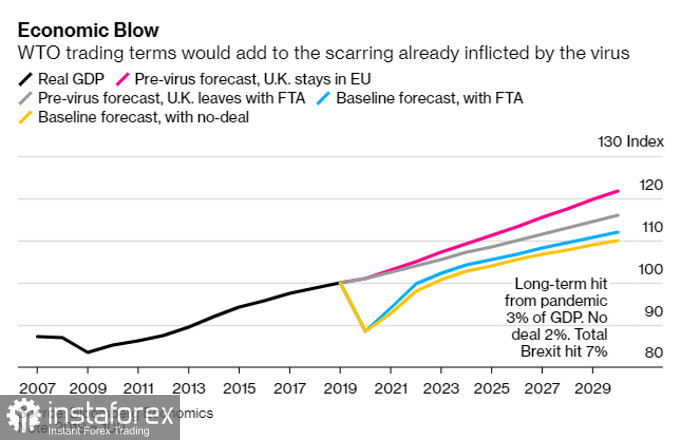

A Brexit trade agreement has been concluded. Its negotiations, which lasted more than six months, fortunately bore fruit and led to a deal that would help the UK avoid the economic shocks that it would have faced in 2021, as breaking ties with the EU would not bring it anything good, especially since the country is already dealing with a new type of coronavirus.

The deal has also eased the burden from the Bank of England, and its new terms will take effect starting January 1, 2021. Now, companies and businesses that do bilateral trade will need to adjust to the new rules, that is, a trade turnover of approximately $ 900 billion per year.

Most likely, the agreement will improve consumer and business sentiment, which declined sharply this year due to the COVID-19 crisis. A further increase in business confidence, which has remained strong even amid the pandemic, will definitely spur stronger economic activity. And in addition, in the medium term, demand for the pound should increase because of the new deal.

The agreement is now waiting to be signed by the EU leaders, followed by the European and British parliaments.

If the bill is finally ratified, there will be a new customs regime, monitoring and forms, which will end the free access of goods and the old trade relations that have been in place since the 1970s. This will lead to disruptions in ports and, quite possibly, even a shortage of food in supermarkets. Disruption to supply chains will also affect business activity, leading to slower economic growth and higher prices.

But in the longer term, the new agreement avoids a scenario where the UK would see a 1.5% decrease in output in 2021, which would only exacerbate the expected recession due to the latest restrictions imposed because of the new coronavirus strain.

The new outlook, as a result of the Brexit agreement, provides for more robust economic growth that is 0.5% above the baseline scenario.

As for the GBP / USD pair, though demand may slow down due to the tougher quarantine restrictions, the upward potential remains quite high. A breakout from 1.3625 will most likely lead to a stronger jump towards 1.3690 and 1.3750, or even towards the 38th figure. But if the quote moves below 1.3535, the pound will collapse to 1.3475 and below.

USD: US President Donald Trump signed the 2021 budget over the weekend, including the $ 900 billion bailout bill. According to the White House, the president signed the bill in the original form in which it was agreed. Therefore, Americans will receive $ 600 per person next year, not $ 2,000 which Trump requested earlier. Nonetheless, the signing of the document indicates that negotiations on additional economic assistance, which the US economy urgently needs now, will continue.

The new aid package also includes $ 1.4 trillion, which will go to the budget that supports the work of the US government. Thus, the amount of $ 2.3 trillion, which was so criticized by Trump and which became a problem this summer, was still approved.

Although the Democrats prefer a larger bill, they have to support Trump's decision. Last Sunday, House Speaker Nancy Pelosi said, "Every vote against the new bill is a vote to deny the financial difficulties that families face. It also denies Americans the help they need."

Both the Democrats and Republicans agree with the need for payments, but according to Trump, it is clear that no one wants to throw money around.

Meanwhile, President-elect Joe Biden recently announced that after taking office early next year, he will push for even more stimulus. However, it remains unclear whether the Republicans, who so far control the Senate, will agree to this.

With regards to the EUR / USD pair, a breakout from 1.2175 will most likely lead to a sharp decline towards 1.2080 and 1.2040. But if the quote consolidates above 1.2220, the EUR / USD pair may rise to 1.2260 and then to 1.2310.

CAD: The Canadian dollar remained trading in a sideways channel after data emerged that building permits in Canada rose 12.9% in November, up from its figure in the previous month. At the same time, the data for October was revised upward to -12.6%, which is better than its previous estimate of -14.6%. Compared to the same period last year, building permits increased by 16.2%.

Therefore, in the USD/CAD pair, only a breakout from 1.2820 will lead to a sharp decline towards 1.2770 and 1.2690. But if the quote consolidates at 1.2885, the USD/CAD pair may go to 1.2955.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română