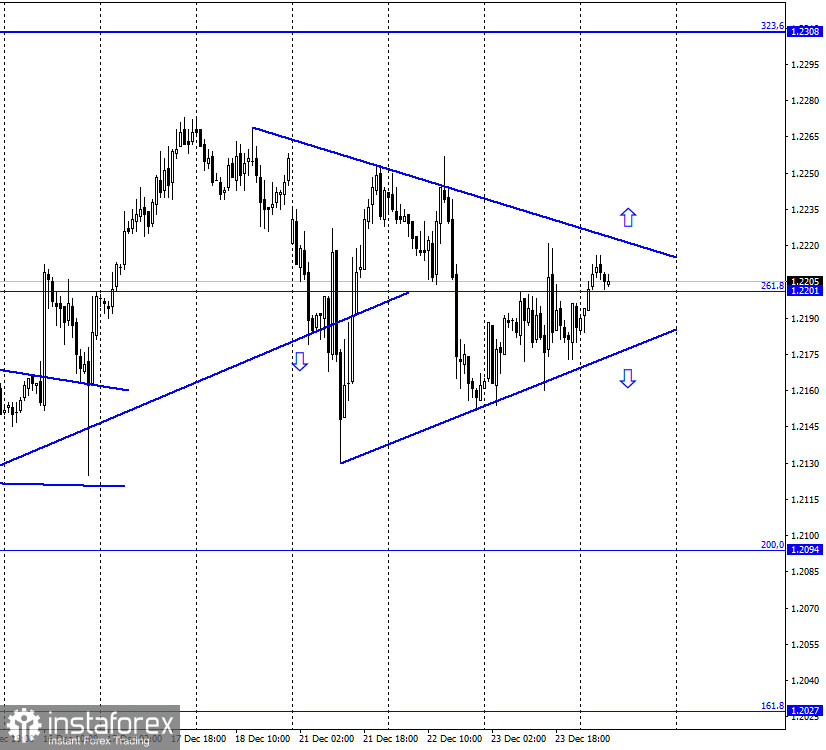

EUR/USD – 1H.

On December 24, the EUR/USD pair performed a rebound from the lower trend line, a reversal in favor of the European currency, and began a new growth process in the direction of the upper trend line. The rebound of quotes from this line will work in favor of the US dollar and some fall back to the lower trend line. Fixing the pair's rate above the upper trend line will increase the probability of further growth in the direction of the corrective level of 323.6% (1.2308). Meanwhile, the Christmas and New Year holidays are approaching, so there is less news, and there will be no economic reports at all today or tomorrow. Perhaps the most interesting and significant event of recent days was the refusal of Donald Trump to sign a package of assistance to the American economy totaling $ 900 billion. The US President called the amount of assistance to American citizens and the unemployed in this package "pathetic" and demanded to increase payments from $ 600 to 2 or even 4 thousand dollars. It is not yet known whether the Democrats will make such concessions, although most likely they will not. Let me remind you that in the fall, Democrats and Republicans discussed the aid package for several months, and then the Democrats insisted on a larger package of measures, totaling more than $ 2 trillion. Now, Donald Trump is pushing for an increase in the aid package. It's all like a political game. Also, Donald Trump blocked the US defense budget, which provides for an increase in salaries for military personnel and 740 billion for various military programs and construction.

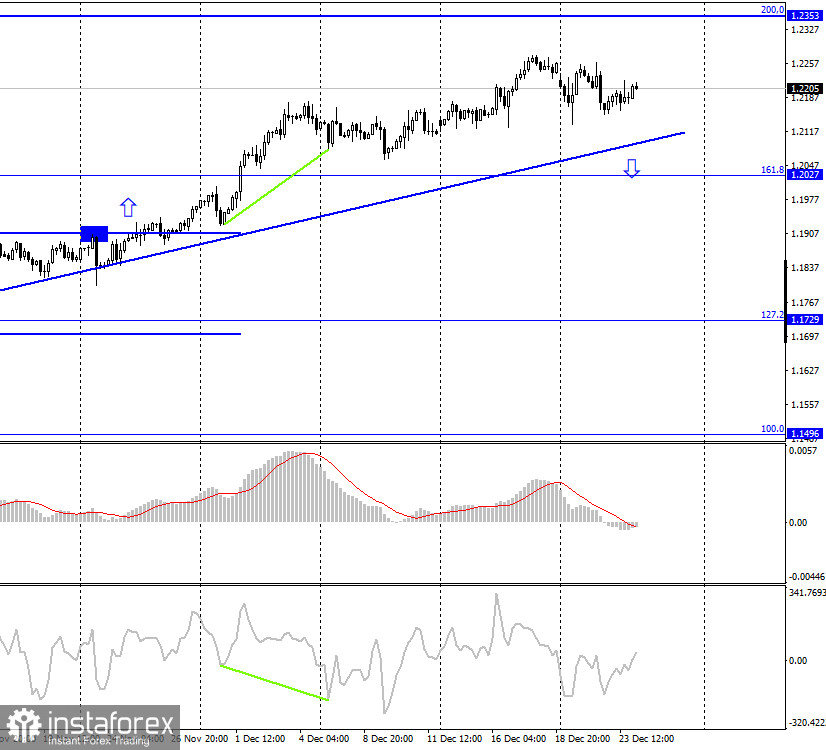

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a reversal in favor of the European currency, but in general, they are trading between the corrective level of 200.0% (1.2353) and the upward trend line, which keeps the current mood of traders "bullish". Thus, on this chart, it is impossible to conclude the end of the upward trend. I believe that it is better now to analyze an hourly schedule, where you can track changes more quickly.

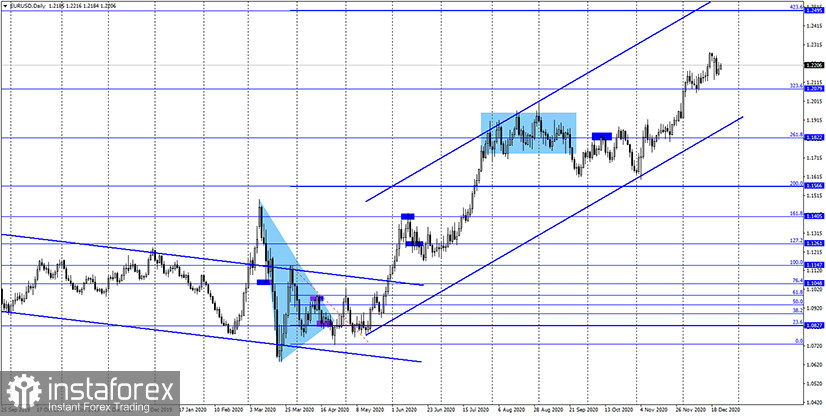

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair continue the process of growth in the direction of the corrective level of 423.6% (1.2495). Until the moment when the pair performs consolidation under the level of 323.6%, there are still high chances of growth.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 23, a report on orders for durable goods was released in the United States, which slightly exceeded traders' expectations. The report on applications for unemployment benefits also turned out to be better than traders expected. However, the US currency is still growing with great difficulty.

News calendar for the United States and the European Union:

On December 24, there will be no reports and news in America and the European Union. The information background will be absent today. Many institutions go on Christmas holidays.

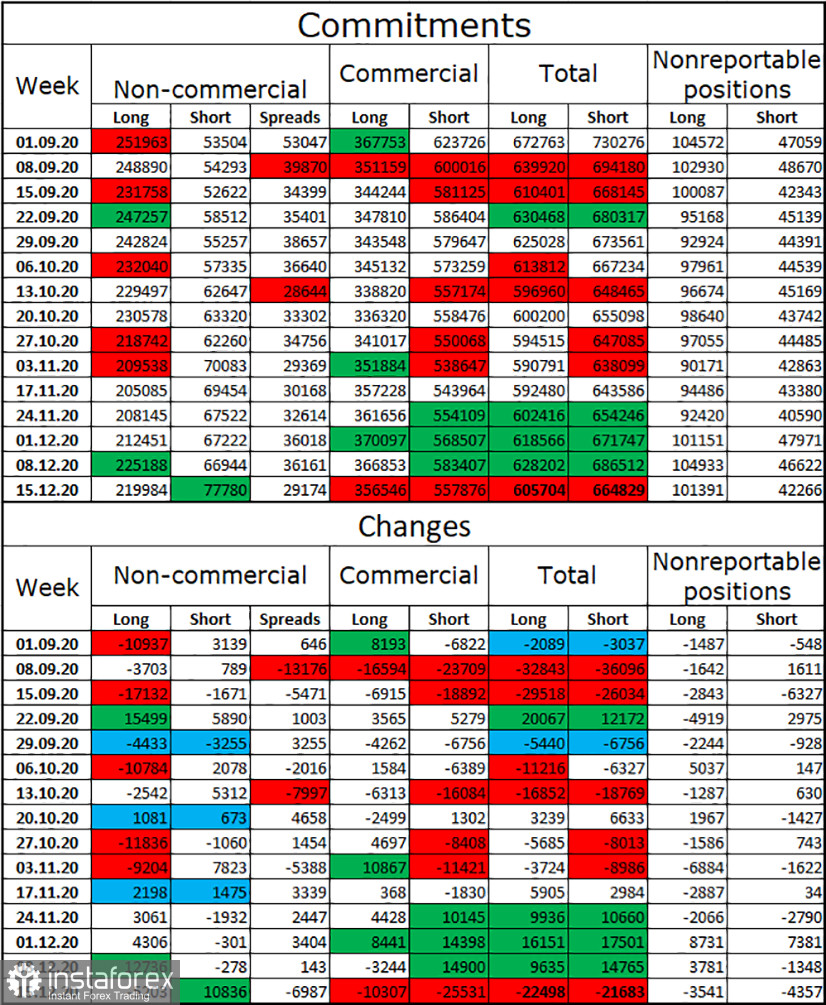

COT (Commitments of Traders) report:

For four weeks in a row, the mood of the "Non-commercial" category of traders became more "bullish". This was indicated by COT reports and it coincided with what was happening on the euro/dollar pair. However, in the reporting week, speculators opened as many as 11 thousand new short-contracts, and also closed 5200 long-contracts. Thus, they significantly weakened their bullish mood. And despite this, the euro continues to show growth. However, a sharp change in the mood of the "Non-commercial" category of traders does not mean that the euro currency should immediately fall. The latest COT report shows that speculators are once again preparing for the fall of the euro currency, or at least for the end of its growth.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro in case of a rebound from the upper trend line or in case of consolidation under the lower trend line on the hourly chart. New purchases of the pair can be opened with a target of 1.2308 when the quotes are fixed above the descending trend line on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română