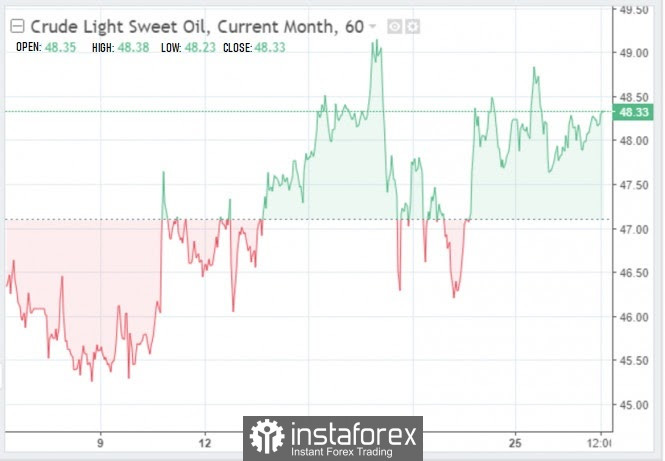

Oil prices increased today during the Asian session. In the New York Mercantile Exchange, February WTI futures traded at $ 48.35 a barrel, which is 0.69% higher than its price yesterday.

March Brent futures, meanwhile, rose by 0.61% and hit $ 51.53 a barrel.

It seems that the continuous decline of the dollar is favorable to the oil market. At the moment, the USD index is trading at a very low level, that is, below 90 points. In particular, it dropped by 0.17% and is trading at $ 89.77. This low price of the dollar makes oil more affordable when purchased in another currency.

Aside from that, oil also grew on the news that energy reserves in the United States have significantly decreased. Instead of the expected decline of 2.6 million barrels, reserves depleted by 4.8 million barrels.

Now, oil has gained almost 6% since the beginning of December. Its main driver was the optimistic sentiment of market participants associated with the emergence of COVID-19 vaccines. However, the introduction of these vaccines is unlikely to be massive and widespread in the near future, especially with the active dissemination of conspiracy theories. To add to that, global incidence is still very high, which may lead to tougher restrictions and new lockdowns. These, in turn, will significantly limit the demand for oil.

At the same time, hopes for larger payments to US households, as part of the new stimulus package, still fall short. The current bill provides for $ 600 payment to each American, which Donald Trump called "ridiculous". Unfortunately, Senate Majority Leader Mitch McConnell blocked the proposal to increase payments from $ 600 to $ 2,000.

Increased payments could have had a beneficial effect on energy demand.

In the current situation, demand is likely to slow, which will ultimately constrain oil prices.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română