To open long positions on EURUSD, you need to:

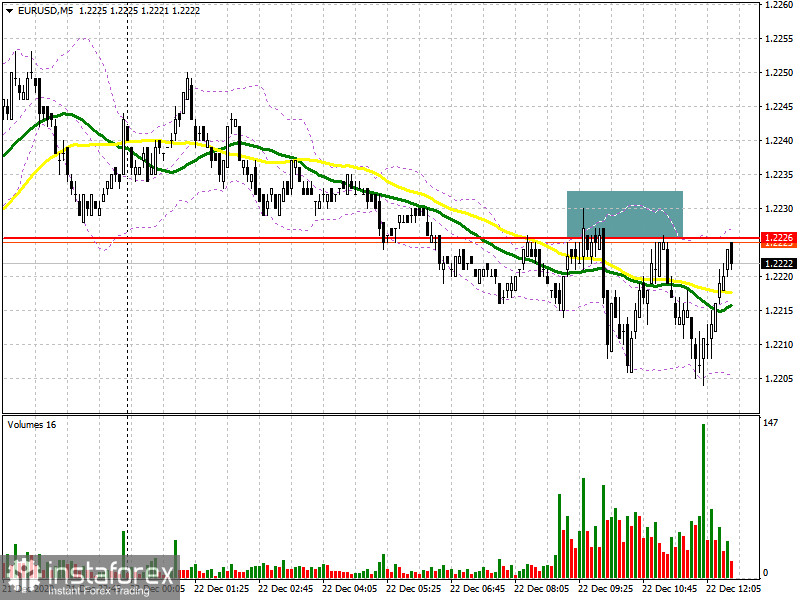

In my morning forecast, I paid attention to the level of 1.2226 and recommended entering the market from it. Let's take a look at the 5-minute chart and talk about what happened. It is visible how the bears break below the level of 1.2226 and consolidate under this range, testing it several times from the bottom up. This led to the formation of a clear signal for the sale of the euro, which continues to operate now. The movement from the level of 1.2226 has so far been no more than 20 points, however, the chance of a further fall remains in the second half of the day.

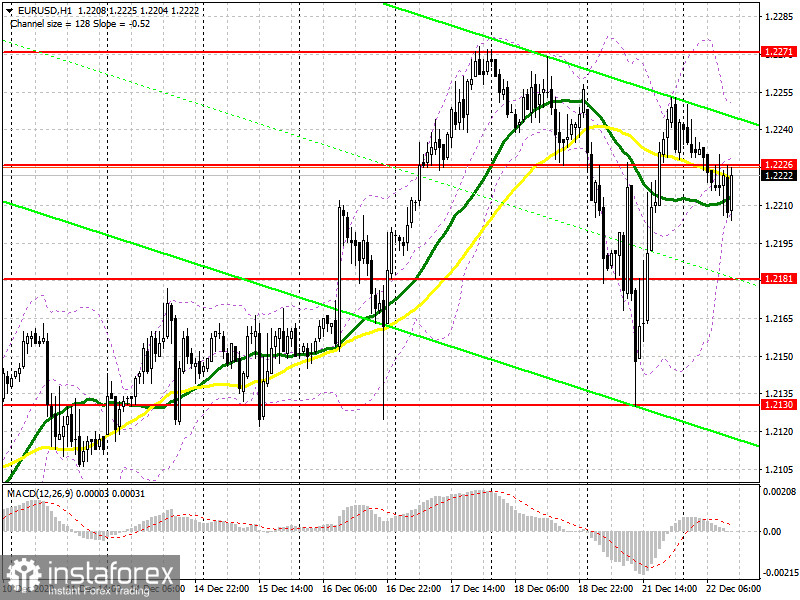

Buyers will focus on regaining control over the level of 1.2226, as only after that it will be possible to talk about the resumption of the upward trend in the euro. The nearest target in this case will be the resistance of 1.2271. However, only weak data on the consumer confidence indicator in the United States will lead to a breakthrough and consolidation above this range together, which will open new highs for euro buyers in the area of 1.2304 and 1.2339, where I recommend taking the profits. With another unsuccessful attempt by buyers to get above 1.2226, the pressure on the euro may increase. In this case, it is better not to hurry with purchases, however, it is best to wait for the update of a larger minimum of 1.2181, from where you can open long positions if a false breakdown is formed. I recommend buying the pair immediately for a rebound only after updating this week's low in the area of 1.2130 with the aim of an upward correction of 25-30 points within the day.

To open short positions on EURUSD, you need to:

Despite the good data on Germany, the sellers of the euro coped with the morning task and achieved a breakdown below 1.2226. As long as trading is conducted below this range, we can expect a further decline in the pair along with the newly formed trend. The main target of the bears, in this case, will be the area of 1.2181, where I recommend fixing the profits. We can expect the euro to return to the support area of 1.2130 if the epidemiological situation in the Eurozone countries worsens and a new strain of coronavirus appears in Germany, France, and several other countries. If the bulls manage to regain the level of 1.2226 in the afternoon, it is best to postpone short positions until the test of the annual maximum in the area of 1.2271. I recommend opening short positions from there only after forming a false breakout. It is best to count on sales for a rebound only after testing the levels of 1.2304 and 1.2339 with the aim of a downward correction of 20-25 points within the day.

Let me remind you that the COT report (Commitment of Traders) for December 15 recorded an increase in short positions and a reduction in long ones. Although buyers of risky assets believe in the continuation of the bull market, especially against the background of the expectation of vaccination in the Eurozone, which will begin from December 25 to 27. However, the rush to buy at current highs has decreased. Thus, long non-profit positions decreased from the level of 222,521 to the level of 218,710, while short non-profit positions increased from the level of 66,092 to the level of 76,877. The total non-profit net position fell to 141,833 from 156,429 a week earlier. The growth of the delta, which was observed for three consecutive weeks, has stopped, thus, it is unlikely that you can expect rapid growth of the euro at the end of this year. Talk of a further major recovery will be possible only after European leaders agree with the UK on a new trade agreement.

Signals of indicators:

Moving averages

Trading is conducted in the area and 50 daily moving averages, which indicates market uncertainty with further direction.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of an upward correction, the upper limit of the indicator around 1.2255 will act as a resistance. A break of the lower limit of the indicator in the area of 1.2200 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română