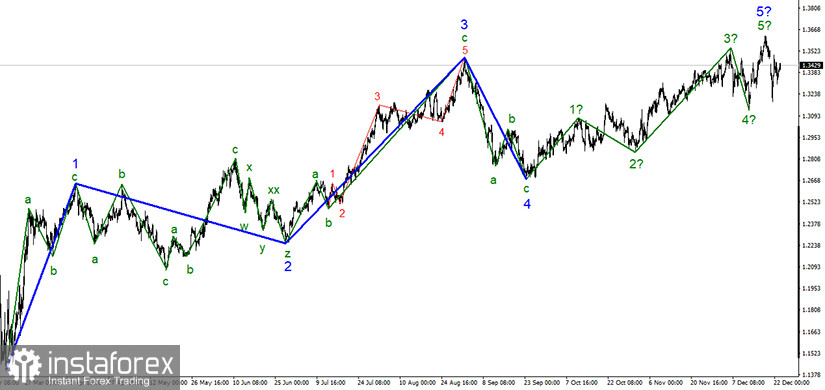

The section of the trend, which originates on September 23, finally took a five-wave form. And the view is quite complete. Of course, the wave layout can become more complicated once again, as it has done more than once, but at the moment everything looks like a complete wave structure. If this is indeed the case, then the decline in quotes will continue within the new downward trend section with targets located near the 30th figure, and possibly even lower.

The lower chart clearly shows the wave 5 in 5 of the upward trend section, which updated the maximum of the previous wave 3.Thus, the construction of the upward trend section can really be completed. If this assumption is correct, then the decline in quotes will resume within the expected wave c. Until a successful attempt to break the maximum of the current wave 5 in 5, the working option will be the option with the construction of a downward trend section.

The pound sterling has lost a total of 400 points over the past week. However, this decline has long been over, and in recent days the instrument is already rising. So far, everything is similar to the construction of correction waves a and b, with wave b taking a three-wave form. Thus, if this assumption is correct, then between the 35th figure and the 1.3550 mark, there should be a downward reversal and a resumption of the decline in the instrument's quotes. At the same time, if the demand for the pound sterling continues to remain so high, then the entire upward section of the trend may become more complicated more than once.

Despite the fact that in the past few months, officials from Britain and the European Union have always said that the chances of a trade agreement is extremely low, and time sorely lacking, recent reports suggest that the parties are now down to one issue to agree on – the question of fisheries. Let me remind you that in monetary terms, this is not such an acute issue. European fishermen catch no more than 1 billion fish in British waters each year. However, London wants to establish full control over its waters, which is inherent in any independent state. At least, that's what Boris Johnson thinks. I do not know whether to say that everything should be resolved in the near future, since this "near future" has been dragging on for a couple of months. The markets seem to believe again that a deal is possible, and London and Brussels are just "breaking the Comedy".

It is on the basis of this belief that the pound could rise in recent days. Recall that the UK and US GDP for the third quarter were both higher than market expectations. But at the same time, the pound sterling is growing in general, contrary to the dollar, which is having a very hard time after March 2020.

General conclusions and recommendations:

The Pound-Dollar instrument has presumably started building a new downward trend section. Thus, I currently recommend selling the GBP/USD instrument for each MACD signal "down" with targets located around the 31st and 30th figures, within the expected first (global) wave of a new downward trend section. A successful attempt to break the maximum of the wave 5 in 5 will indicate the readiness of traders for new purchases of the pound sterling and cancel the option of building a new downward trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română