New Year's Eve purchases on global markets continue, pushing the US dollar index even lower. Investors are focused on optimism and ignore the emergence of negative fundamentals. U.S. Senate majority leader Mitch McConnell on Tuesday blocked a vote to increase payments to Americans to $2,000 from the previously planned $600, but the markets ignored it. Investors continue to bet that a deal on fiscal stimulus will eventually be reached, further reducing demand for the safe-haven dollar.

Most analysts are inclined to predict a further decline in the dollar in 2021. This is also because the next US President, Joe Biden, is expected to push for even greater support measures for the US economy.

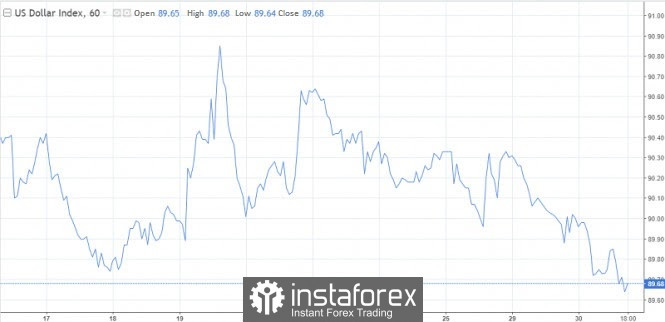

Risk sentiment peaked during the Asian session, while it eased slightly in the European session. Trading in the United States began neutrally. The dollar index continued its downward trend, losing more than 0.3%. The 90 mark is broken and it seems that sellers have set a goal to gain a foothold below.

Having a downward mood for the dollar, we can talk about the priority of transactions for the sale of the US currency

In Europe, sentiment was buoyed by the fact that Britain became the first country in the world to approve the COVID-19 vaccine. The pound rose against the dollar but was little changed against the euro as traders returning from the Christmas break grapple with the December 24 Brexit deal.

The agreement certainly avoids a chaotic Brexit, but it does not apply to services, which make up 80% of the British economy. The fact that the deal does not provide an equivalent framework for financial services and growing support for Scottish independence could create further headwinds for the British currency, Commonwealth Bank of Australia strategists write. The weakening dollar is mainly helping sterling to stay afloat around the 1.35 mark.

Despite the strong downward trend in the USD, doubts are creeping in about the continuation of this dynamic at the very beginning of the new year. In the medium term, the decline of the dollar has not yet been canceled, but a respite, or correction, is brewing. Extremely high volumes of bets on the fall of the greenback, the deterioration of the epidemiological situation in the world create prerequisites for a sharp turn in the market.

There are doubts that "the American currency may become much cheaper in the near future. Moreover, the average forecast of experts surveyed by Bloomberg implies that in the first quarter the dollar will rise in price against all currencies from the G10, "analysts write.

There are doubts that "the US currency may soon become much cheaper. Moreover, the average forecast of experts surveyed by Bloomberg implies that in the first quarter, the dollar will rise in price against all currencies from the G10, " analysts write.

Thus, in the near term, a sudden rise in the dollar may take everyone by surprise.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română