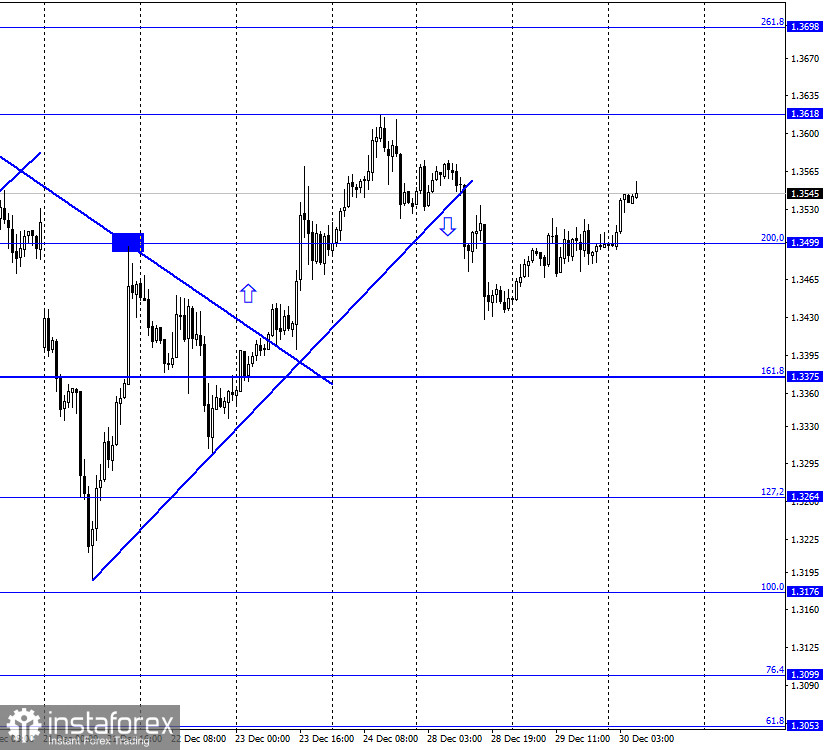

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair quotes resumed the growth process on December 29 and closed above the corrective level of 200.0% (1.3499). Thus, the growth process can be continued in the direction of the level of 1.3618 and the Fibo level of 261.8% (1.3698). Meanwhile, the UK and the EU have come close to historic days for themselves. Today, on December 30, an agreement on trade and cooperation is to be signed, as reported by the European Council. "The agreement will be signed by the parties on December 30. The head of the European Council Charles Michel and the head of the European Commission Ursula von der Leyen will sign the document on behalf of the EU, and Prime Minister Boris Johnson will sign on behalf of the UK," the European Council said in a statement. Thus, a fat point will be put in the nine-month negotiations. And tomorrow at midnight, what the UK has been waiting for 4 years will take place - Brexit. Thus, on January 1, the British will once again become a fully independent nation, and Boris Johnson will begin to rebuild the country after the coronavirus and Brexit. At the same time, the British dollar continues to trade near-annual peaks. News from the US Congress and the signing of a trade deal may once again support the British currency. At the same time, the pound sterling has been growing for a long time, is there a desire for bull traders to buy it further?

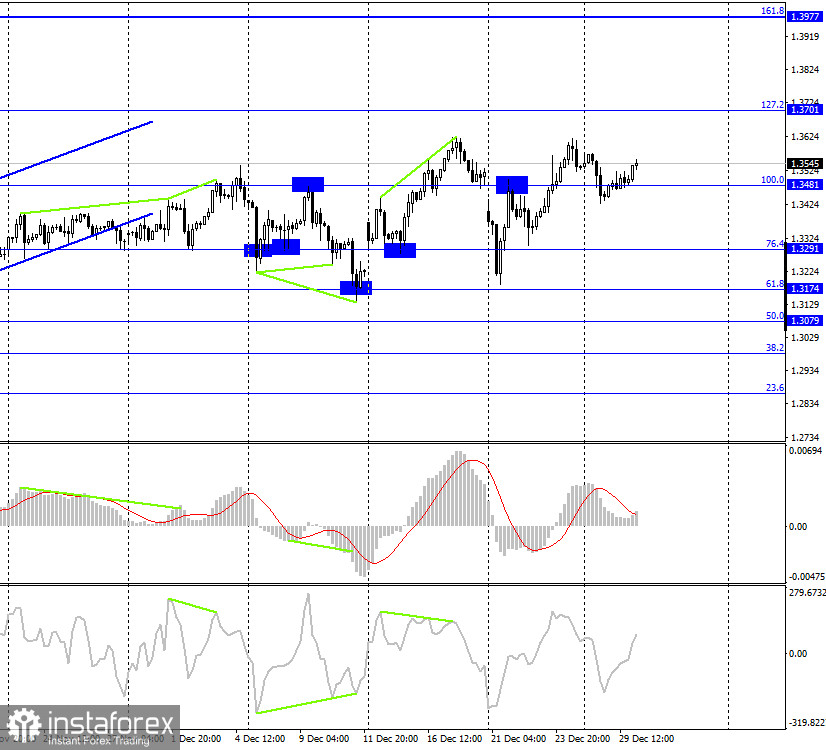

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a reversal in favor of the British currency and resumed the growth process in the direction of the corrective level of 127.2% (1.3701). A new consolidation of the pair's exchange rate under the Fibo level of 100.0% (1.3481) will work in favor of the US dollar and a new fall in the direction of the corrective level of 76.4% (1.3291). Today, the divergence is not observed in any indicator.

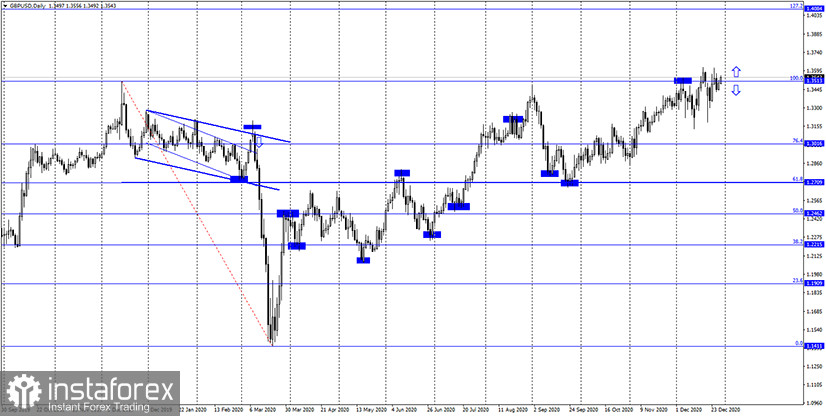

GBP/USD – Daily.

On the daily chart, the pair's quotes returned to the corrective level of 100.0% (1.3513). The rebound of the exchange rate from this level will again work in favor of the US currency and the beginning of a new fall in the direction of the Fibo level of 76.4% (1.3016). Anchoring above it will increase the likelihood of further growth.

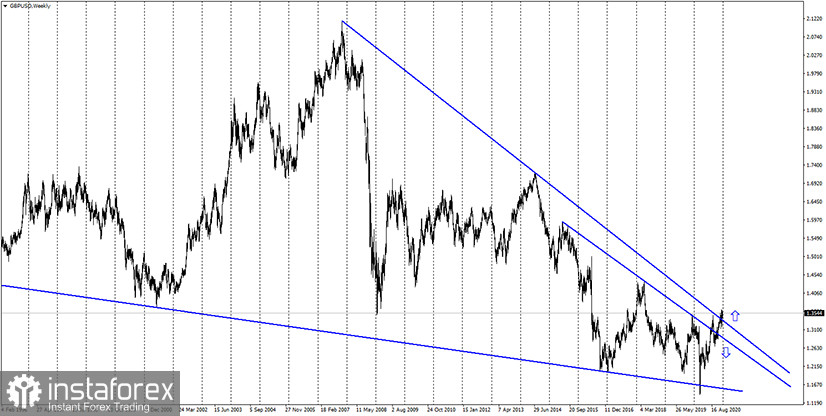

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes.

Overview of fundamentals:

There were no economic reports or other developments in the UK and the US on Tuesday. The information background was completely absent.

The economic calendar for the US and the UK:

On December 30, the calendar of economic events in the UK and the US are again empty. The information background will be absent today.

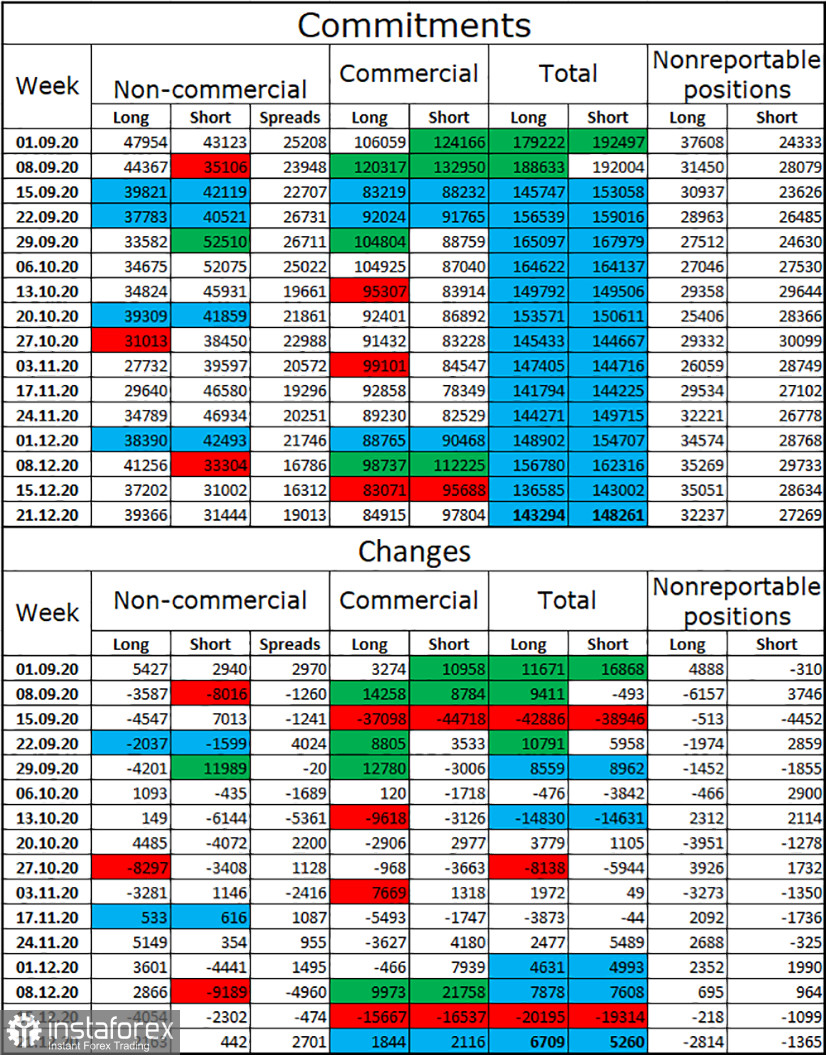

COT (Commitments of Traders) report:

The latest COT report showed that speculators were getting rid of both long and short contracts. The new COT report, which was released only last night, showed only small changes in the mood of major traders. The category of "Non-commercial" traders opened in the reporting week until December 21 - 2 thousand new long-contracts, and 0.5 thousand short-contracts. Such figures do not allow us to draw any serious conclusions about the future of the British pound. It can be noted that speculators again increased purchases of the British, but this was already 8 days ago. The total number of long contracts focused on the hands of speculators is only 8 thousand more than short contracts. For example, the difference in the euro currency is 3 times. Thus, I still can not conclude that the mood for the British is exclusively "bullish" and that the pound will continue to grow.

GBP/USD forecast and recommendations for traders:

New purchases of the British pound were recommended to open in case of consolidation above the level of 200.0% (1.3499) on the hourly chart with a target of 1.3618. I recommend selling the pound sterling at the close under the level of 200.0% on the hourly chart with a target of 1.3375.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română