Overview :

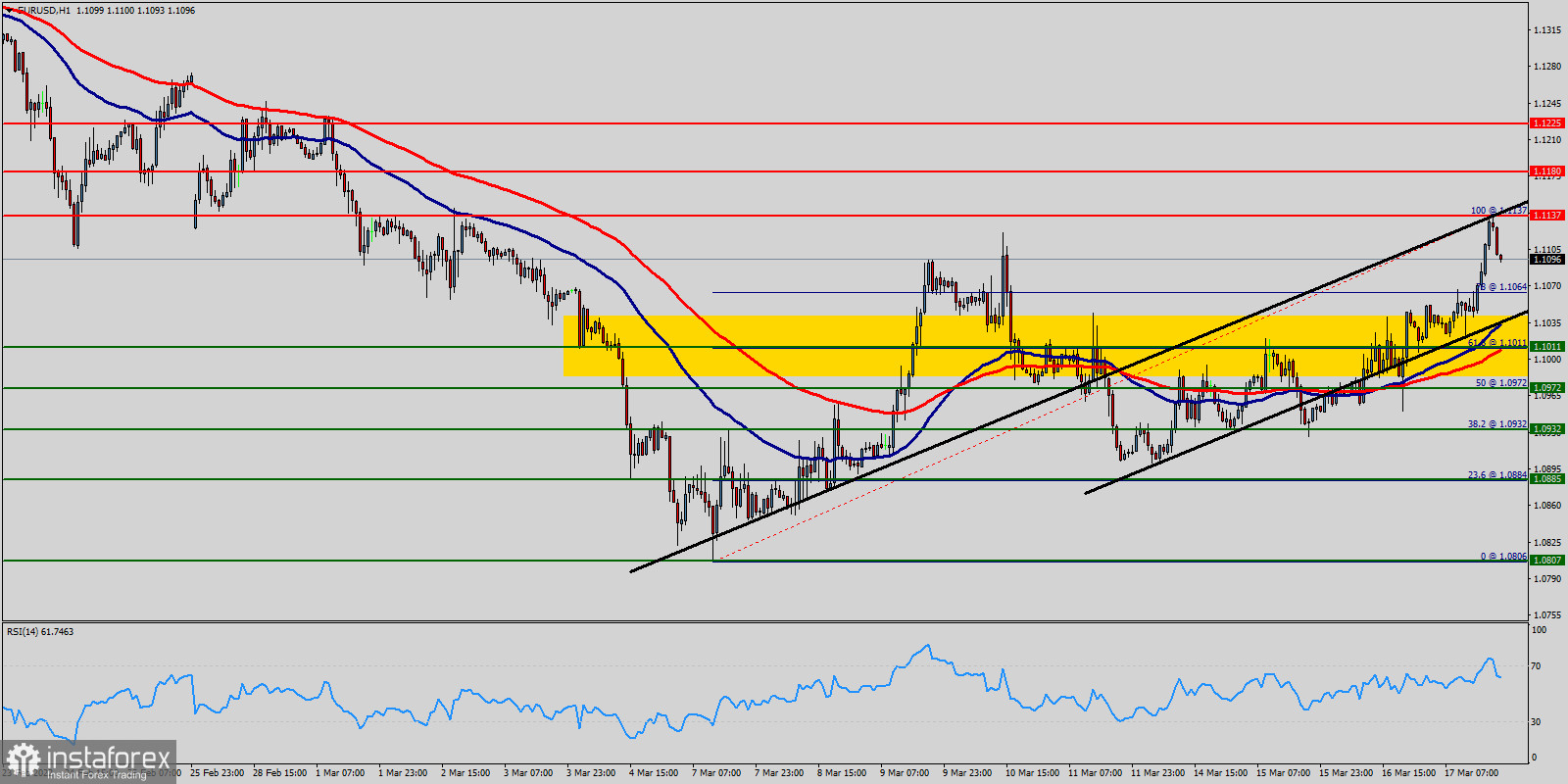

In the one-hour time frame, the trend is still bullish as long as the level of 1.0972 is not broken. The level of 1.0972 has been rejected several times confirming the validity of a bullish market today.

The support level is seen at 1.0972 . The market is still indicating a strong bullish trend from the spot of 1.0972. Thereupon, it would be wise to buy above the level of at 1.0972 with the primary target at 1.1137, which represent the ratio of 100% Fibonacci - last bullish wave - top.

We expect the EUR/USD pair to continues moving in an uptrend above the level of 1.1137 towards the second target at 1.1180, while major resistance is found at 1.1225.

On the downside, a clear break below 1.1137 could trigger further bearish pressure testing 1.1011, which coincides with a triple bottom.

Moreover, the RSI is becoming to signal a downward trend, as the trend is still showing strong above the moving average (100) and (50).

Then, the trend is keeping its bearish momentum today. As a result, it is gainful to sell below this price with targets at 1.1137 and 1.1011. We expect a new range below the area of 1.1011 towards the daily support of 1.0972.

The bias remains bearish in the nearest term testing 1.0972 and 1.0932.

Consequently, the EUR/USD pair will probably be moved between the levels of 1.0932 and 1.1137.

Alternatively, stop loss has always been in consideration. Hence, it will be useful to set it above the resistance of 1.1225.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română