What is needed to open long positions on EUR/USD

EUR/USD is still trading on the range-bound market amid low volatility under the empty economic calendar for the Eurozone. Targets which I pointed out in my morning market review have not been reached yet. Hence, there have been no signals for a market entry to discuss. The technical picture of the currency pair remains the same for the second half of the trading day. So, I recommend trading on the same principles which I unveiled in the morning article.

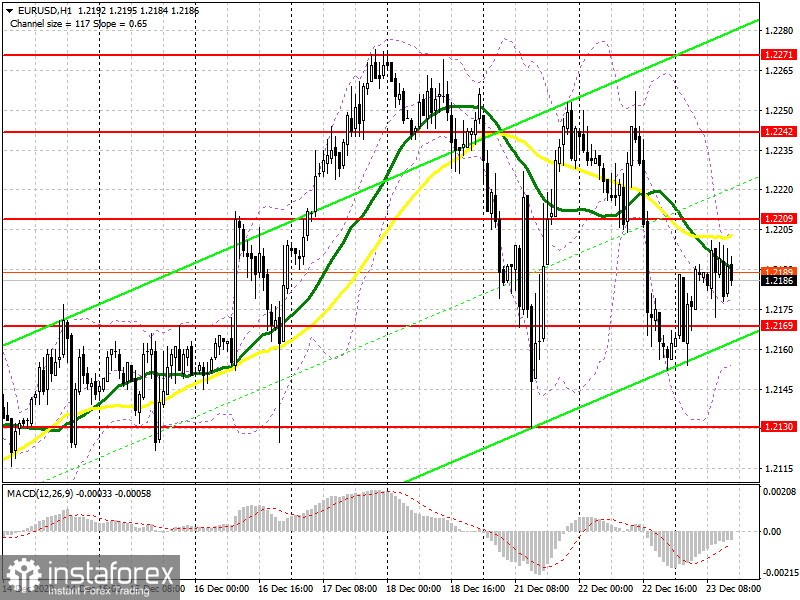

The buyers will be focused on defending support at 1.2169. Only if a fake breakout is formed there in the second half of the trading day, this will generate a signal to open long positions on EUR/USD. During the American trade, investors will get to know a series of macroeconomic data from the US. Please make sure you don't miss initial unemployment claims in the US as well as personal income and spending data. In case of upbeat data and lack of activity around support of 1.2169, you would rather postpone long positions until the price hits a lower low after a one-week low of 1.2130.

Besides, it is possible to buy EUR/USD at a bounce from a local low at 1.2083 bearing in mind a 20-25 pips intraday correction. However, the buyers will be able to rule the market again on condition that the price breaks and holds firmly above the level of 1.2209. Moving averages that are playing on the sellers' side are passing slightly below this level. The test of 1.2209 downwards will generate an extra buy signal with the target at resistance of 1.2242 where I recommend profit taking.

What is needed to open short positions on EUR/USD

The sellers aim to regain control over the level of 1.2169. If the price fixes below this level and tests it from the opposite side, this will create selling pressure, thus providing a good market entry point with short positions. This scenario will be implemented after macroeconomic data from the US is released. In this case, the main target of the bears will be a low of this week at near 1.2130. This level is likely to be breached after the news on first cases of the mutant COVID-19 strain in Germany or France. If so, the pair is expected to move downwards to 1.2083. The key target of the bears is seen at 1.2042 where I recommend profit taking. If the bulls manage to defend support of 1.2169, we can expect a minor climb of EUR/USD to a high of 1.2209. However, it would be a good idea to open short positions from there only after a fake breakout. It would be better to open short positions after 1.2242 and 1.2271 are tested within a downward 20-25 pips intraday correction.

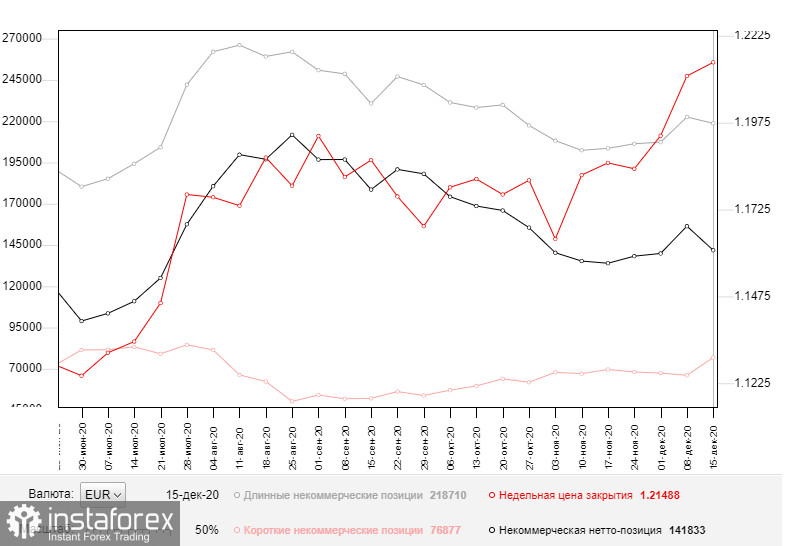

Let me remind you that the COT report (Commitment of Traders report) from December 15 logged an increase in short positions and a fall in long positions. Buyers of risky assets believe in bullish prospects for EUR/USD amid expectations of mass vaccination in the Eurozone that will be launched on December 25-27. Nevertheless, fewer traders are willing to buy the pair at current highs. So, long non-commercial positions declined from 222,521 to 218,710. At the same time, short non-commercial positions increased from 66,092 to 76,877. The overall non-commercial net position dropped to 141,833 against 156,429 a week ago. The delta has stopped its growth which has been posted for three weeks in a row. In this context, the euro will hardly finish the year with a buoyant rally. Traders can rely on the euro's rally on condition the EU and UK leaders nail down a post-Brexit trade deal.

Signals of technical indicators

Moving averages

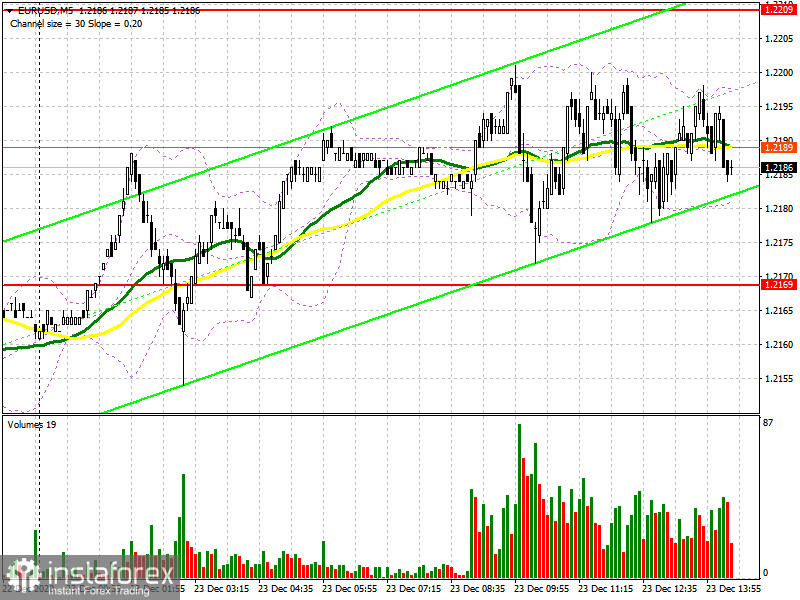

The pair is trading below 30- and 50-period moving averages. It indicates further selling pressure on EUR.

Remark. The author is analyzing a period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

A breakout of the upper indicator's border at near 1.2200 will trigger a new wave of EUR growth. In case the currency pair trades lower, the lower border at near 1.2155 will act as support.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română