In yesterday's trading, the US dollar was in demand among investors as a safe asset and strengthened across a wide range of markets. In all likelihood, market participants were frightened by a new strain of COVID-19, which has already been called "British". Although, if you remember this, as it is believed, the new strain did not appear yesterday. Its appearance in the second half of this year has already been noted in Wales, Scotland, as well as several Scandinavian countries, such as Sweden and Norway. As already suggested in previous materials, the excitement caused by the new strain of coronavirus in the UK, as well as the isolation of the United Kingdom, is nothing but another (perhaps the last) lever to influence the Cabinet of Boris Johnson to sign a trade agreement with the European Union and leave the EU with the deal concluded. The countdown to the moment when the UK leaves the European Union has already started. This was once again reminded by the EU negotiator Michel Barnier, however, a compromise has still not been found. It is likely that, under certain conditions, negotiations will continue after the first of January next year, when the UK officially leaves the pan-European economic area.

Let us go back to yesterday's statistics. The final data on US GDP for the third quarter came out better than expected (33.1%) and the growth of the world's leading economy was 33.4%. However, consumer confidence in the United States was worse than economists' expectations, which were reduced to 97, while the actual figure was 88.6. Although, I do not think that yesterday's strengthening of the US currency was caused solely by these macroeconomic indicators, especially since they were mixed. It should be noted that yesterday the US Congress still passed a bill on the $ 892 billion aid package from COVID-19, thereby preventing the possible closure of government structures. Most likely, this news, along with concerns about a new strain of coronavirus, supported the US currency. Today, starting from 14:30 London time, a large block of macroeconomic statistics will begin to arrive from the United States, where the main attention of investors will be attracted by personal expenses and incomes of Americans, as well as orders for durable goods. European macroeconomic reports are not scheduled for today.

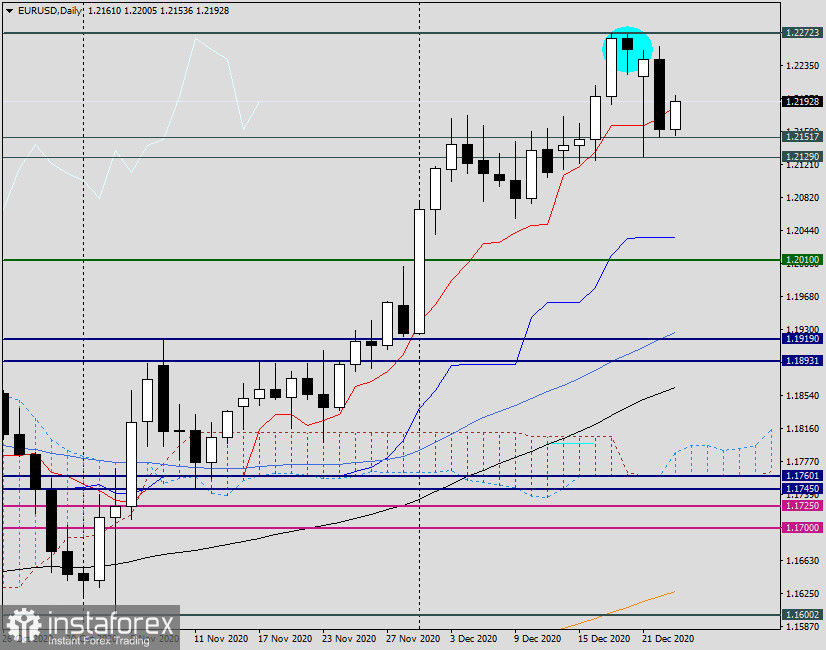

Daily

So, following the results of yesterday's trading, a rather impressive bearish candle appeared on the daily chart of the main currency pair with a closing price of 1.2160. As previously expected, the price zone of 1.2177-1.2130 will be extremely important, and a move below 1.2130 may signal a reversal of the course in the south direction. Although yesterday's session ended under the red line of the Tenkan Ichimoku indicator, today the pair did not go below yesterday's lows of 1.2151 but began to strengthen from 1.2153. Such a course of trading, as well as the inability of the euro to update the minimum trading values on December 21 (1.2129), allow us to count on the growth of the single European currency. However, this does not mean the cancellation of the alternative downward scenario, so we will consider both options for today's trading on EUR/USD.

H1

In this timeframe, we will focus on the ascending channel, the lower border of which passes near the horizontal levels of 1.2151 and 1.2129. At the same time, by setting two arrows, I completely allow a false breakdown of the support line of the channel, after which the price will return to its limits and continue to grow. On the other hand, the 50 simple and 89 exponential moving averages act as a serious and quite strong resistance, so the appearance of bearish candles or one characteristic candle under the 50 MA and 89 EMA will be a signal to open short positions. In the case of a true breakdown (with fixing) of the brown support line of the channel, as well as two horizontal levels of 1.2151 and 1.2129, you can also try selling on a rollback to them.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română