To open long positions on GBP/USD, you need:

Yesterday, we did not have a single signal to enter the market, while the British pound's volatility remained at a fairly low level, and the pair failed to test the designated levels, from which one could make a decision to enter the market.

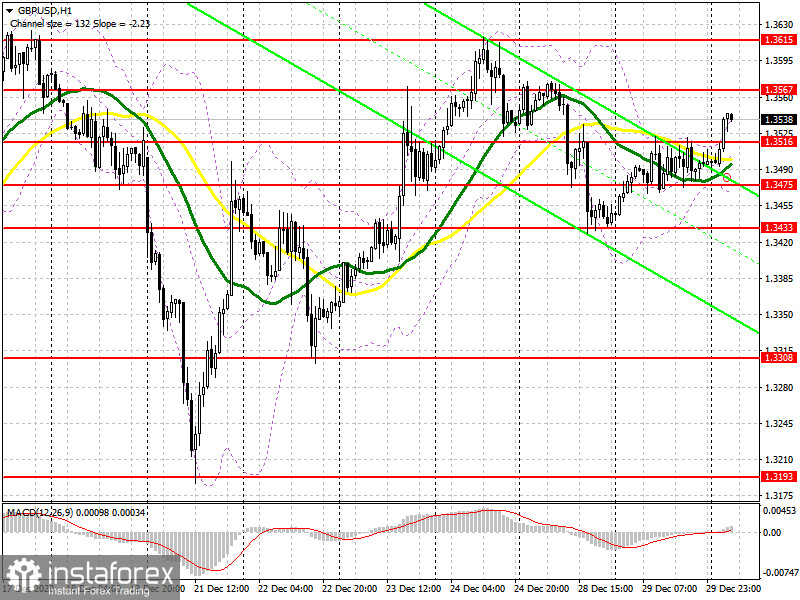

Buyers are currently focused on resistance at 1.3567. A breakout and consolidation at this level with a test from top to bottom creates a good entry point into sustaining the bull market. In this case, we can expect a larger upward movement to the high of 1.3615 along with an update and an exit to the 1.3690 area, where I recommend taking profits. If the pound is under pressure in the morning, then it is best to open long positions only when a false breakout has formed in the support area of 1.3516, where the moving averages are, playing on the side of those who buy the pound. I recommend buying GBP/USD immediately on a rebound from a low of 1.3475, or even lower, from a larger support area of 1.3433, counting on an upward correction of 25-30 points within the day.

To open short positions on GBP/USD, you need:

The dollar's weakness will continue to push the British pound. In this regard, it is best not to rush to sell GBP/USD today. Only a false breakout in the new resistance area of 1.3567, which was formed as a result of a sharp decline in the pair's volatility, will return pressure to the pound and lead to a downward correction to the support area of 1.3516, on which the succeeding direction depends. A breakout of this level and being able to test it from the bottom up creates a good signal to open short positions in sustaining the downward correction, in hopes for the pound to fall to lows of 1.3475 and 1.3404, which is where I recommend taking profits. In case the pound grows further, I recommend not rushing to sell. It is best to wait for the renewal of annual highs around 1.3615, where forming a false breakout will be a signal to open short positions. I recommend selling GBP/USD immediately on a rebound from a high of 1.3690, counting on a decrease of 25-30 points within the day.

The Commitment of Traders (COT) reports for December 21 recorded an increase in interest in the British pound, both among buyers and sellers. Long non-commercial positions increased from 35,128 to 37,550. At the same time, short non-commercial remained practically unchanged and increased only from 31,060 to 31,518. As a result, the non-commercial net position remained positive and grew to 6,032, against 4,068 a week earlier. All this suggests that traders continue to bet on the pound's growth, even in the face of the new Covid-19 strain, which was first reported in the UK. Everyone believes in the vaccine and that the beginning of next year, as soon as the quarantine measures are lifted, will be associated with strong economic growth, which will give the market a new bullish impetus and cause the pound to update new annual highs. Additional stimulus from the Bank of England may somewhat smooth out the upward trend in the pound, but it may not be there, since the trade agreement with the EU was concluded at the very last moment.

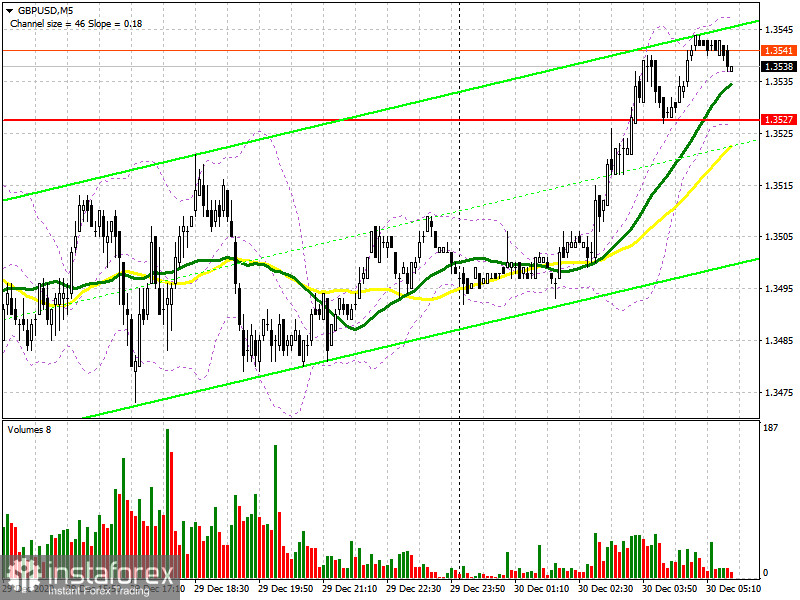

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates the sideways nature of the market in the short term.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakout of the upper border of the indicator around 1.3620 will lead to a new wave of growth for the pound. A breakout of the lower boundary at 1.3510 will increase pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română