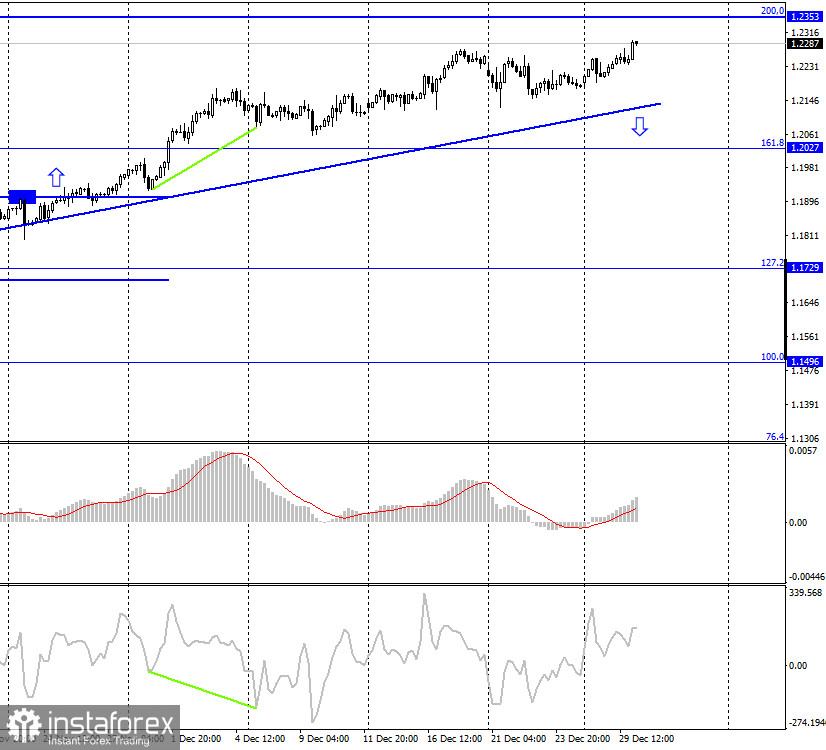

EUR/USD – 1H.

On December 29, the EUR/USD pair performed a new reversal in favor of the European currency and closed above the level of 1.2272. Thus, the growth process can now be continued in the direction of the next corrective level of 323.6% (1.2308) and the level of 1.2353. The upward trend line continues to characterize the current mood of traders as "bullish". At the same time, the information background is now rather poor. In America, the "battle for payments" continues in the US Congress. Let me remind you that earlier, under the pressure of several senators, Donald Trump signed the budget for 2021, which also included a package of financial assistance to Americans and small and medium-sized businesses. However, Trump later called for an increase in payments to Americans from $ 600 to $ 2,000. Yesterday, the House of Representatives voted in favor of this proposal and approved it. However, payments of $ 2,000 will be intended only for those categories of citizens whose income is less than $ 75,000 per year. Thus, most Americans will receive their crisis payments, and unemployed Americans will receive allowances for unemployment benefits. All this implies that the US government will again take money from somewhere to pour it into the economy. And the most likely option is to turn on the printing press. Thus, another $ 1.0-1.5 trillion may become more in the economy, and the US dollar once again reacted by falling to these measures of the US government.

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a reversal in favor of the euro and continue the weak growth process in the direction of the corrective level of 200.0% (1.2353). The rebound of quotes from this level, which can happen very soon, will allow traders to count on a reversal in favor of the US currency and some fall. Closing the pair's rate under the trend line will also work in favor of the beginning of a fall in quotes.

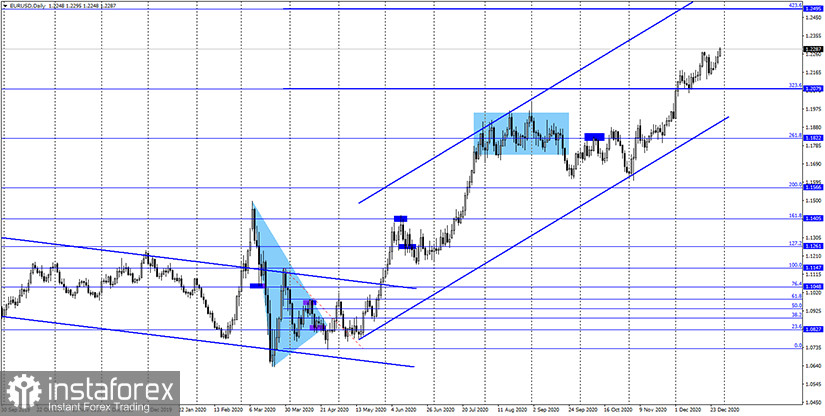

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair continue the process of growth in the direction of the corrective level of 423.6% (1.2495). Until the moment when the pair performs consolidation under the level of 323.6%, there are high chances of growth.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 29, there was not a single important news or report in the United States and the European Union. There was no information background. Events unfold only in the US Congress, where deputies at the end of the year adopted several important documents and budgets.

News calendar for the United States and the European Union:

On December 30, there will again be no reports and news in America and the European Union. The information background will be absent today.

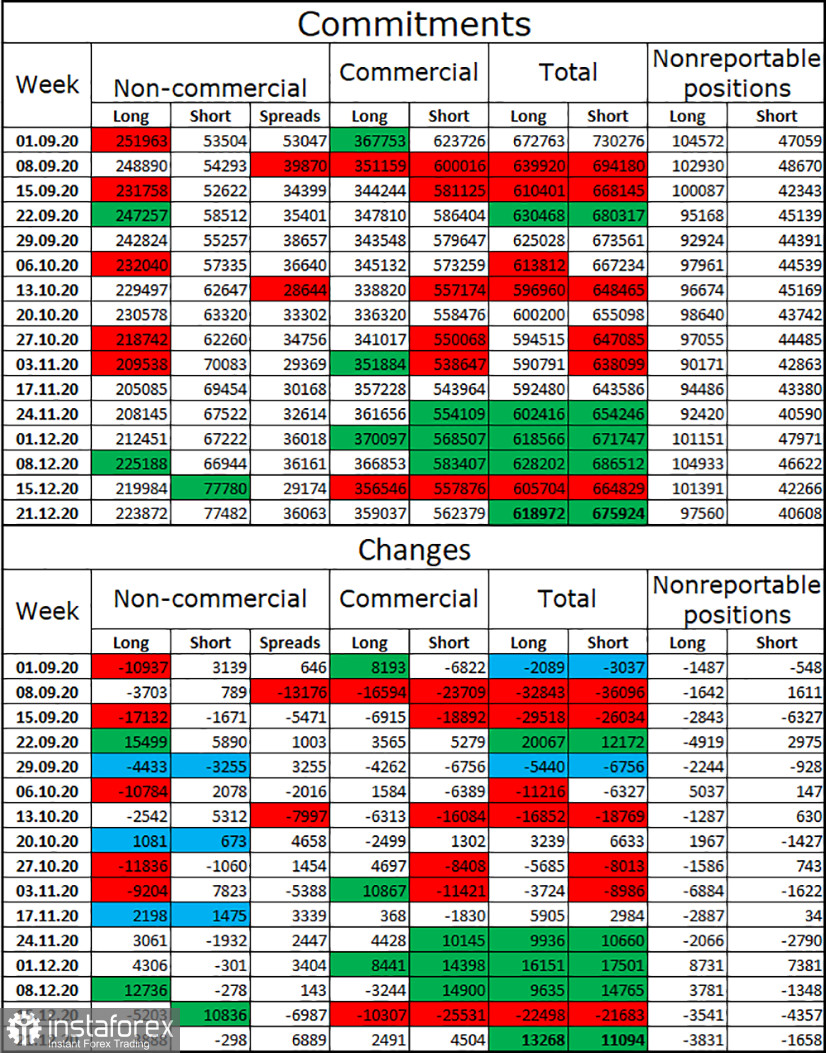

COT (Commitments of Traders) report:

The latest COT report from December 15 showed a sharp increase in the number of open short contracts by the "Non-commercial" category of traders, which is considered the most important. Before that, speculators had been building up long contracts for four weeks. And now the new COT report, which was released only today, again shows the build-up of long contracts by speculators. This means that they are once again beginning to believe in the European currency, which has only been growing in recent months. The total number of long-contracts focused on the hands of major players is 224 thousand, which is three times more than the number of short-contracts. Since speculators do not currently reduce the number of long contracts and do not increase the number of short ones, I conclude that the euro may grow further. However, let me remind you that each COT report is released three days late, and also describes changes that have already occurred.

EUR/USD forecast and recommendations for traders:

On Wednesday, I recommend selling the euro currency in case the price is fixed under the ascending trend line on the hourly chart with targets of 1.2201 and 1.2131. New purchases of the pair can be opened with the targets of 1.2272 and 1.2308 when the quotes rebound from the ascending trend line on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română