The world currency markets are ending a very difficult 2020 with cautious optimism, hoping that 2021 will be a turning point and allow the global economy to recover more actively amid the vaccinations of the world's population, as well as previously taken significant measures of soft monetary policy in economically developed countries.

In addition to solving this important problem, the Brexit issue will finally be over. This lasted four and a half years and was the most important topic that directly influenced not only the exchange rate of the British currency or the dynamics of the FTSE 100 index, but also the movements of European currencies and stock indices.

Let's now discuss our forecast for the upcoming year. We believe that the volatility in the markets, including the currency exchange one, will remain quite high in January. The global economy will begin to actively recover as soon as the situation around the COVID-19 pandemic stabilizes, whose process seems to be delayed throughout the winter and possibly, also in spring months. Here, the production rates will begin to grow and the situation on the labor markets will improve, which will lead to an increase in consumer demand and will ultimately lead to an increase in inflationary pressure.

In this case, if the recovery process will take place linearly and people's lives will return to their usual course, rising inflation will begin to force the world's central banks and the Fed to think about adjusting the rates of their monetary policies. So, if we consider the prospects of the US dollar, particularly its weakening that is expected at the beginning of the new year, then we can assume that it may stop by autumn. We will observe the stabilization of the dollar exchange rate and its smooth reversal upwards, as soon as the Fed clearly states that the US economy is actively recovering and the regulator begins to think about adjusting the monetary policy.

This is undoubtedly an optimistic scenario for the development of events in the new year. But this may not happen, since a lot will depend on how effective the process of the global economy's recovery from the pandemic crisis will be. Nevertheless, it is still a fact that it will be realized sooner or later. We just want to check if it's effective in the new 2021.

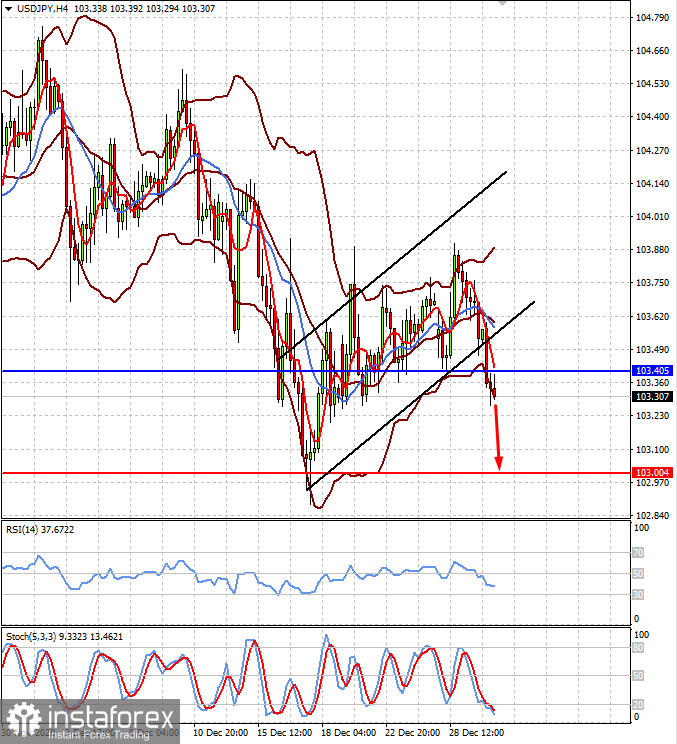

Forecast of the day:

The USD/CAD pair is trading below the level of 1.2800. If the positive mood on commodity markets continues, it can further decline to the level of 1.2685 at the start of new year.

The USD/JPY pair declined below the level of 103.40. The weakness of the US dollar may lead to its continued decline to the level of 103.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română