Well, despite the author's pessimistic forecasts about the possibility of concluding a trade agreement between the UK and the European Union before the end of this year, right on the eve of the Christmas holidays, like in a good old fairy tale, negotiators from the EU and the UK reported reaching an agreement on further trade agreements between the parties. This news came yesterday afternoon. However, the final point should be put on the issue of fishing, after which the European Parliament and the British Parliament will have to ratify the bill before the end of this year. Let me remind you that such an option (reaching an agreement at the very last moment) was previously assumed, and this is exactly what happened. However, European parliamentarians were ready to meet for the next meeting if the deal was concluded before December 20, however, the parties did not have time to agree by this date. Nevertheless, the importance of the issue of further trade relations between the former allies is too great, so the European Parliament will meet and consider the approval of this document. Will the House of Commons of the British Parliament support the deal that Prime Minister Boris Johnson concluded with the European Union? Earlier, British parliamentarians twice rejected the version of the deal proposed by the previous Prime Minister Theresa May. However, Johnson has the necessary majority in this situation, consisting of 80 deputies of the House of Commons. Therefore, the current head of the British Cabinet of Ministers has much more support, which means that the deal with the EU can be ratified.

As for the technical picture for the main currency pair, since the markets are closed today on the occasion of the celebration of Catholic Christmas, it is already possible to conclude the results of weekly trading.

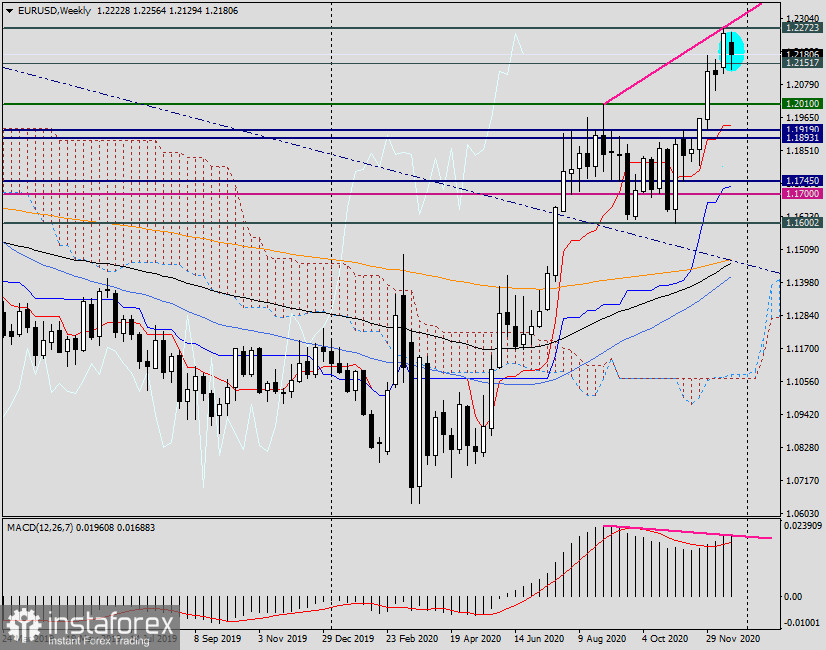

Weekly

The picture on the weekly timeframe is very interesting and leaves big questions about the future ability of the main currency pair of the Forex market to continue moving in a northerly direction. As can be seen on the chart, after a fairly significant increase from 1.1600, under the strong resistance of sellers at 1.2272, which did not submit to the euro bulls, a reversal model of the candle analysis "harami" appeared. The essence of this model is that the last small bearish candle is located inside the body of the previous bullish one. Also, it is necessary to note the bearish divergence of the MACD indicator, which is an additional signal for a possible decline. It is difficult to assume that it will be a corrective pullback or a trend change. Here, I would like to note that the reversal model "harami" is not as strong as the "tombstone" or "hanged" and is less often worked out by the market. The fact that it appeared right under the strong resistance level of 1.2272 increases the chances of working out the extended reversal model, and is also confirmed by the bearish divergence of the MACD. In general, there is something to think about. Although everything will depend on how the auction opens on the night from Sunday to Monday. It is quite possible that, given the agreement on Brexit, the next weekly session will open with an upward price gap. This will be especially possible if the document on trade relations between the EU and the UK is ratified. So now the floor belongs to the parliamentarians, who will start working from Monday.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română