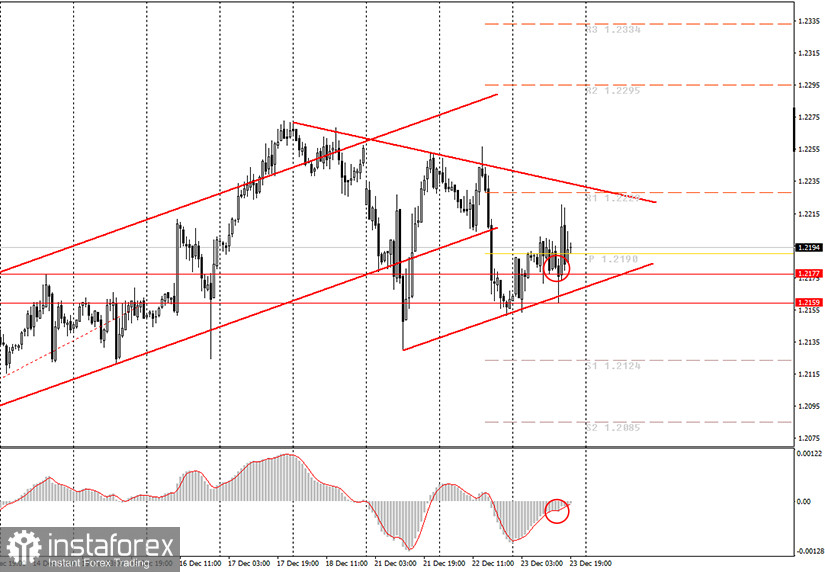

Hourly chart of the EUR/USD pair

The EUR/USD pair continued to correct within the framework of a new downward trend on Wednesday, which is signaled by a downward trend line. The price tried to start a new round of downward movement, and the MACD indicator generated a sell signal. However, the indicator turned to the downside, below the zero mark. The indicator did not have time to discharge, therefore, it took some time for the signal to appear, and secondly, it was weak. According to yesterday's recommendations, novice traders should not have opened short positions on this signal. Since there weren't any signals during the day, and today, beginners did not have to enter the market for the EUR/USD pair at all. However, take note that the movements from the last few days made it possible for us to create an upward trend line, so now we have a kind of triangle, inside which the quotes are located. Logically, now the pair will try to move towards the downward trend line, rebounding from it can provoke a new round of downward trend. Getting the price to settle above this line will be a strong enough signal for long deals. But getting the pair to settle below the upward trend line will be a powerful signal for new short deals on the pair.

No important news from the European Union and the US on Wednesday, but several relatively important reports were published. Take note that the most important report on orders for durable goods exceeded the forecast value of + 0.6% m/m and reached +0.9%. But the data on personal income and spending of Americans turned out to be much weaker than forecasts. The income level of the population fell by 1.1%, while the level of expenditures - by 0.4%. At the same time, the number of new initial applications for unemployment benefits reached 803,000 (forecast of 882,000), and the number of repeated applications decreased to 5.3 million against the forecast of 5.55 million. In general, today's news could be interpreted in favor of the dollar, but it received market support for only half an hour, and was falling for most of the day (growth of the euro/dollar pair = fall of the dollar).

No macroeconomic events in the US and the European Union on Thursday. The celebration of Christmas begins, so many exchanges, banks and other subjects of the financial system will be closed on Thursday and Friday. Consequently, there will be very little news these days. Unfortunately, now there is not a single global fundamental theme that would constantly influence the pair's movement. So novice traders should pay more attention to technical analysis tomorrow and the day after tomorrow. Volatility can be low these days.

Possible scenarios for December 24:

1) Long positions are currently irrelevant, since a downward trend has formed and there is a trend line. Therefore, we would not recommend opening long positions until this line is crossed. The targets in this case will be near the resistance level of 1.2295.

2) Trading down looks more appropriate, but the correction is still present. So we should wait for it to end, the MACD indicator is already sufficiently discharged (to the zero level), and a sell signal is being created. The upward trend line will provide some resistance to the downward movement, but once it is surpassed, short deals can be left open with the target at 1.2124.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română