Even though the UK had a day off yesterday, the pound was still quite actively declining. It is clearly a matter of gradually realizing that a trade agreement between the United Kingdom and the European Union is more beneficial to Brussels than to London. The agreement itself is quite heavy and it is clearly impossible to understand all its provisions very quickly. Nevertheless, there is less and less doubt that the UK has made too many concessions that are extremely unprofitable for them. Brussels also added fuel to the fire, announcing that the European Parliament will start the procedure for confirming the agreement only in March. In the meantime, the agreement will operate in a temporary mode. It will come into force in violation of all procedural rules. In other words, the European Union is ready to accept the agreement without looking. This is possible only if the agreement itself is really extremely beneficial to the European Union. Of course, there is still the possibility that Brussels has gone mad, but it has a deterrent in the form of Germany and France. So, no one will let Brussels officials go crazy. And apparently, the negative sentiment on the pound will only increase that will lead to its further weakening which is most likely to be gradual and time-consuming. However, the trend looks quite obvious. the negative sentiment on the pound will only increase that will lead to its further weakening which is most likely to be gradual and time-consuming. However, the trend looks quite obvious. the negative sentiment on the pound will only increase that will lead to its further weakening which is most likely to be gradual and time-consuming. However, the trend looks quite obvious.

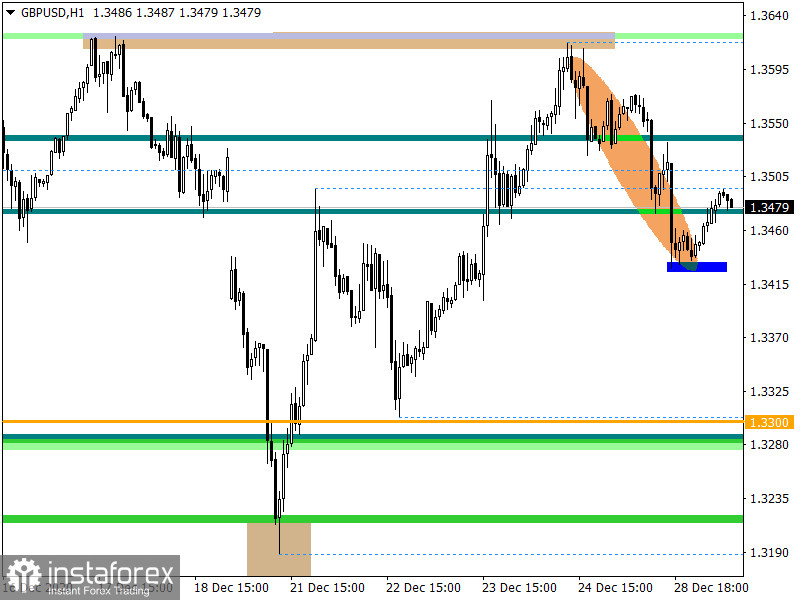

The GBP / USD currency pair showed a downward movement during the past days. As a result, the pullback set on Thursday was extended towards the value of 1.3430, where a variable support was found.

The market dynamics continues to show high activity, where the daily indicator on a stable basis exceeds the bar of 100 points indicating a high speculative interest among traders.

If we proceed from the current location of the quote, then we can see a slight upward movement from the variable support of 1.3430, which can be regarded in the market as a regrouping of trading forces.

Looking at the trading chart in general terms, the daily period is clear that the quote is still at the conditional peak of the medium-term uptrend.

It can be assumed that the downward interest will remain in the market, where if the price is kept lower than 1.3425, a path will open in the direction of the values of 1.3380 - 1.3320. From the point of view of complex indicator analysis, it can be seen that technical instruments on the minute and hour periods signal a sale due to the stage of a pullback from the peak of the trend. The daily period signals a purchase focusing on the medium-term trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română