News reports about the mutated COVID-19 virus that appeared in the UK, with a 70% higher infection rate than the previous one, caused a local sharp collapse in global markets. In this context, Britain itself announced a high degree of isolation of the country due to a new threat.

This news captured investors' minds so much that the announcement of new support measures for $ 900 billion agreed in Congress, faded into the background, although it seemed to keep the markets from another collapse. At the same time, there is unprecedented optimism in the stock markets. It seems that not only professional investors, but also housewives are eager to invest, afraid to miss this strongest rally since the beginning of the century.

Amid these events, intraday volatility strongly increased in December, indicating that professional investors are still aware of all the risks and fix the profit on their securities on growth, while others are mindlessly buying back companies' shares on a decline, hoping for a continuation of the Christmas rally.

On the other hand, the picture in the currency markets fully reflects the mood in the stock and commodity markets, as well as the entire topic of events related to the coronavirus infection. Traders have actually stopped considering the prices of emerging economic statistics and focus their attention to the COVID-19 situation and the withdrawal of the UK with the European Union (Brexit).

We believe that the recent excitement that has been observed in the markets will further stimulate a high level of volatility. Investors will continue to fully respond to non-market external factors. Moreover, we expect the situation to worsen if a new strain of COVID-19 begins to take over more regions in Europe. This may become the basis for a wide drop in demand for company shares and for the strengthening of the US dollar.

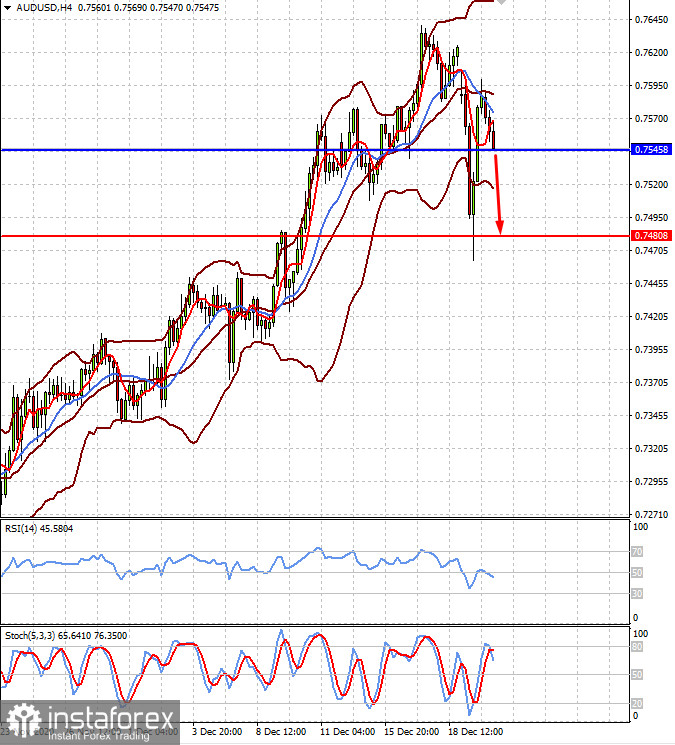

Forecast of the day:

The AUD/USD pair is trading above the level of 0.7545. The worsening mood on world markets may serve as a basis for the pair's further decline to the level of 0.7480.

The USD/CAD pair continued to rise amid declining crude oil prices. The pair is trading above the level of 1.2865 and a consolidation above which will lead to further growth to 1.2955.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română