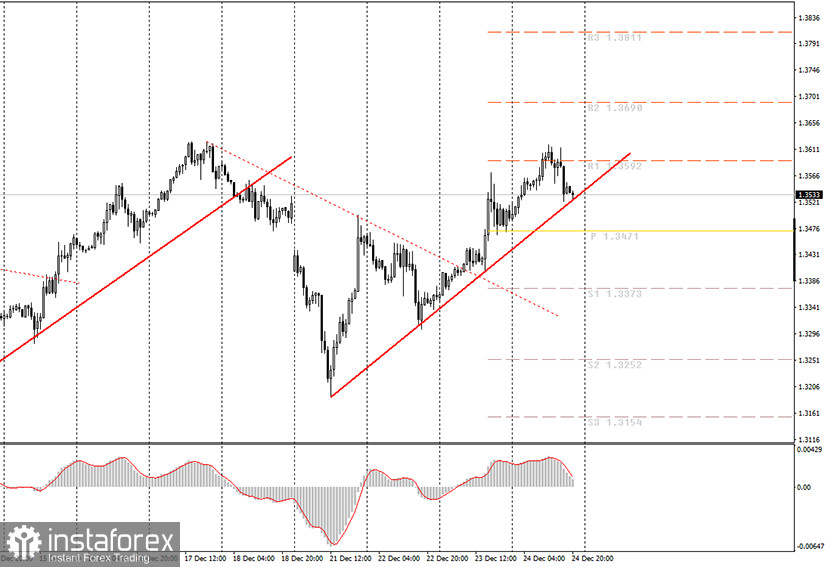

The hourly chart of the GBP/USD pair.

The GBP/USD pair was trading quite actively on Thursday, December 24. The pair's quotes returned to the highs of the year. At the same time, it returned to the 2.5-year highs, however, it could not update and began a round of downward correction. As a result, the price fell to the upward trend line and now traders have to decide: either overcome this line or bounce back and resume the upward trend. To be honest, given how long the pound has been growing, even if there is a trade deal, it is hard to believe in its further growth. But this is the foreign exchange market. If arguments like "hard to believe" worked here, everything would be easy and simple, like in a fairy tale. Therefore, technically, the chances of growth or decline are 50/50. We are more inclined to fall, as the pound has grown in recent months solely on expectations of a trade deal between London and Brussels. There is such an expression in Forex: "Buy on rumors, sell on facts." Perhaps it will be implemented this time with a vengeance. But for its implementation, you will still need a technical signal in the form of fixing the price below the trend line.

Well, the deal is agreed, there are only small things that the EU and the UK are sure to be able to settle before the New Year. However, according to many experts, the British economy will still not be saved from a new fall (decline in GDP) of the economy at the beginning of 2021. The negative effect of Brexit will still be there, and the presence of a trade deal will only slightly smooth it out. Thus, in the fourth quarter, the British economy may suffer losses due to the second "lockdown" and stricter quarantine due to a new strain of "coronavirus", and in the first quarter of the new year – thanks to Brexit. Therefore, we should not expect positive economic news from Britain in the near future. Based on this alone, we would have predicted a fall in the British pound. Plus, the pound is heavily overbought. But, as mentioned above, this is a market, so you can not be 100% sure of anything. Therefore, you need to wait for a technical signal.

As of December 28, the following scenarios are possible:

1) Buy orders now remain relevant, as the upward trend continues. Thus, novice traders can now wait for a new buy signal in the form of a price rebound from the trend line. The target for buying, in this case, is the resistance level of 1.3690, which is located much higher than the current highs of the pair. We remind you that you need a clear rebound from the trend line.

2) Sales are now impractical, since the downward trend has been canceled, and the new one has not yet been formed. Thus, now you need to wait for the quotes to consolidate below the upward trend line and only then sell the pair with the support levels of 1.3471 and 1.3373. This consolidation can occur immediately at the opening of trading on Monday night.

What's on the chart:

Price support and resistance levels – target levels when opening purchases or sales. You can place Take Profit levels near them.

Red lines – channels or trend lines that display the current trend and show which direction is preferable to trade now.

Up/down arrows – show when you reach or overcome what obstacles you should trade for an increase or decrease.

MACD indicator – a histogram and a signal line, the intersection of which is a signal to enter the market. It is recommended to use it in combination with trend lines(channels, trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp reversal of the price against the previous movement.

Beginners in the Forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management is the key to success in trading over a long period.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română