To open long positions on EUR/USD, you need:

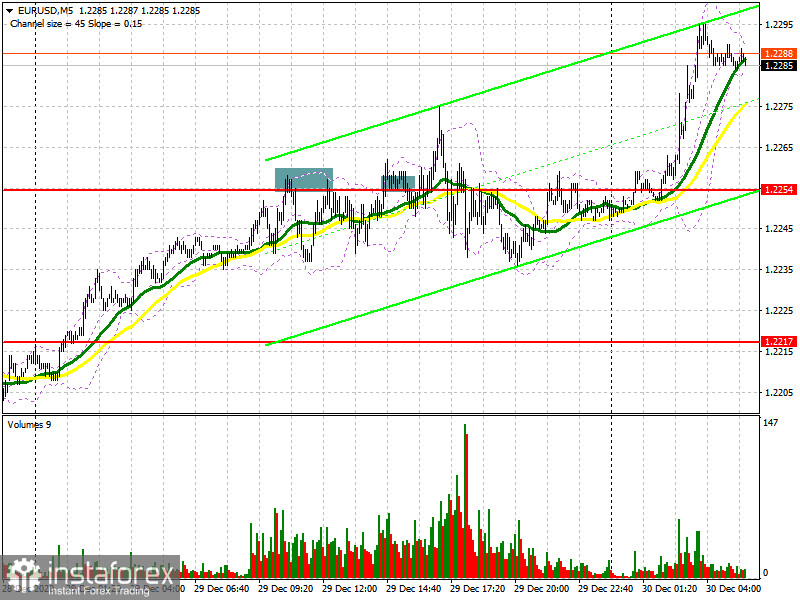

Yesterday there were several signals to enter the market, however, given the weak volatility, there was no normal movement in either direction. Let's take a look at the 5-minute chart and break down the trades. Even in my afternoon forecast, I pointed to a good signal to open short positions from the 1.2254 level. However, the decline from it was no more than 20 points. The bulls managed to settle above the 1.2254 level during the US session, but they failed to build strong growth from it either. The growth was around 20 points and it also ended quickly. I marked all entry points on the chart.

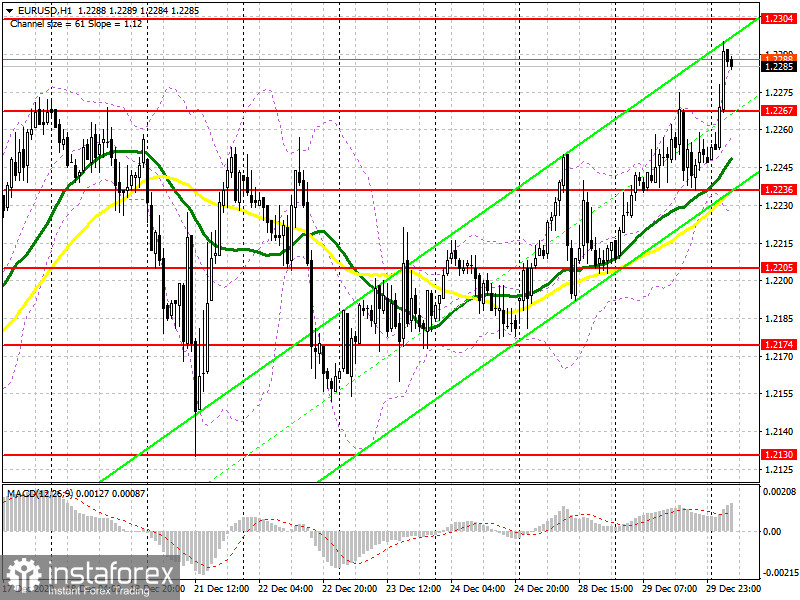

Today's Asian session was more interesting. Buyers have already come close to resistance at 1.2304. A breakout and consolidation above this level with a test from the bottom up creates a good signal to open long positions in order for EUR/USD to rise to highs of 1.2339 and 1.2417, where I recommend taking profits. In case the pair falls in the first half of the day, you can focus on support at 1.2267. However, forming a false breakout in that area creates a signal to open long positions in the euro. If the quote does not rapidly rise from this level, then it is best to abandon short positions until a low of 1.2236 has been updated, where you can buy the euro immediately on a rebound, counting on an upward correction of 20-25 points within the day. Larger lows are seen in the 1.2205 and 1.2174 areas.

To open short positions on EUR/USD, you need:

Sellers of the euro aim to regain control over the 1.2267 level, which they missed in today's Asian session. Getting the pair to settle below this range and testing it from the other side will raise the pressure on the pair, which creates a good entry point for short positions. In this case, the main goal is to pull down EUR/USD to the area of support at 1.2236, as well as to update a larger low around 1.2205, where I recommend taking profit. An equally important task is to protect a new annual high in the 1.2304 area, to which the pair is gradually approaching. Forming a false breakout there creates a good entry point for short positions in hopes for the pair to return to the support area of 1.2267. In case the bears are not active at the 1.2304 level, I recommend postponing short positions until the 1.2339 high has been tested and sell EUR/USD immediately on a rebound, counting on a correction of 20-25 points within the day.

The Commitment of Traders (COT) report for December 21 recorded an increase in both short and long positions. Buyers of risky assets continue to believe in a bull market amid news that vaccination against the first strain of coronavirus has begun in Europe. However, due to the quarantine measures taken after the detection of a new strain of Covid-19 that appeared recently in the UK, there are still quite a few problems. Thus, long non-commercial positions rose from 218,710 to 222,443, while short non-commercial positions jumped from 76,877 to 78,541. The total non-commercial net position rose from 141,833 to 143,902 a week earlier. Delta growth has resumed, but is unlikely to continue at the end of this year, as trading volume will be rather low. Therefore, you should not count on the euro's rapid growth this week, although the low trading volume may lead to a surge in volatility.

Indicator signals:

Moving averages

Trading is carried out above 30 and 50 moving averages, which indicates the euro's successive growth in the short term.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case the pair falls, support will be provided by the middle border of the indicator in the 1.2265 area, or the lower border in the 1.2235 area.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română