Crypto Industry News:

Larry Fink, CEO of BlackRock, confirmed that the world's largest asset manager is researching how to serve customers with digital currencies.

Fink pointed to growing customer interest in digital currencies in a letter to shareholders on Thursday.

Fink's comments are in sharp contrast to his previous assessment of customer interest in cryptocurrencies. In July last year, Fink said in an interview that he did not see much demand for digital assets. His opinions clearly confirm reports from industry media that an asset manager worth $ 10 trillion plans to offer its clients investors cryptocurrency trading services.

Fink also wrote that the Russia-Ukraine conflict will force countries to reassess currency dependencies and look for payment methods that can lower the costs of cross-border transactions:

"A global digital payment system, carefully designed, can improve the settlement of international transactions while reducing the risk of money laundering and corruption."

Digital currencies can also help lower the cost of cross-border payments, for example when foreign workers send wages back to their families, Fink added.

Technical Market Outlook:

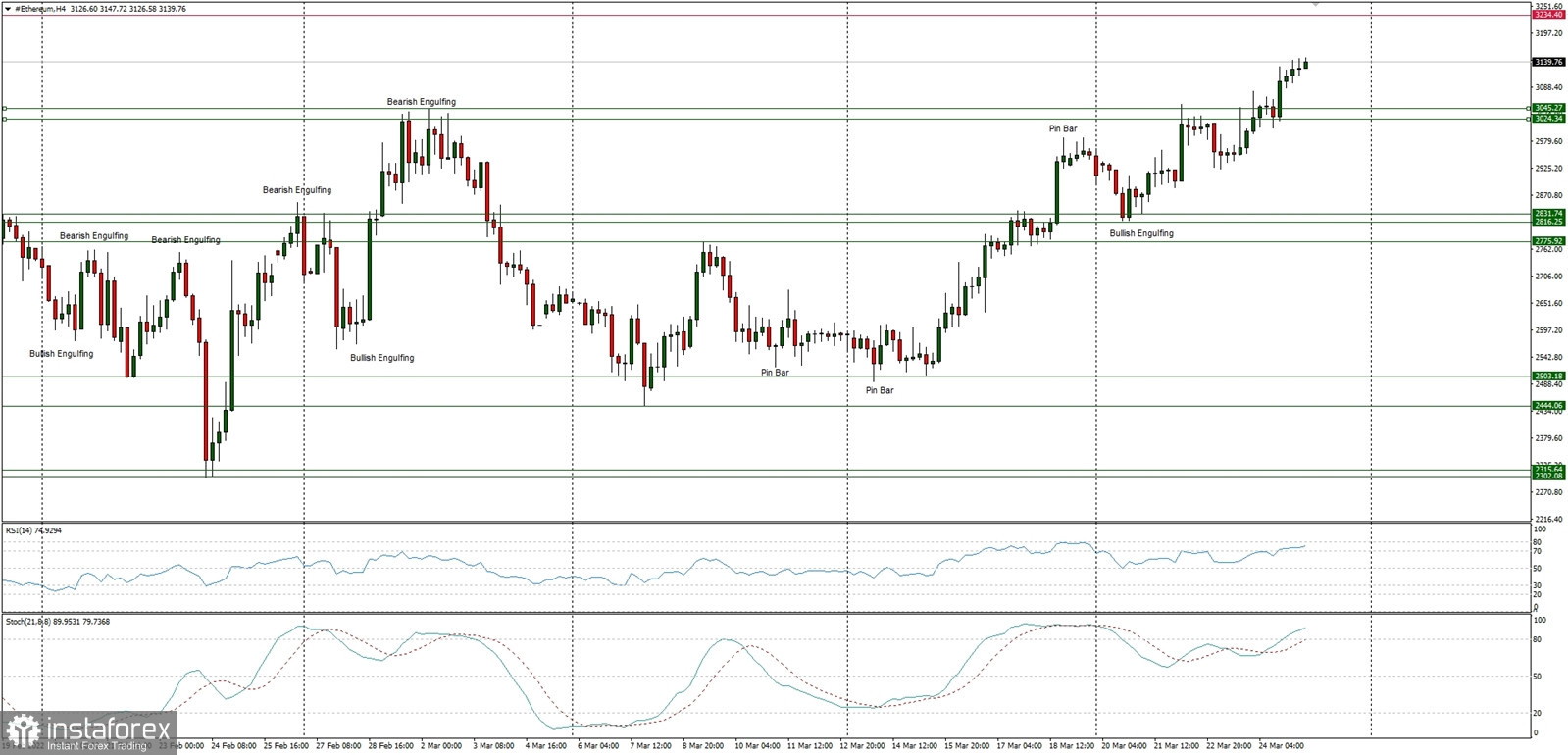

The ETH/USD pair has made a new high at the level of $3,080 (at the time of writing the article). The nearest technical support is seen at the level of $3,045. In a case of a further breakout higher, the next target for bulls is the supply zone located between the levels of $3,244 - $3,287. As long as the price stays above the technical support seen at $2,831 - $2,778 the outlook is bullish. The strong and positive momentum supports the bullish outlook.

Weekly Pivot Points:

WR3 - $3,607

WR2 - $3,304

WR1 - $3,113

Weekly Pivot - $2,810

WS1 - $2,610

WS2 - $2,316

WS3 - $2,211

Trading Outlook:

The market keeps trying to bounce higher after over the 50% retracement made since the ATH at the level of $4,868 was made. The level of $3,192 is the next key Fibonacci retracement for bulls, but the bulls had failed to break through three times already. On the other hand, the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română