To open long positions on GBPUSD, you need to:

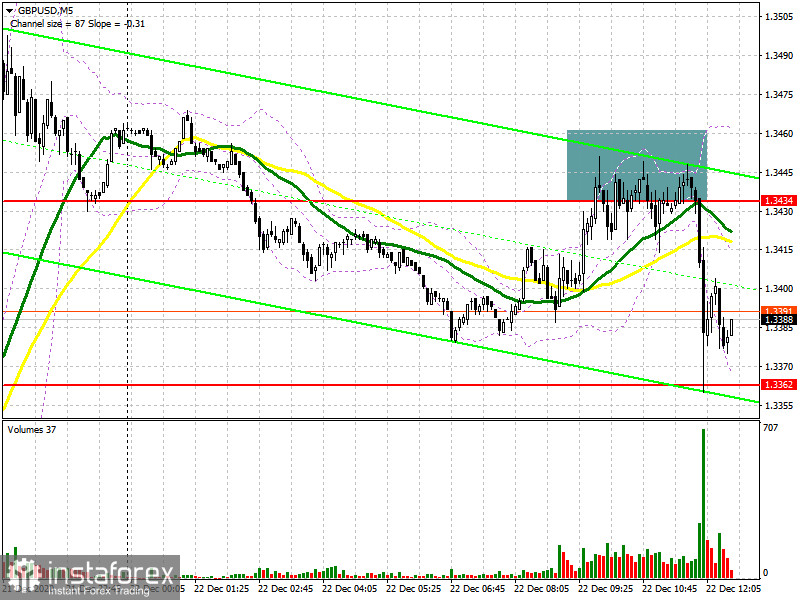

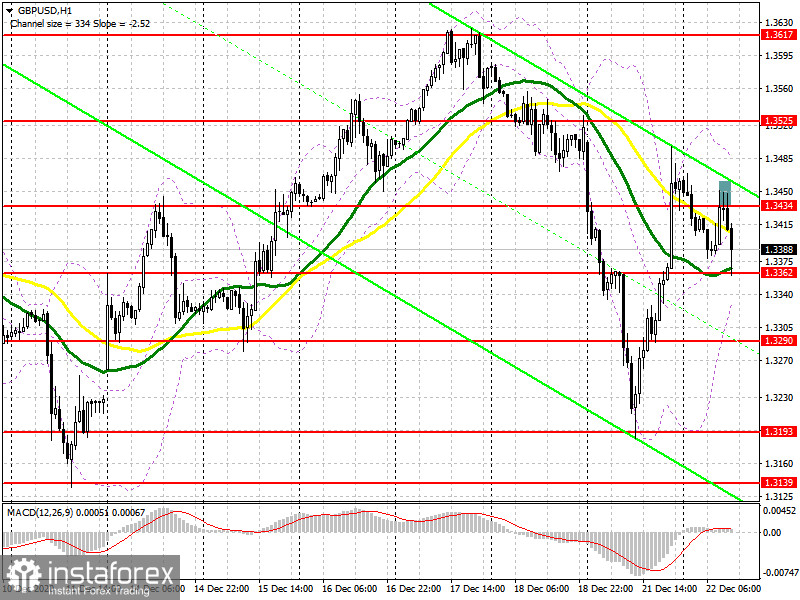

In my morning forecast, I paid attention to sales from the level of 1.3434, which happened. Let's look at the 5-minute chart and talk about where you can and should have entered the market. The chart clearly shows how buyers are trying their best to gain a foothold above the resistance of 1.3434, but nothing came of it. Data on UK GDP for the 3rd quarter contributed to the growth of the pound, but it was not possible to achieve a breakdown of 1.3434, which led to the formation of a sell signal. This is especially clear on the hourly chart, where each time the candle closed, the price was below this level. As a result, the drop was more than 70 points to the support area of 1.3362, where I have already recommended opening long positions.

Despite the high volatility in the first half of the day, the technical picture did not change in any way and the benchmarks remained the same. Buyers perfectly coped with their task and managed to hold the level of 13362. Now they can expect the pound to continue to recover in the short term to the resistance of 1.3434. The main goal in the second half of the day will be its breakthrough. The test of this level from top to bottom forms an additional entry point into long positions to reach a maximum of 1.3525, where I recommend fixing the profits. The longer-term target remains the resistances of 1.3617 and 1.3690, however, they will only be available if there is good news on the Brexit agreement. Let me remind you that the European Union is considering a new British proposal on fishing rights, and if the outcome is positive, this could lead to a sharp strengthening of the pound against the US dollar. If the pair declines again and there is no bull activity in the support area of 1.3362, it is best not to rush to buy but to wait for the update of the minimum of 1.3290. However, I recommend opening long positions from this level only after the formation of a false breakout. A larger support level is seen in the area of 1.3193, where you can buy GBP/USD immediately on the rebound with the expectation of a correction of 35-40 points.

To open short positions on GBPUSD, you need to:

The bears showed themselves in the resistance area of 1.3434, having achieved the formation of a false breakout in the first half of the day. However, it was not possible to cope with a more difficult task and break below 1.3362. The return of GBP/USD back to the level of 1.3434 closer to the middle of the day complicates the situation for sellers. Only the next formation of a false breakout will return pressure on the pair and lead to its repeated decline in the support area of 1.3362. Breaking this level will depend on the European Union's response to the UK's fisheries proposal. Only the test of the level of 1.3362 from the bottom up forms a good signal to open short positions on GBP/USD already to reduce to the lows of 1.3290 and 1.3193, from where yesterday there was strong demand from buyers. Bad news on the trade agreement will lead to a larger collapse of GBP/USD to the area of the minimum of 1.3114. If the bulls manage to break above the resistance of 1.3434, then I do not recommend rushing to sell. You can open short positions immediately for a rebound after the first update of the resistance of 1.3525. A larger level is also seen near the maximum of 1.3617, from which we can expect a downward correction of 30-35 points within the day.

Let me remind you that in the COT reports (Commitment of Traders) for December 15, there is a decrease in interest in the British pound, both buyers and sellers. Long non-profit positions fell from 39,344 to 35,128, while short non-profit positions fell from 33,634 to 31,060. As a result, the non-profit net position remained positive, but fell to the level of 4,068, against 5,710 a week earlier. All this suggests that traders are taking a wait-and-see position, although a small preponderance of buyers, even in this situation, continues to be observed. Given that the UK has imposed strict quarantine measures due to a new strain of coronavirus that has gone out of control, and for which there is no vaccine yet, it will not be the right decision to expect a further strengthening of the pound at the end of this year. Only good news on Brexit can bring back new players who are betting on the growth of GBP/USD to the market.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily averages, which indicates an active confrontation between buyers and sellers of the pound.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pair grows, the upper limit of the indicator in the area of 1.3475 will act as a resistance. In the event of a decline in the pound, the lower limit of the indicator in the area of 1.3355 will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română