EUR/USD

Last night, the main negotiators on the EU-UK trade deal gave their countries a Christmas present - they agreed on all the points of the agreement after the final decision on the fishing issue. Today and tomorrow the MPs of both parties will study the document in order to have time to ratify it before the new year. Probably, this event prevented the speculative attacks on the European currencies, which we expected. But the markets did not rise, for example, the euro closed the day five points lower than Wednesday's close. This all speaks of the likely intention of market participants to sell European currencies after the holidays and the ratification of the agreement, since current prices already include a positive outcome of the transaction, but the main reason, in our opinion, which we have already discussed more than once, is even a good deal (and accepted deal is not very good) will look worse than economic relations between the two regions before Brexit.

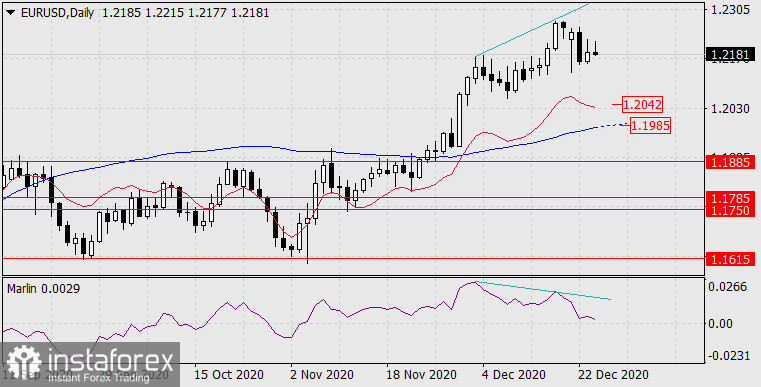

Investors will return to work on Monday (except for the UK, Canada, Australia), and the technical picture is not favorable for long deals: the price divergence with the Marlin oscillator persists and develops on the daily chart:

The first target for the decline is the 1.1985-1.2042 range formed by the MACD line and the embedded price channel line. Then we wait for the price in the target range of 1.1750/85.

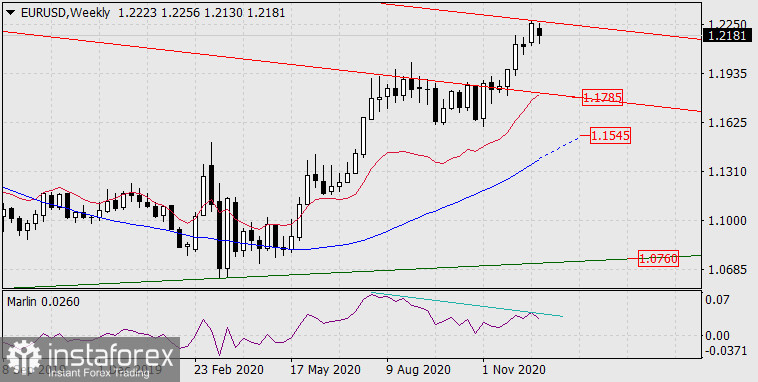

In the medium term, the euro will be waiting for the MACD line on the weekly timeframe in the 1.1545 region, even deeper than 1.0760 - support for the upward trend line of the monthly timeframe. But this decline will be largely dependent on US policy. Take note that the price has formed a reversal divergence with the oscillator on the weekly chart.

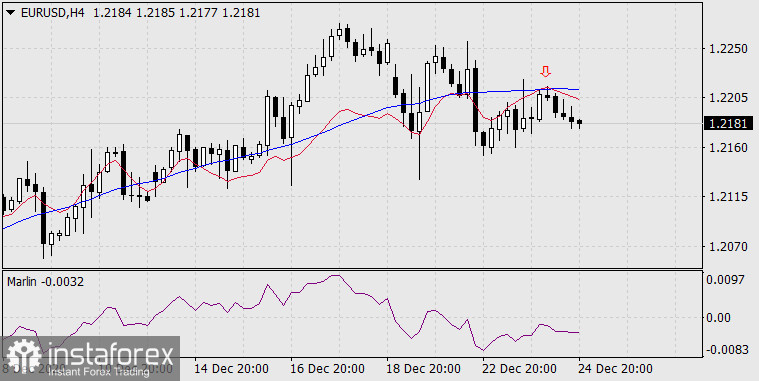

The four-hour chart shows that the price has reversed to the downside from the MACD line yesterday. The situation is developing normally.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română