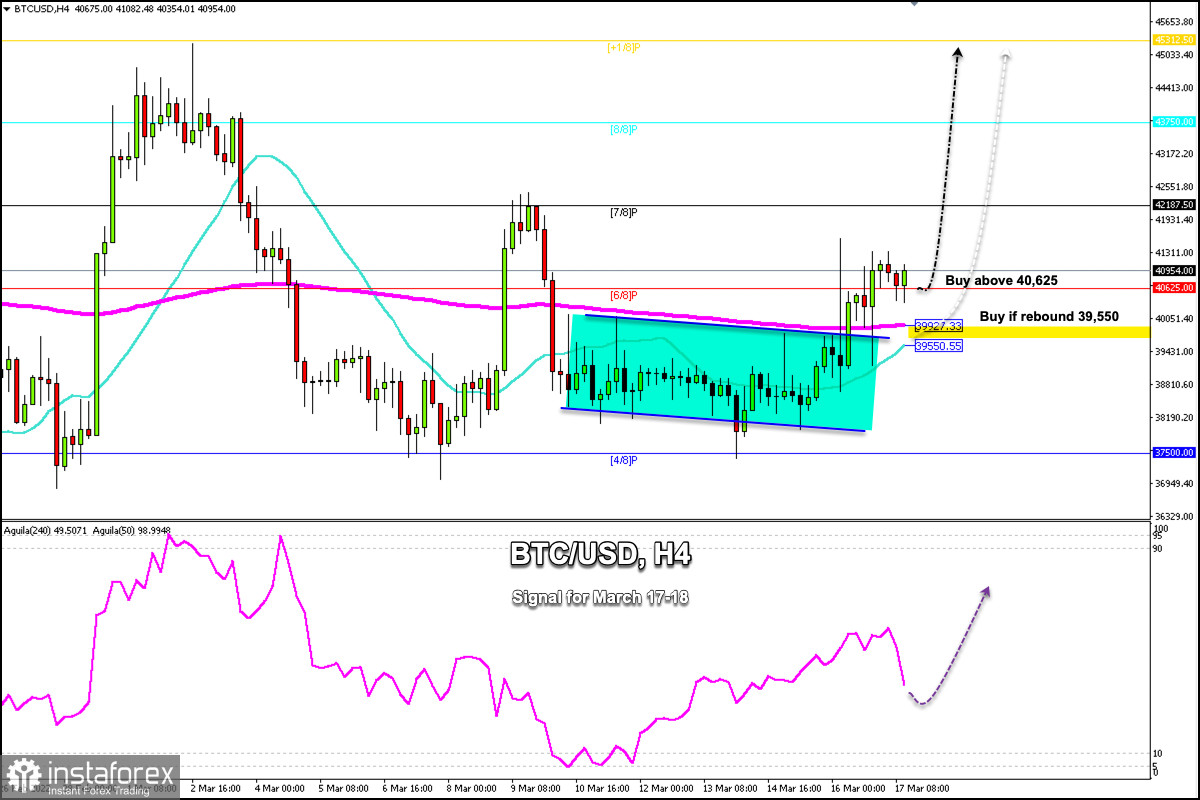

In recent months, Bitcoin (BTC/USD) has been bouncing above the 4/8 Murray line located at 37,500, not being able to surpass it. the price formed a downtrend channel that was broken yesterday with the Fed's decision regarding the key interest rate.

Currently, Bitcoin is trading above the 21 SMA and the 200 EMA both located at 39,927. Bitcoin is hovering above this level, now consolidating above 6/8 Murray.

We can see that this level where the moving averages are located for now, has become a strong bottom that coincides with the psychological level of $40,000.

Since yesterday, the short-term outlook for Bitcoin has changed and has become bullish. We expect Bitcoin to continue its upward movement in the next few hours and the price could reach 7/8 Murray at 42,187. Besides, it could reach the high of March 1 around 45,312.

As long as Bitcoin continues to trade and bounce above the 200 EMA, there is a chance for more buying. This will give us the opportunity to increase our long positions above 39,500. Bitcoin is expected to reach the level of 45,300 in a few days.

Conversely, in case of a sharp break and close below the 21 SMA at 39,550 on the 4-hour chart, BTC is likely to drop back to the support 4/8 Murray at 37,500. Below 4/8 of Murray (37,500), if BTC trades moving away from this level, the price will accelerate the drop to 1/8 Murray at 32,812.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română