It seems that incentives are not yet expected any time soon after Donald Trump did not sign the $900 billion aid package proposed by Congress. The markets somehow managed to react without an emotional shake-up and maintained a moderately positive mood. Perhaps they do not care much about the opinion of the outgoing President, they consider the allocation of incentives to be almost resolved. However, it is possible that we will witness a delayed reaction.

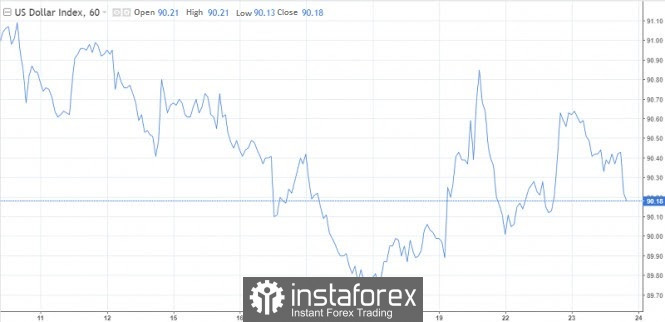

The growth of the dollar, which at the beginning of the week was a factor of pressure on risky assets, has slowed down at present. The USD index rose by 0.6% on Tuesday and recorded a loss of 0.10% at the opening of the US session on Wednesday. Further, the downward trend intensified. Nevertheless, it is not worth counting on a further decline in the dollar. The global markets are currently undergoing a correction, the so-called sluggish sales will allow you to release steam after the rally and, alternatively, form the basis for new growth momentum.

We are likely to see a corrective rebound to 90.7 and higher on the dollar index. Growth to 91.40 is possible. With a prolonged correction, the indicator can reach the levels of 92.2 and 93.90

The EUR/USD pair may end the year around the 1.21– 1.22 mark, this will happen in the case of soft corrective movements. If the risk is sold off more aggressively, the main currency pair of the Forex market risks falling by one or two figures, that is, in the area of 1.20. A more pessimistic scenario suggests a decline to 1.17.

Dollar in 2021

In addition to the short-term prospects, investors are also interested in the longer-term prospects for the US dollar. Many expect that the current weakness of the dollar, which has lost more than 6% against a basket of 6 currencies since the beginning of 2020, will be a turning point. In the coming year, growth can be recorded everywhere, from US stocks and EM markets to industrial metals. One of the catalysts for the growth of demand is low-interest rates and massive fiscal stimulus in the United States.

Participants in a recent Reuters poll believe that the dollar will continue to fall in early 2021. The downward trend will last at least until the middle of the year. This is due to the fact that market players will continue to be interested in buying risk and strive for higher returns.

U.S. exporters will welcome a weaker dollar, as it will make their products more competitive outside the states. The winners will be U.S. multinationals and equity investors.

The downward movement of the dollar also contributes to the maintenance of commodity prices. These goods are in the US dollar and when it falls, they become more accessible to foreign investors.

"The fall in the dollar is a double incentive for commodities, not only because most commodities are priced in dollars, but also because periods of dollar weakness usually coincide with faster growth," Robeco said.

A weak dollar is a real boon for emerging markets, as it makes it easier to service the debt of those countries that borrowed in dollars. The MSCI Emerging Markets index, which measures the performance of stocks, has risen 13% since January 2020. Societe Generale analysts reported a reduction in the share of the greenback in its portfolio of assets to a record low. Their recommendation is to increase the share of EM shares, with the greatest emphasis on Korean and Indonesian companies.

Many expect the dollar to go down the beaten path in the new year, but not all. Therefore, betting against the greenback can not be called a one-way street. Events in the new year may develop in favor of the dollar. For example, the Federal Reserve will decide to tighten monetary policy ahead of time, which will contribute to the upward trend of the dollar.

In addition, the greenback tends to become more expensive when something akin to a coronavirus happens in the world. For example, earlier this week it became known about the emergence of a new type of this infection, which the world has been fighting for almost a year. The mutation has caused unrest and resulted in an almost asleep dollar in motion. This is quite a revealing episode, and the dollar, no matter what they say, remains the safest asset.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română