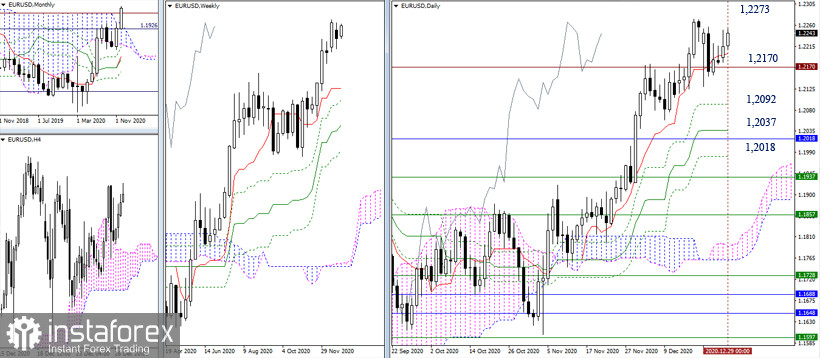

EUR/USD

Significant changes were not observed yesterday. The pair continues to move above important levels: 1.2199 -70 (daily Tenkan + historical level), thereby maintaining the support of bullish moods. To continue its development and strengthening, it is necessary to consolidate above the high extreme (1.2273). The recovery of the upward trend will allow us to consider new upward prospects. On the contrary, a decline and loss of 1.2199-70 will deprive the bulls of the daily short-term support to rise and open up opportunities for the continuation of a downward correction. The next daily targets (1.2092 Fibo Kijun - 1.2037 Kijun) are reinforced by the support of the monthly cloud (1.2018).

The bulls are still supported by all analyzed technical tools in the smaller time frame. Currently, the pair is testing the first resistance of the classic pivot levels (1.2250). Further pivot points for growth can be noted at 1.2284 (R2) and 1.2319 (R3).

Meanwhile, the key supports are joining forces today around the range of 1.2215-04 (central pivot level + weekly long-term trend). A consolidation below will change the current balance of power in the hourly chart, favoring the bears' strengthening. Their pivot points, in the form of support levels, can be noted at 1.2181 - 1.2146 - 1.2112.

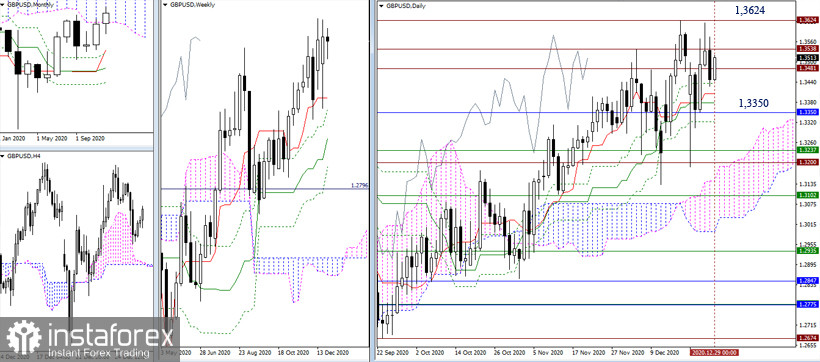

GBP/USD

The end of the month and year is approaching. The pair continues to move in the attraction area of the levels 1.3481 - 1.3538, relying on the support of the daily Ichimoku cross. They can now be noted at 1.3437 - 1.3405 - 1.3379 - 1.3321. The daily cross gained from the lower limit of the monthly cloud (1.3350) and so, a consolidation below will allow us to consider new prospects for the bearish players. Alternatively, updating the high (1.3624) and a reliable consolidation above will complete the current correction and open up new opportunities for the upward movement.

On the hourly time frame, the bulls retain their key supports. They are located today at 1.3484 (central pivot level) and 1.3456 (weekly long-term trend), so there is no need to talk about a clear advantage now. The pair continues to rely on the levels and stay in their attraction zone. In addition, the weekly long-term trend has been practically horizontal for a long time. These are all signs of uncertainty and lack of leadership.

Nevertheless, the location above the key levels (1.3484-56) gives an initial advantage to the bulls. Their pivot points are 1.3539 (R1) - 1.3631 (R2) - 1.3686 (R3). On the other hand, a movement below the levels of 1.3484-56 will allow us to consider bearish targets. They are currently located at 1.3392 (S1) - 1.3337 (S2) - 1.3245 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română