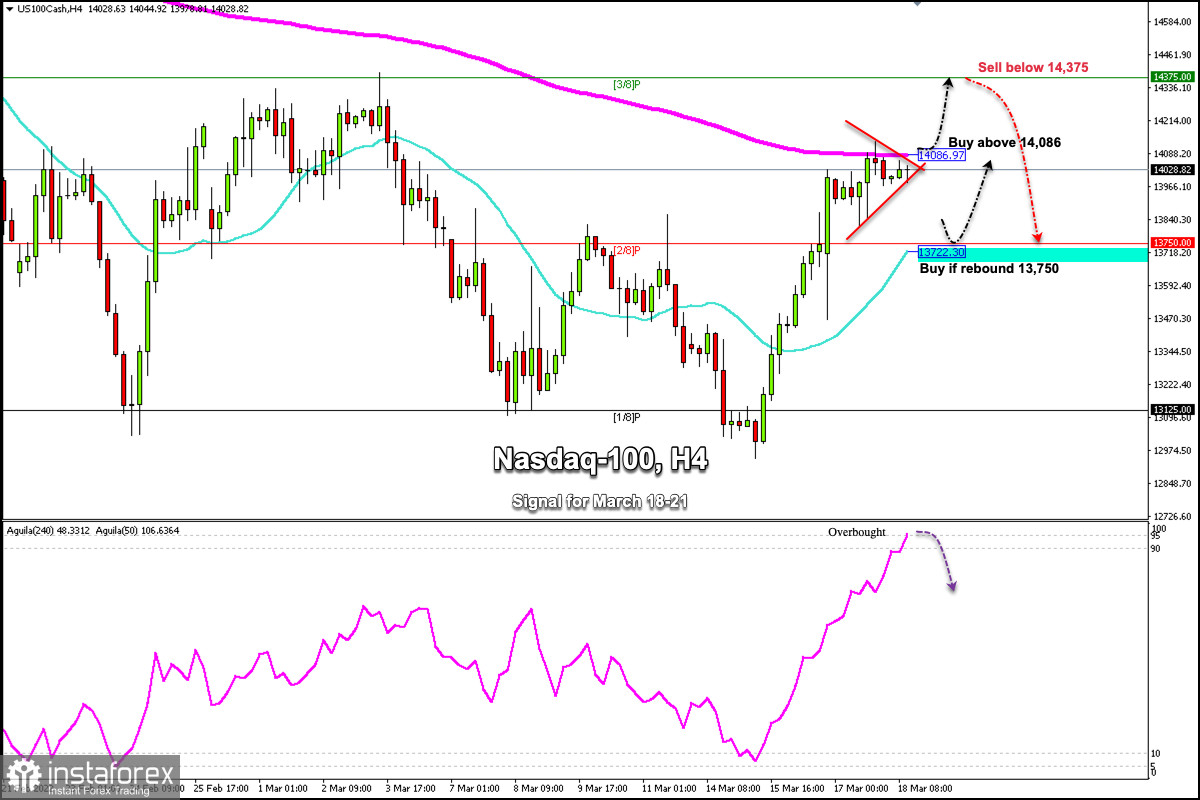

Nasdaq-100 (#NDX) reached the resistance zone of the 200 EMA on the 4-hour chart located around 14,086.

On the 4-hour chart, we can see the formation of a symmetrical triangle below the 200 EMA. A sharp break above 14,086 could accelerate the bullish momentum and reach the zone of 3/8 Murray at 14,375.

Conversely, a sharp break below the symmetrical triangle and trading below the 200 EMA could trigger a correction to the 21 SMA located at 13,722.

The Nasdaq-100 had a strong rebound from the low of 12,942 and has been accumulating strenght for four days straight. The index has gained 1,300 points, this represents more than 10%.

The trigger for this strong upward movement is as a result of investors turning to risky assets caused by the rate hike of 0.25% by the FED, which was not only anticipated by market participants, but was also taken into account in current prices.

Investors knew the actions of the FED and what it would do, they did not expect a drastic change in the direction of the economic future, so the fear dissipated. This encouraged investors to stop taking refuge in gold and invest in risky assets such as Nasdaq-100.

In the next few hours, the Nasdaq-100 is expected to continue rising, giving us an opportunity to buy above the 200 EMA located at 14,086 with targets at 14,375.

The eagle indicator has reached the extremely overbought zone and it is likely that in the next few hours there will be an imminent correction.

So, we can wait for the Nasdaq-100 to hit 3/8 at 14,375 to sell or wait for a correction at 2/8 Murray and the 21 SMA around 13,722 to buy. The eagle indicator is showing signs of extreme exhaustion.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română