GBP/USD

Analysis:

The price decline that began last Thursday has a powerful wave level. It changed the current wave layout. The previous movements of the last 3 weeks refer to the extended correction plane of TF H4. The next suitable section has a reversal potential.

Forecast:

In the next day, a flat mood is expected to move in the price corridor between the opposite zones, with a general downward vector. In the European session, you can expect a short-term rise to the resistance zone.

Potential reversal zones

Resistance:

- 1.3450/1.3480

Support:

- 1.3330/1.3300

Recommendations:

Trading on the pound market today is possible within the intraday with a reduced lot. Sales can be unprofitable. It is recommended to skip this phase of movement and look for buy signals in the support zone.

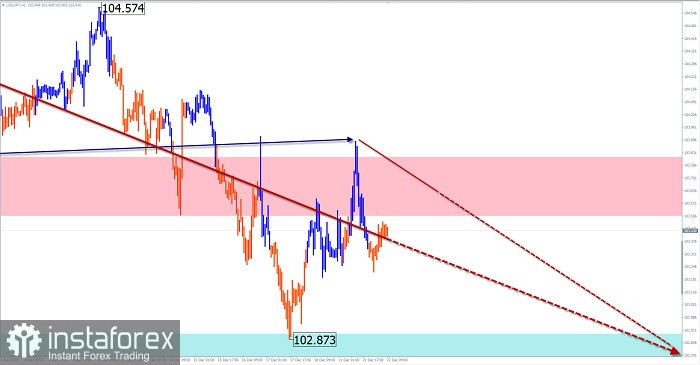

USD/JPY

Analysis:

On the chart of the Japanese yen, the direction of price fluctuations is set by the algorithm of the downward wave of November 9. Yesterday, the hidden correction of the wrong view was completed. The subsequent decline has a reversal potential and can be the beginning of the final section of the main trend.

Forecast:

In the first half of the day, a flat is expected today. The price is likely to rise in the area of the resistance zone. By the end of the day, you can expect a reversal and a second decline. The resistance zone shows the lower limit of the expected price move.

Potential reversal zones

Resistance:

- 103.50/105.80

Support:

- 102.90/102.60

Recommendations:

There are no conditions for purchases today. It is recommended to track signals for selling the instrument in the area of the resistance zone.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the instrument's movements in time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română