Yesterday's trading was the first one after the Christmas holidays, and not all market participants returned from them. The countries of the British Commonwealth – Great Britain, Canada, Australia and New Zealand celebrated Boxing Day, which means that trade volumes were reduced.

The economic calendar was literally empty. Statistics from Europe, the United States or the United Kingdom were not released.

What happened on the trading charts?

The pound continued its correction against the high of the medium-term upward trend, where the quote found a resistance above it last week, namely in the area of 1.3600/1.3625. The maximum decline of the British currency reached the level of 1.3428, where there was a temporary stop.

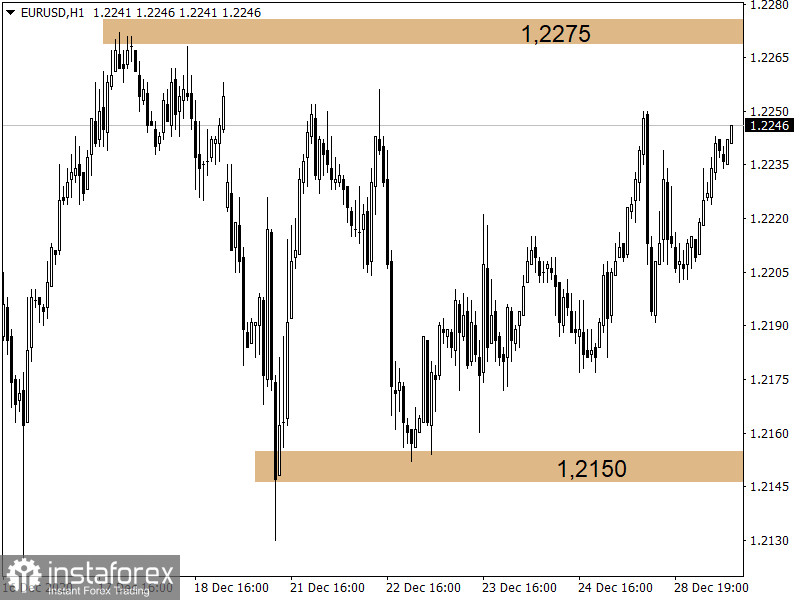

Moreover, the quote still remains within the side channel 1.2150/1.2275, albeit euro's local upward interest. We expected such a development when the scenario was described in the previous review.

Trading recommendation for GBP/USD on December 29

British traders are here today, but the economic calendar is still empty. The only thing to grasp is the information flow regarding Brexit.

We are interested in the comments of high-ranking officials regarding the completed deal. Perhaps, there will be criticism, statements, or something else that can affect speculators' hype.

As for price movements, traders are considering the possibility of the pound's further weakening. Sell positions will be considered below the level of 1.3425, with the prospect of moving to 1.3320.

An alternative scenario of the market development will be considered if the price is held above the level of 1.3510 in a four-hour time frame, which may lead to a recovery process against the recent correction.

Trading recommendation for EUR/USD on December 29

Similarly in Britain, there was no publication of statistics in Europe. Meanwhile, only the S&P/CaseShiller house price index is to be published in the US, where it is predicted to grow from 6.6% to 6.9%.

Traders will continue to move within the amplitude of 1.2150/1.2275, where the method of breaking a particular border is considered to be the best trading tactic.

So, moving on a breakdown implies holding the price outside the established limits, preferably for a four-hour TF. This can be followed by a movement towards a breakdown.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română