4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -18.2781

The British currency at the end of the last trading week and the beginning of this one collapsed down by 440 points. Even during Monday, it managed 300 points, but the fall was impressive. Especially because we've been waiting for it for a long time. Unfortunately, even such a noticeable drop in quotes does not mean that a downward trend will now begin. The pound/dollar pair fell yesterday to the Murray level of "0/8"-1.3184, from which it had previously bounced. Thus, this time the fall may be interpreted as a correction, and the upward trend will resume again. From a technical point of view, a new downward trend has now formed, but how many such trends have formed in recent months? The pair then traded in the "high-volatility swing" mode, then regularly formed false signals. Therefore, it is now very difficult to conclude that market participants are ready for the sale of the British. Today, we want to focus the attention of traders on one important and ambiguous factor.

Yesterday morning, when it became known about the new strain of "coronavirus", that the UK is being quarantined and the UK itself is also quarantined for many EU countries and the world, everyone somehow immediately decided that it was the new strain that caused the collapse of the pound sterling. We would like to draw the attention of traders to the fact that today is December 22, and there is still no deal between the UK and the EU. Of course, it is possible that Michel Barnier and David Frost have decided to make a new year's surprise and will announce an agreement on December 31. But this joke is not funny. Formally, the parties can even agree and ratify the agreement on December 31, without even getting acquainted with it. Although this option is now hard to believe, especially in the case of the European Parliament, in which representatives of all 27 EU member states must give their consent to the deal. And to give consent to the transaction, you need to at least read the document, which will have several hundred pages, that's for sure. 9 days until Brexit and the end of the "transition period". Now only one option is possible, in which they will meet. This is just a retroactive approval of the deal. We wrote about this option a few weeks ago, because even then it was clear that Barnier and Frost would not have time to agree. It is difficult to predict what exactly this "back number" will be, but there are no other options. Only officially recognize the failure in the negotiations.

Meanwhile, British Prime Minister Boris Johnson once again said that the "transition period" will end on December 31 and London refuses to extend it for a longer period. "We have to ratify any agreement before January 1, which means that there is not enough time, and therefore our negotiators continue to work hard," Johnson said. But maybe this is the secret? Maybe this is just a bluff on the part of the British Prime Minister, who is famous for such "tricks"? What will prevent Johnson from saying on December 31 that since the negotiators did not have time, to avoid a "hard" Brexit, the "transition period" has been extended for, say, a year?

However, I would also like to note that the European Parliament now refuses to vote for any deal in 2020. Earlier, the European Parliament demanded that the negotiations end on December 20. "The European Parliament expressed its readiness to organize an extraordinary meeting, provided that an agreement is reached before midnight on Sunday, December 20. We learned that today, there will be no agreement. Therefore, the European Parliament will not be able to agree to an agreement this year," said David McAllister, head of the Foreign Affairs Committee. Thus, in reality, the chances of agreeing on a deal in 2020 remain scanty. The EU's chief negotiator, Michel Barnier, wrote on Twitter on Sunday: "At this crucial moment, we continue to work hard with David Frost and his team."

So, perhaps the pound did not fall yesterday because of a new strain of "coronavirus"? Perhaps market participants have finally taken into account the fact that there is likely to be no deal with the European Union. Or if it does, it won't be anytime soon. And, as we have said many times, the lack of a deal is the biggest blow to the British economy. Perhaps market participants have finally stopped believing in myths and fairy tales and started living reality. And the reality now is that there is no reason to assume that 2020 will end with the signing of an agreement between London and Brussels. Of course, there is no denying the importance of the new COVID-2019 strain, as well as the fact that quarantine has been tightened in the UK. Perhaps even both of these factors played a role. However, if the absence of a deal and the failure of negotiations are more important, then the pound may continue to fall, while the euro currency, for example, is not obliged to continue falling. Moreover, on Monday, the euro very quickly stopped falling and regained almost all the positions lost earlier. The same cannot be said about the British currency. Thus, we are still inclined to believe that the failure in the Brexit negotiations and the almost zero probability of an agreement are the reasons for the fall of the pound.

However, as we have already said, the fall in recent days does not mean that a downward trend will now begin, and the subsequent pullback up – and does cast doubt on this scenario. At this time, it is recommended to consider sell orders, as a formal downward trend has been formed. So far, the price has corrected back to the moving average line, so you need to wait for the completion of the round of this correction and see if the price goes back above the moving average. If so, the pair will either resume the upward trend or switch back to the "high-volatility swing" mode.

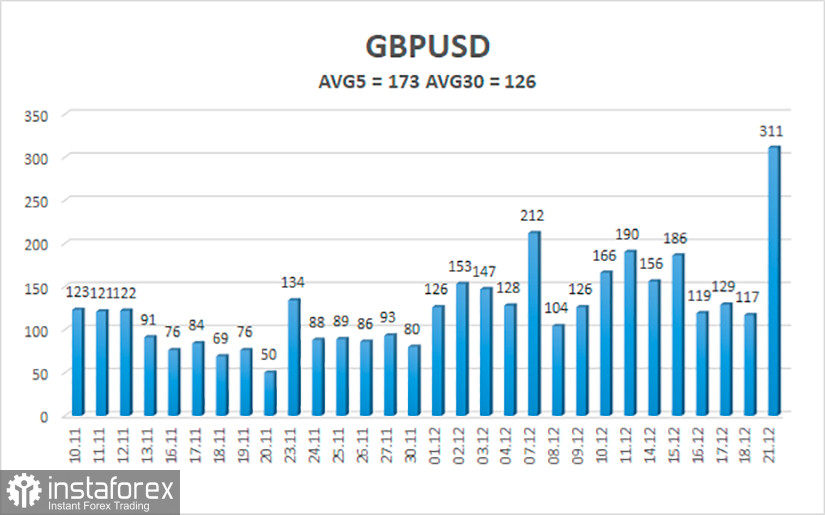

The average volatility of the GBP/USD pair is currently 173 points per day. For the pound/dollar pair, this value is "high". On Tuesday, December 22, thus, we expect movement inside the channel, limited by the levels of 1.3278 and 1.3624. The reversal of the Heiken Ahi indicator back down signals a new round of downward movement.

Nearest support levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest resistance levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe is now in a new round of upward movement, perhaps this is a correction. Thus, today it is recommended to sell the pair with targets of 1.3367 and 1.3306 if the price bounces off the moving average. It is recommended to trade the pair again for an increase with the targets of 1.3550 and 1.3611 if the price is fixed above the moving average line. In general, high-volatility "swings" have now begun again. Not a good time to trade.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română