Before moving on to the technical picture of the AUD/USD currency pair, it is necessary to pay attention to the publication of reports on retail sales in Australia, which were published tonight. It was forecasted that retail sales would show a negative trend of minus 0.6%, however, the actual figure significantly exceeded expectations and showed an increase of 7%. Naturally, such a significant divergence from the forecast value in the direction of improvement should have served the Australian dollar well and sent the quote up, but this, oddly enough, did not happen. Moreover, at the time of writing, the AUD/USD currency pair is trading with a fairly pronounced decline. In my opinion, the threat of the new COVID-19 strain revealed has overshadowed the excellent Australian retail sales data and discouraged investors from taking risks. Let's start analyzing the price charts and first turn our attention to the weekly timeframe:

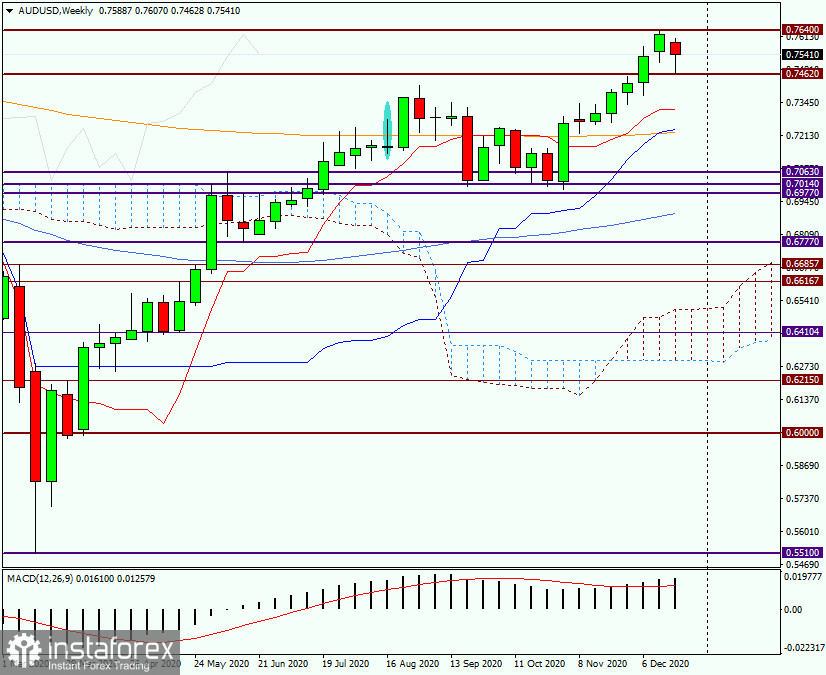

Weekly

Last trading week, the AUD/USD currency pair ended with growth, and this week became the fifth in a row that the "Aussie" is strengthening. It would seem that nothing should have foreshadowed a change in sentiment, and the pair could (and can) continue to grow. However, information about the new strain of COVID-19, which is 70% more dangerous and contagious than the previous one, did its job and trading for the pair opened with a price gap down. But as can be clearly seen on the chart, after falling to the area of 0.7460, the pair has found strong support and is turning up. At the moment, the weekly candlestick already has a fairly long lower shadow, which signals that the bottom has been reached and a reversal in the north direction. On the other hand, the week has just started and all the main events are still ahead. So far, we can only assume that the breakdown of strong resistance of sellers at 0.7640 and the closing of weekly trading above this mark will confirm the further bullish scenario for this currency pair. If this fails to succeed, the future prospects for the price movement of the "Aussie" will look very vague, and here's why.

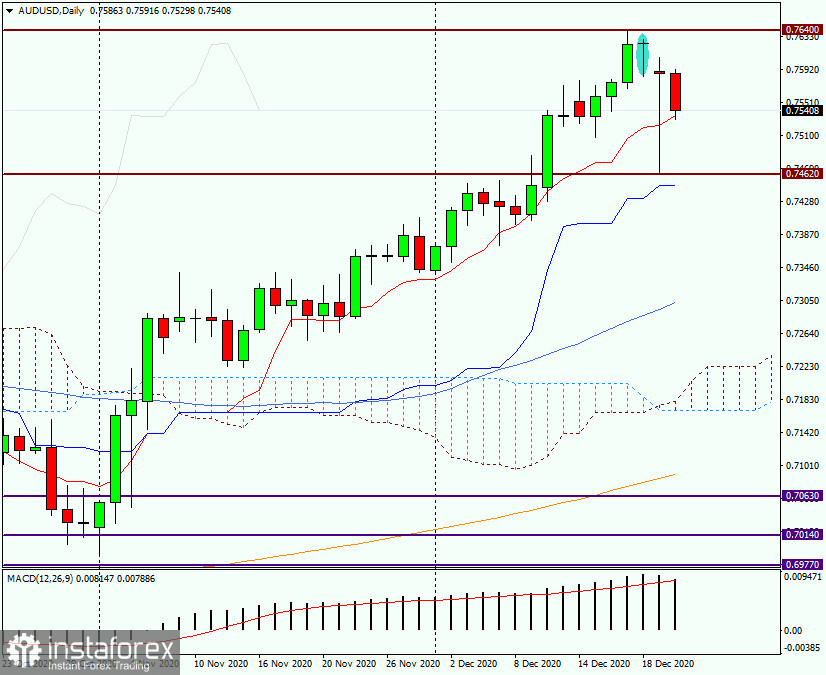

Daily

On the daily chart of AUD/USD, Japanese candlestick reversal signals began to appear. This applies to the Friday candlestick made in the form of "The Hanged Man" or "The Hanging Man." This model is quite strong and is often worked out by bidders. This assumption was confirmed yesterday, and the pair fell to 0.7462. However, there were large buyers of the Australian currency and almost all the decline was leveled. Today, at the moment of writing, the pair is kept from further decline by the red Tenkan line of the Ichimoku indicator. If the bulls on the instrument fail to keep the quote above the Tenkan and trading ends under this line, the near-term bearish prospects will become stronger. If today's candle has a long lower shadow, and trading closes significantly above the Tenkan, it will count on the subsequent growth of the quote and consider options for opening long positions. At the end of this article, AUD/USD is trading near 0.7545. If the bulls on the "Aussie" can raise the quote above 0.7600 and gain a foothold above this mark, you can try to buy based on the breakout of the resistance of 0.7640. It is less risky to wait for the breakdown of this mark and consider opening long positions on the Australian dollar on a pullback to it.

Successful bidding!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română