 1.3204 and 1.3080. So, the support level stands at 1.3080, while daily resistance is found at 1.3204. Therefore, the market is likely to show signs of a bearish trend around the spot of 1.3204. In other words, sell orders are recommended below the spot of 1.3204 with the first target at the level of 1.3110 and continue towards 1.3080 in order to test the weekly support 3 on the 30M chart. Furthermore, the price has been set below the strong resistance at the level of 1.3204, which coincides with the 50% Fibonacci retracement level. This resistance has been rejected several times confirming the downtrend. Additionally, the RSI starts signaling a downward trend. As a result, if the GBP/USD pair is able to break out the first support at 1.3154, the market will decline further to 1.3110 in order to test the weekly support 2. On the other hand, if the GBP/USD pair succeed to break through the weekly pivot point level of 1.3204 today, the market will move upwards continuing the development of the bullish trend to the level 1.3298 (double top). Stop loss : On the other hand, if a breakout happens at the resistance level of 1.3298, then this scenario may be invalidated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română